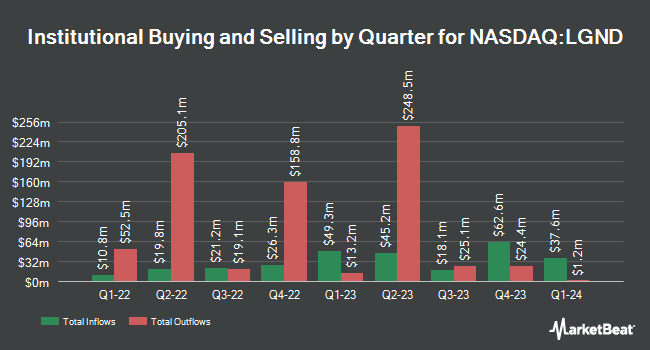

Fisher Asset Management LLC raised its stake in Ligand Pharmaceuticals Incorporated (NASDAQ:LGND - Free Report) by 12.4% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 59,574 shares of the biotechnology company's stock after acquiring an additional 6,555 shares during the period. Fisher Asset Management LLC owned approximately 0.33% of Ligand Pharmaceuticals worth $5,963,000 at the end of the most recent quarter.

Other institutional investors have also recently modified their holdings of the company. Chicago Capital LLC raised its stake in Ligand Pharmaceuticals by 124.3% in the second quarter. Chicago Capital LLC now owns 514,946 shares of the biotechnology company's stock valued at $43,389,000 after purchasing an additional 285,350 shares in the last quarter. F M Investments LLC bought a new stake in shares of Ligand Pharmaceuticals during the 2nd quarter worth approximately $11,350,000. Dimensional Fund Advisors LP boosted its position in shares of Ligand Pharmaceuticals by 6.7% during the 2nd quarter. Dimensional Fund Advisors LP now owns 708,624 shares of the biotechnology company's stock worth $59,707,000 after acquiring an additional 44,543 shares in the last quarter. Envestnet Asset Management Inc. increased its stake in Ligand Pharmaceuticals by 47.7% in the second quarter. Envestnet Asset Management Inc. now owns 79,612 shares of the biotechnology company's stock valued at $6,708,000 after acquiring an additional 25,717 shares during the last quarter. Finally, Lisanti Capital Growth LLC acquired a new position in Ligand Pharmaceuticals during the third quarter valued at approximately $2,481,000. 91.28% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

A number of equities research analysts have weighed in on the company. Benchmark raised their target price on Ligand Pharmaceuticals from $110.00 to $135.00 and gave the company a "buy" rating in a report on Friday, November 8th. Barclays lifted their target price on Ligand Pharmaceuticals from $125.00 to $150.00 and gave the company an "overweight" rating in a research report on Friday, November 8th. Royal Bank of Canada increased their target price on shares of Ligand Pharmaceuticals from $130.00 to $140.00 and gave the stock an "outperform" rating in a report on Tuesday, November 12th. HC Wainwright reaffirmed a "buy" rating and set a $157.00 price target on shares of Ligand Pharmaceuticals in a report on Friday, November 8th. Finally, Oppenheimer increased their price objective on shares of Ligand Pharmaceuticals from $135.00 to $147.00 and gave the company an "outperform" rating in a research note on Friday, November 8th. Six research analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company presently has an average rating of "Buy" and a consensus target price of $144.83.

Get Our Latest Report on LGND

Ligand Pharmaceuticals Stock Performance

Shares of Ligand Pharmaceuticals stock traded down $1.08 on Friday, hitting $121.47. The stock had a trading volume of 72,061 shares, compared to its average volume of 136,096. The stock has a 50 day moving average of $109.73 and a 200 day moving average of $99.49. The firm has a market capitalization of $2.30 billion, a P/E ratio of 48.39 and a beta of 0.99. Ligand Pharmaceuticals Incorporated has a twelve month low of $57.00 and a twelve month high of $129.90.

Insider Transactions at Ligand Pharmaceuticals

In other Ligand Pharmaceuticals news, insider Andrew Reardon sold 2,000 shares of the stock in a transaction that occurred on Monday, September 23rd. The shares were sold at an average price of $99.60, for a total transaction of $199,200.00. Following the completion of the sale, the insider now owns 22,534 shares of the company's stock, valued at approximately $2,244,386.40. This represents a 8.15 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, COO Matthew E. Korenberg sold 6,275 shares of the business's stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $104.10, for a total transaction of $653,227.50. Following the completion of the transaction, the chief operating officer now owns 50,777 shares in the company, valued at $5,285,885.70. This trade represents a 11.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 19,322 shares of company stock worth $1,974,073. Company insiders own 5.90% of the company's stock.

Ligand Pharmaceuticals Profile

(

Free Report)

Ligand Pharmaceuticals Incorporated, a biopharmaceutical company, engages in the development and licensing of biopharmaceutical assets worldwide. Its commercial programs include Kyprolis and Evomela, which are used to treat multiple myeloma; Rylaze, a recombinant erwinia asparaginase for the treatment of acute lymphoblastic leukemia or lymphoblastic lymphoma in adult and pediatric patients; Filspari, a dual endothelin and angiotensin II receptor antagonist in development for rare kidney diseases and non-immunosuppressive treatment indicated for immunoglobulin A nephropathy; Teriparatide injection product for osteoporosis; Vaxneuvance for the prevention of invasive disease caused by streptococcus pneumoniae serotypes; and Pneumosil, a pneumococcal conjugate vaccine to help fight against pneumococcal pneumonia among children.

Featured Stories

Before you consider Ligand Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ligand Pharmaceuticals wasn't on the list.

While Ligand Pharmaceuticals currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.