Five9 (NASDAQ:FIVN - Get Free Report)'s stock had its "buy" rating restated by research analysts at Needham & Company LLC in a research note issued on Friday,Benzinga reports. They currently have a $48.00 target price on the software maker's stock. Needham & Company LLC's target price would suggest a potential upside of 30.36% from the company's current price.

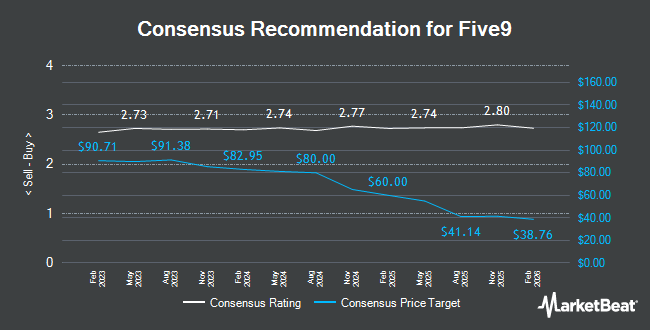

Several other brokerages have also recently commented on FIVN. BTIG Research dropped their price target on shares of Five9 from $100.00 to $45.00 and set a "buy" rating on the stock in a research report on Friday, August 9th. Bank of America raised shares of Five9 from an "underperform" rating to a "buy" rating and set a $63.00 price objective for the company in a research note on Monday, August 5th. Barclays decreased their price objective on shares of Five9 from $75.00 to $55.00 and set an "overweight" rating for the company in a report on Friday, August 9th. Robert W. Baird lowered Five9 from an "outperform" rating to a "neutral" rating and cut their price target for the stock from $90.00 to $40.00 in a report on Friday, August 9th. Finally, Roth Mkm decreased their target price on Five9 from $90.00 to $67.00 and set a "buy" rating on the stock in a research report on Friday, August 9th. Five research analysts have rated the stock with a hold rating and fifteen have issued a buy rating to the stock. Based on data from MarketBeat.com, Five9 presently has an average rating of "Moderate Buy" and a consensus target price of $61.00.

Get Our Latest Research Report on Five9

Five9 Price Performance

FIVN stock traded up $4.01 during trading on Friday, reaching $36.82. 6,453,887 shares of the company were exchanged, compared to its average volume of 1,483,559. Five9 has a 52-week low of $26.60 and a 52-week high of $92.40. The company has a market cap of $2.75 billion, a P/E ratio of -51.78 and a beta of 0.85. The stock's 50 day moving average price is $29.37 and its 200 day moving average price is $39.54. The company has a debt-to-equity ratio of 1.39, a quick ratio of 2.15 and a current ratio of 2.15.

Five9 (NASDAQ:FIVN - Get Free Report) last posted its quarterly earnings results on Thursday, August 8th. The software maker reported ($0.06) EPS for the quarter, beating the consensus estimate of ($0.20) by $0.14. The company had revenue of $252.09 million during the quarter, compared to analysts' expectations of $244.54 million. Five9 had a negative return on equity of 6.59% and a negative net margin of 5.44%. As a group, analysts predict that Five9 will post -0.09 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, CFO Barry Zwarenstein sold 4,408 shares of the business's stock in a transaction dated Tuesday, September 10th. The stock was sold at an average price of $26.97, for a total transaction of $118,883.76. Following the transaction, the chief financial officer now owns 101,732 shares in the company, valued at $2,743,712.04. The trade was a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In other news, CFO Barry Zwarenstein sold 4,408 shares of the business's stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $26.97, for a total transaction of $118,883.76. Following the sale, the chief financial officer now owns 101,732 shares in the company, valued at approximately $2,743,712.04. The trade was a 0.00 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, CRO Daniel P. Burkland sold 2,605 shares of the firm's stock in a transaction that occurred on Monday, August 26th. The shares were sold at an average price of $33.41, for a total transaction of $87,033.05. Following the transaction, the executive now directly owns 132,554 shares of the company's stock, valued at $4,428,629.14. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 36,493 shares of company stock valued at $1,097,753. 1.80% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Five9

Large investors have recently made changes to their positions in the company. Quent Capital LLC boosted its holdings in Five9 by 8.7% in the 2nd quarter. Quent Capital LLC now owns 4,379 shares of the software maker's stock worth $193,000 after buying an additional 352 shares during the period. BOKF NA boosted its stake in Five9 by 1.7% during the first quarter. BOKF NA now owns 39,846 shares of the software maker's stock valued at $2,445,000 after buying an additional 657 shares during the last quarter. Rhumbline Advisers grew its holdings in Five9 by 0.8% during the 2nd quarter. Rhumbline Advisers now owns 86,000 shares of the software maker's stock valued at $3,793,000 after buying an additional 673 shares in the last quarter. State Board of Administration of Florida Retirement System grew its holdings in Five9 by 1.0% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 76,495 shares of the software maker's stock valued at $4,751,000 after buying an additional 745 shares in the last quarter. Finally, Signaturefd LLC increased its stake in Five9 by 1,892.3% in the 3rd quarter. Signaturefd LLC now owns 1,036 shares of the software maker's stock worth $30,000 after acquiring an additional 984 shares during the last quarter. 96.64% of the stock is currently owned by institutional investors.

Five9 Company Profile

(

Get Free Report)

Five9, Inc, together with its subsidiaries, provides intelligent cloud software for contact centers in the United States, India, and internationally. It offers a virtual contact center cloud platform that delivers a suite of applications, which enables the breadth of contact center-related customer service, sales, and marketing functions.

Featured Stories

Before you consider Five9, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Five9 wasn't on the list.

While Five9 currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.