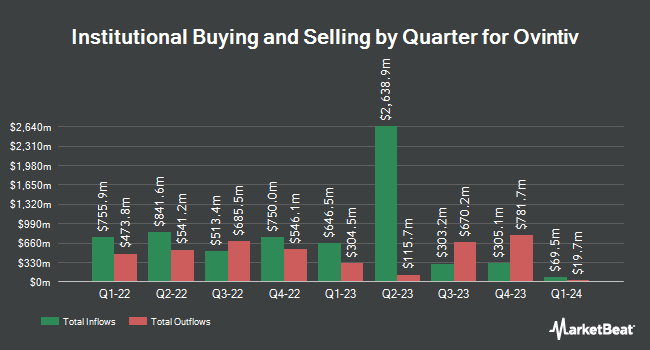

Fisher Asset Management LLC lessened its holdings in shares of Ovintiv Inc. (NYSE:OVV - Free Report) by 8.3% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 740,010 shares of the company's stock after selling 66,656 shares during the quarter. Fisher Asset Management LLC owned approximately 0.28% of Ovintiv worth $28,350,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also recently added to or reduced their stakes in the company. Public Employees Retirement System of Ohio raised its position in shares of Ovintiv by 31.2% in the first quarter. Public Employees Retirement System of Ohio now owns 157,095 shares of the company's stock valued at $8,153,000 after purchasing an additional 37,349 shares during the period. Jacobs Levy Equity Management Inc. bought a new position in shares of Ovintiv in the first quarter valued at approximately $1,149,000. B. Riley Wealth Advisors Inc. bought a new position in shares of Ovintiv in the first quarter valued at approximately $396,000. Tidal Investments LLC raised its position in shares of Ovintiv by 7.0% in the first quarter. Tidal Investments LLC now owns 7,648 shares of the company's stock valued at $397,000 after purchasing an additional 497 shares during the period. Finally, Plato Investment Management Ltd bought a new position in shares of Ovintiv in the first quarter valued at approximately $617,000. Institutional investors own 83.81% of the company's stock.

Ovintiv Stock Down 0.0 %

OVV opened at $45.73 on Wednesday. The firm's 50-day simple moving average is $41.62 and its 200-day simple moving average is $44.13. The company has a debt-to-equity ratio of 0.46, a quick ratio of 0.52 and a current ratio of 0.52. Ovintiv Inc. has a twelve month low of $36.90 and a twelve month high of $55.95. The firm has a market cap of $11.90 billion, a price-to-earnings ratio of 6.06 and a beta of 2.62.

Ovintiv Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Stockholders of record on Friday, December 13th will be issued a $0.30 dividend. This represents a $1.20 annualized dividend and a dividend yield of 2.62%. The ex-dividend date is Friday, December 13th. Ovintiv's payout ratio is 15.92%.

Analyst Ratings Changes

A number of research firms have recently commented on OVV. Truist Financial lifted their price target on shares of Ovintiv from $57.00 to $59.00 and gave the company a "buy" rating in a research report on Friday, November 15th. Royal Bank of Canada dropped their price target on shares of Ovintiv from $62.00 to $61.00 and set a "sector perform" rating on the stock in a research report on Thursday, August 1st. Barclays raised their price objective on shares of Ovintiv from $53.00 to $57.00 and gave the stock an "overweight" rating in a research note on Friday, November 15th. Evercore ISI lowered their price objective on shares of Ovintiv from $60.00 to $54.00 and set an "outperform" rating on the stock in a research note on Monday, September 30th. Finally, Siebert Williams Shank upgraded shares of Ovintiv to a "strong-buy" rating in a research note on Tuesday, October 15th. Five analysts have rated the stock with a hold rating, twelve have issued a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $56.65.

View Our Latest Analysis on OVV

About Ovintiv

(

Free Report)

Ovintiv Inc, together with its subsidiaries, explores, develops, produces, and markets natural gas, oil, and natural gas liquids in the United States and Canada. The company operates through USA Operations, Canadian Operations, and Market Optimization segments. Its principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta.

See Also

Before you consider Ovintiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ovintiv wasn't on the list.

While Ovintiv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.