Fisher Asset Management LLC increased its position in Ultra Clean Holdings, Inc. (NASDAQ:UCTT - Free Report) by 42.3% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 225,469 shares of the semiconductor company's stock after buying an additional 67,059 shares during the quarter. Fisher Asset Management LLC owned 0.50% of Ultra Clean worth $8,106,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

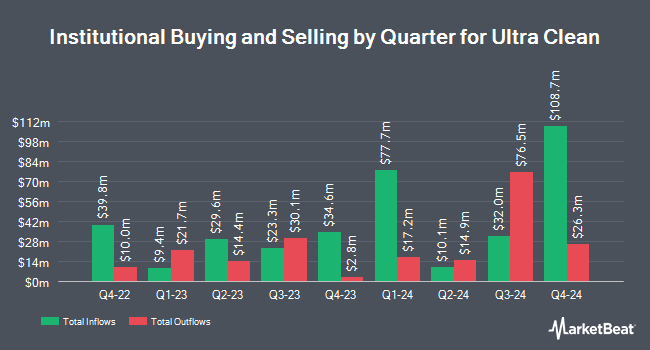

Several other institutional investors and hedge funds also recently made changes to their positions in UCTT. Creative Planning acquired a new position in shares of Ultra Clean in the third quarter valued at approximately $546,000. Moloney Securities Asset Management LLC acquired a new position in shares of Ultra Clean in the third quarter valued at approximately $1,048,000. Summit Global Investments acquired a new stake in Ultra Clean during the 3rd quarter valued at approximately $1,450,000. Weil Company Inc. increased its position in Ultra Clean by 18.2% during the 3rd quarter. Weil Company Inc. now owns 30,682 shares of the semiconductor company's stock valued at $1,225,000 after purchasing an additional 4,723 shares during the period. Finally, Aigen Investment Management LP acquired a new stake in Ultra Clean during the 3rd quarter valued at approximately $229,000. Institutional investors and hedge funds own 96.06% of the company's stock.

Analyst Ratings Changes

Separately, Needham & Company LLC reissued a "buy" rating and set a $40.00 target price on shares of Ultra Clean in a research report on Thursday.

Read Our Latest Analysis on UCTT

Ultra Clean Trading Up 6.0 %

Shares of UCTT stock traded up $1.43 during trading hours on Friday, hitting $25.32. 752,248 shares of the company were exchanged, compared to its average volume of 378,049. The firm has a market cap of $1.14 billion, a P/E ratio of 316.54, a P/E/G ratio of 0.51 and a beta of 2.09. Ultra Clean Holdings, Inc. has a fifty-two week low of $22.85 and a fifty-two week high of $56.47. The company has a debt-to-equity ratio of 0.52, a quick ratio of 1.63 and a current ratio of 2.75. The company has a 50 day simple moving average of $35.06 and a two-hundred day simple moving average of $36.13.

Ultra Clean Company Profile

(

Free Report)

Ultra Clean Holdings, Inc develops and supplies critical subsystems, components and parts, and ultra-high purity cleaning and analytical services for the semiconductor industry in the United States and internationally. The company provides ultra-clean valves, high purity connectors, industrial process connectors and valves, pneumatic actuators, manifolds and safety solutions, hoses, pressure gauges, and gas line and component heaters; chemical delivery modules that deliver gases and reactive chemicals in a liquid or gaseous form from a centralized subsystem to the reaction chamber; and gas delivery systems, such as weldments, filters, mass flow controllers, regulators, pressure transducers and valves, component heaters, and an integrated electronic and/or pneumatic control system.

Further Reading

Before you consider Ultra Clean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ultra Clean wasn't on the list.

While Ultra Clean currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.