Fisher Funds Management LTD bought a new stake in shares of NVIDIA Co. (NASDAQ:NVDA - Free Report) in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor bought 280,318 shares of the computer hardware maker's stock, valued at approximately $37,806,000. NVIDIA accounts for 0.9% of Fisher Funds Management LTD's portfolio, making the stock its 28th biggest holding.

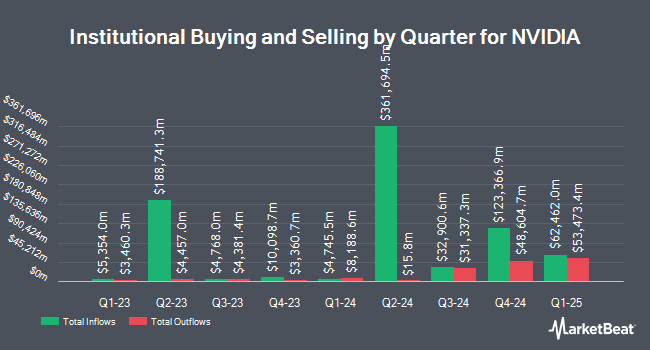

Other institutional investors and hedge funds have also bought and sold shares of the company. AMF Tjanstepension AB grew its stake in shares of NVIDIA by 2.2% in the third quarter. AMF Tjanstepension AB now owns 8,039,712 shares of the computer hardware maker's stock worth $976,348,000 after purchasing an additional 169,445 shares during the last quarter. Wealth Group Ltd. lifted its holdings in NVIDIA by 5.0% in the 3rd quarter. Wealth Group Ltd. now owns 5,602 shares of the computer hardware maker's stock worth $680,000 after buying an additional 265 shares during the period. SOA Wealth Advisors LLC. increased its stake in shares of NVIDIA by 0.3% during the third quarter. SOA Wealth Advisors LLC. now owns 120,634 shares of the computer hardware maker's stock valued at $14,650,000 after buying an additional 350 shares during the period. Swedbank AB raised its holdings in shares of NVIDIA by 4.8% during the third quarter. Swedbank AB now owns 40,888,722 shares of the computer hardware maker's stock valued at $4,965,526,000 after acquiring an additional 1,868,358 shares in the last quarter. Finally, Eaton Cambridge Inc. boosted its holdings in NVIDIA by 4.6% in the third quarter. Eaton Cambridge Inc. now owns 18,732 shares of the computer hardware maker's stock valued at $2,275,000 after acquiring an additional 819 shares in the last quarter. 65.27% of the stock is currently owned by institutional investors.

NVIDIA Stock Performance

NVIDIA stock traded down $3.95 during midday trading on Monday, hitting $105.72. The stock had a trading volume of 165,878,439 shares, compared to its average volume of 314,143,137. The company has a current ratio of 4.10, a quick ratio of 3.64 and a debt-to-equity ratio of 0.13. NVIDIA Co. has a 52-week low of $75.61 and a 52-week high of $195.95. The company has a market capitalization of $2.58 trillion, a PE ratio of 41.59, a P/E/G ratio of 1.76 and a beta of 1.77. The firm's fifty day moving average is $125.01 and its two-hundred day moving average is $131.61.

NVIDIA (NASDAQ:NVDA - Get Free Report) last announced its quarterly earnings data on Wednesday, February 26th. The computer hardware maker reported $0.89 EPS for the quarter, beating the consensus estimate of $0.84 by $0.05. NVIDIA had a net margin of 55.69% and a return on equity of 114.83%. The firm had revenue of $39.33 billion for the quarter, compared to the consensus estimate of $38.16 billion. On average, research analysts forecast that NVIDIA Co. will post 2.77 EPS for the current year.

NVIDIA Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, April 2nd. Stockholders of record on Wednesday, March 12th will be paid a $0.01 dividend. This represents a $0.04 dividend on an annualized basis and a dividend yield of 0.04%. The ex-dividend date is Wednesday, March 12th. NVIDIA's dividend payout ratio (DPR) is 1.36%.

Analyst Ratings Changes

Several research analysts have commented on the stock. Truist Financial upped their price objective on shares of NVIDIA from $204.00 to $205.00 and gave the stock a "buy" rating in a report on Thursday, February 27th. Needham & Company LLC restated a "buy" rating and issued a $160.00 price objective on shares of NVIDIA in a report on Wednesday, March 19th. Cantor Fitzgerald reiterated an "overweight" rating and set a $200.00 target price on shares of NVIDIA in a report on Wednesday, March 19th. DA Davidson lowered their target price on NVIDIA from $135.00 to $125.00 and set a "neutral" rating for the company in a research note on Thursday, March 20th. Finally, HSBC reduced their price target on NVIDIA from $195.00 to $185.00 and set a "buy" rating on the stock in a research note on Monday, January 13th. Four research analysts have rated the stock with a hold rating, thirty-seven have issued a buy rating and two have assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $171.51.

View Our Latest Research Report on NVIDIA

Insider Activity at NVIDIA

In other news, EVP Ajay K. Puri sold 36,462 shares of NVIDIA stock in a transaction that occurred on Monday, January 6th. The shares were sold at an average price of $151.10, for a total transaction of $5,509,408.20. Following the sale, the executive vice president now owns 3,902,888 shares in the company, valued at $589,726,376.80. This trade represents a 0.93 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director John Dabiri sold 2,663 shares of the company's stock in a transaction on Monday, March 10th. The stock was sold at an average price of $110.00, for a total transaction of $292,930.00. Following the transaction, the director now owns 17,279 shares of the company's stock, valued at approximately $1,900,690. This represents a 13.35 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 183,609 shares of company stock valued at $22,642,615. 4.23% of the stock is owned by company insiders.

NVIDIA Company Profile

(

Free Report)

NVIDIA Corporation provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU or vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building and operating metaverse and 3D internet applications.

Read More

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 best stocks to own in Spring 2025, carefully selected for their growth potential amid market volatility. This exclusive report highlights top companies poised to thrive in uncertain economic conditions—download now to gain an investing edge.

Get This Free Report