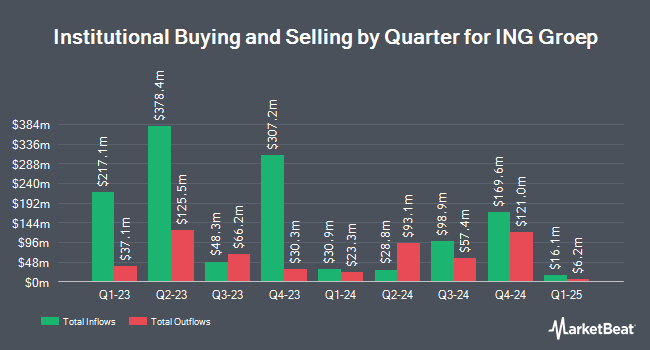

Fisher Asset Management LLC increased its holdings in ING Groep (NYSE:ING - Free Report) by 0.6% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 68,451,083 shares of the financial services provider's stock after acquiring an additional 429,562 shares during the quarter. Fisher Asset Management LLC owned about 1.96% of ING Groep worth $1,243,072,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in ING. Fortitude Family Office LLC purchased a new position in ING Groep during the third quarter valued at $25,000. Summit Securities Group LLC purchased a new position in ING Groep during the second quarter valued at $31,000. Rothschild Investment LLC purchased a new position in ING Groep during the second quarter valued at $31,000. Mather Group LLC. lifted its position in ING Groep by 57.3% during the third quarter. Mather Group LLC. now owns 2,147 shares of the financial services provider's stock valued at $39,000 after buying an additional 782 shares during the period. Finally, Thurston Springer Miller Herd & Titak Inc. purchased a new position in ING Groep during the second quarter valued at $38,000. Hedge funds and other institutional investors own 4.49% of the company's stock.

Wall Street Analyst Weigh In

ING has been the subject of several analyst reports. Deutsche Bank Aktiengesellschaft downgraded ING Groep from a "buy" rating to a "hold" rating in a report on Wednesday, October 9th. Citigroup upgraded ING Groep to a "strong-buy" rating in a report on Thursday, October 17th. Finally, Barclays downgraded ING Groep from an "overweight" rating to an "equal weight" rating in a report on Tuesday, October 22nd.

Check Out Our Latest Report on ING

ING Groep Stock Up 0.4 %

Shares of NYSE:ING traded up $0.06 on Monday, hitting $15.34. 2,677,195 shares of the company traded hands, compared to its average volume of 2,327,461. ING Groep has a 52 week low of $12.77 and a 52 week high of $18.72. The company has a quick ratio of 1.13, a current ratio of 1.13 and a debt-to-equity ratio of 2.89. The stock has a 50 day simple moving average of $17.03 and a 200-day simple moving average of $17.42. The company has a market cap of $53.66 billion, a PE ratio of 6.88, a PEG ratio of 5.95 and a beta of 1.52.

ING Groep Profile

(

Free Report)

ING Groep N.V. provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally. It operates through five segments: Retail Netherlands, Retail Belgium, Retail Germany, Retail Other, and Wholesale Banking. The company accepts current and savings accounts.

See Also

Before you consider ING Groep, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ING Groep wasn't on the list.

While ING Groep currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.