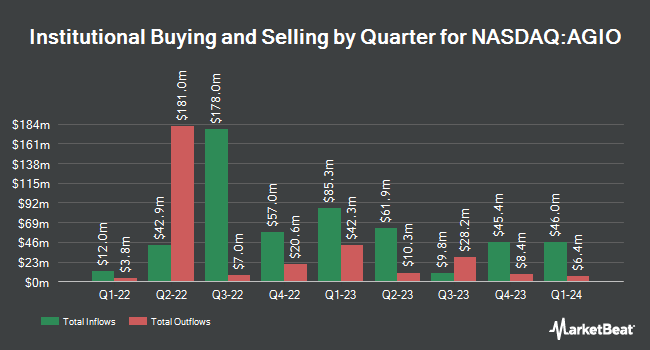

Fisher Asset Management LLC boosted its stake in Agios Pharmaceuticals, Inc. (NASDAQ:AGIO - Free Report) by 20.5% during the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm owned 855,328 shares of the biopharmaceutical company's stock after buying an additional 145,416 shares during the period. Fisher Asset Management LLC owned approximately 1.50% of Agios Pharmaceuticals worth $38,002,000 at the end of the most recent quarter.

A number of other large investors also recently bought and sold shares of AGIO. Acadian Asset Management LLC purchased a new position in shares of Agios Pharmaceuticals during the second quarter worth $37,000. Quest Partners LLC purchased a new position in Agios Pharmaceuticals during the 2nd quarter valued at about $40,000. Mirae Asset Global Investments Co. Ltd. grew its position in Agios Pharmaceuticals by 21.4% in the 3rd quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,058 shares of the biopharmaceutical company's stock valued at $94,000 after acquiring an additional 363 shares in the last quarter. CWM LLC increased its stake in Agios Pharmaceuticals by 554.7% during the third quarter. CWM LLC now owns 2,167 shares of the biopharmaceutical company's stock worth $96,000 after purchasing an additional 1,836 shares during the period. Finally, North Star Asset Management Inc. acquired a new stake in shares of Agios Pharmaceuticals during the second quarter worth about $216,000.

Agios Pharmaceuticals Stock Performance

Shares of NASDAQ:AGIO traded down $0.57 on Wednesday, hitting $58.53. 167,364 shares of the company's stock were exchanged, compared to its average volume of 694,961. Agios Pharmaceuticals, Inc. has a 1-year low of $20.96 and a 1-year high of $62.58. The company has a market capitalization of $3.34 billion, a PE ratio of 5.12 and a beta of 0.75. The firm's 50-day moving average is $47.93 and its 200 day moving average is $45.04.

Insider Buying and Selling

In related news, CFO Cecilia Jones sold 2,542 shares of the business's stock in a transaction on Thursday, September 26th. The shares were sold at an average price of $49.03, for a total value of $124,634.26. Following the completion of the sale, the chief financial officer now directly owns 20,158 shares of the company's stock, valued at $988,346.74. The trade was a 11.20 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at this hyperlink. 4.93% of the stock is owned by company insiders.

Wall Street Analysts Forecast Growth

Several brokerages recently weighed in on AGIO. Raymond James reaffirmed an "outperform" rating and set a $51.00 target price on shares of Agios Pharmaceuticals in a research note on Thursday, October 10th. StockNews.com raised Agios Pharmaceuticals from a "sell" rating to a "hold" rating in a research report on Saturday, November 9th. Scotiabank lifted their target price on Agios Pharmaceuticals from $51.00 to $53.00 and gave the company a "sector outperform" rating in a report on Friday, November 1st. Royal Bank of Canada restated an "outperform" rating and set a $55.00 price target on shares of Agios Pharmaceuticals in a report on Friday, November 1st. Finally, Leerink Partners lowered Agios Pharmaceuticals from an "outperform" rating to a "market perform" rating and reduced their price target for the company from $60.00 to $56.00 in a research report on Friday, September 27th. Five research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company. According to MarketBeat, Agios Pharmaceuticals has a consensus rating of "Hold" and a consensus price target of $52.33.

Get Our Latest Report on AGIO

Agios Pharmaceuticals Profile

(

Free Report)

Agios Pharmaceuticals, Inc, a biopharmaceutical company, discovers and develops medicines in the field of cellular metabolism in the United States. Its lead product includes PYRUKYND (mitapivat), an activator of wild-type and mutant pyruvate kinase (PK), enzymes for the treatment of hemolytic anemias.

Read More

Before you consider Agios Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agios Pharmaceuticals wasn't on the list.

While Agios Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.