Fisher Asset Management LLC increased its holdings in shares of Anheuser-Busch InBev SA/NV (NYSE:BUD - Free Report) by 6.0% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 10,307,014 shares of the consumer goods maker's stock after acquiring an additional 587,329 shares during the period. Fisher Asset Management LLC owned approximately 0.57% of Anheuser-Busch InBev SA/NV worth $683,252,000 at the end of the most recent reporting period.

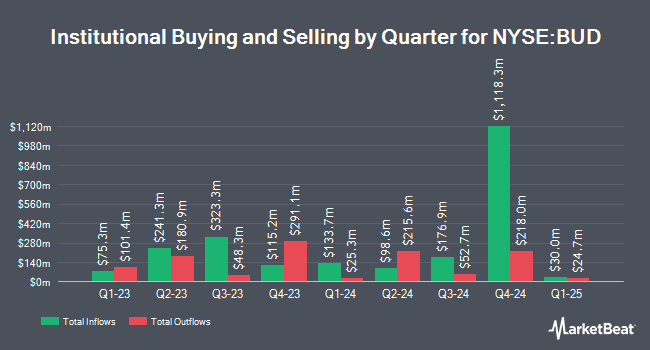

Several other hedge funds have also bought and sold shares of the business. Cerity Partners LLC boosted its stake in Anheuser-Busch InBev SA/NV by 61.9% during the third quarter. Cerity Partners LLC now owns 61,061 shares of the consumer goods maker's stock worth $4,048,000 after acquiring an additional 23,348 shares in the last quarter. Raymond James Trust N.A. boosted its stake in Anheuser-Busch InBev SA/NV by 39.5% during the third quarter. Raymond James Trust N.A. now owns 7,356 shares of the consumer goods maker's stock worth $488,000 after acquiring an additional 2,082 shares in the last quarter. Charles Schwab Investment Management Inc. boosted its stake in Anheuser-Busch InBev SA/NV by 37.7% during the third quarter. Charles Schwab Investment Management Inc. now owns 57,870 shares of the consumer goods maker's stock worth $3,836,000 after acquiring an additional 15,837 shares in the last quarter. Thompson Siegel & Walmsley LLC boosted its stake in Anheuser-Busch InBev SA/NV by 10.7% during the third quarter. Thompson Siegel & Walmsley LLC now owns 152,567 shares of the consumer goods maker's stock worth $10,114,000 after acquiring an additional 14,781 shares in the last quarter. Finally, Altman Advisors Inc. boosted its stake in Anheuser-Busch InBev SA/NV by 1.4% during the third quarter. Altman Advisors Inc. now owns 27,691 shares of the consumer goods maker's stock worth $1,836,000 after acquiring an additional 372 shares in the last quarter. Institutional investors own 5.53% of the company's stock.

Anheuser-Busch InBev SA/NV Stock Performance

Shares of BUD traded up $0.31 during mid-day trading on Monday, hitting $55.04. 1,800,676 shares of the company traded hands, compared to its average volume of 1,644,653. The stock has a 50-day moving average price of $61.89 and a two-hundred day moving average price of $61.76. The company has a debt-to-equity ratio of 0.85, a quick ratio of 0.51 and a current ratio of 0.69. The stock has a market cap of $98.92 billion, a price-to-earnings ratio of 16.99, a P/E/G ratio of 1.75 and a beta of 1.12. Anheuser-Busch InBev SA/NV has a 1 year low of $54.51 and a 1 year high of $67.49.

Wall Street Analysts Forecast Growth

BUD has been the subject of several recent analyst reports. Morgan Stanley lifted their target price on shares of Anheuser-Busch InBev SA/NV from $68.50 to $73.00 and gave the stock an "overweight" rating in a report on Tuesday, September 10th. Citigroup raised shares of Anheuser-Busch InBev SA/NV from a "neutral" rating to a "buy" rating in a report on Tuesday, October 1st. Barclays raised shares of Anheuser-Busch InBev SA/NV to a "strong-buy" rating in a report on Wednesday, October 9th. Evercore ISI raised shares of Anheuser-Busch InBev SA/NV to a "strong-buy" rating in a report on Monday, September 30th. Finally, TD Cowen cut shares of Anheuser-Busch InBev SA/NV from a "buy" rating to a "hold" rating and boosted their price objective for the company from $68.00 to $88.00 in a report on Tuesday, October 8th. Three analysts have rated the stock with a hold rating, five have assigned a buy rating and two have assigned a strong buy rating to the stock. Based on data from MarketBeat, Anheuser-Busch InBev SA/NV has a consensus rating of "Moderate Buy" and a consensus target price of $79.00.

Get Our Latest Stock Analysis on BUD

Anheuser-Busch InBev SA/NV Profile

(

Free Report)

Anheuser-Busch InBev SA/NV produces, distributes, exports, markets, and sells beer and beverages. It offers a portfolio of approximately 500 beer brands, which primarily include Budweiser, Corona, and Stella Artois; Beck's, Hoegaarden, Leffe, and Michelob Ultra; and Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol brands.

Further Reading

Before you consider Anheuser-Busch InBev SA/NV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anheuser-Busch InBev SA/NV wasn't on the list.

While Anheuser-Busch InBev SA/NV currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.