Research analysts at Scotiabank began coverage on shares of Fiverr International (NYSE:FVRR - Get Free Report) in a research report issued on Wednesday,Briefing.com Automated Import reports. The brokerage set a "sector outperform" rating and a $31.00 price target on the stock. Scotiabank's target price indicates a potential upside of 17.46% from the company's previous close.

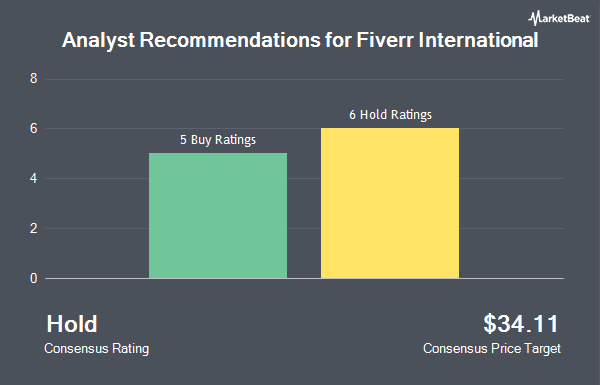

Several other brokerages have also issued reports on FVRR. JMP Securities lowered Fiverr International from an "outperform" rating to a "market perform" rating in a report on Thursday, February 20th. UBS Group raised their price target on Fiverr International from $31.00 to $32.00 and gave the stock a "neutral" rating in a report on Tuesday, December 3rd. Royal Bank of Canada restated a "sector perform" rating and issued a $35.00 price objective on shares of Fiverr International in a research report on Thursday, February 20th. Needham & Company LLC restated a "buy" rating and issued a $36.00 price objective on shares of Fiverr International in a research report on Wednesday, February 19th. Finally, Citizens Jmp downgraded shares of Fiverr International from a "strong-buy" rating to a "hold" rating in a research report on Thursday, February 20th. Five equities research analysts have rated the stock with a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $34.22.

Read Our Latest Research Report on Fiverr International

Fiverr International Stock Performance

NYSE:FVRR opened at $26.39 on Wednesday. The firm has a market capitalization of $946.03 million, a PE ratio of 56.16 and a beta of 1.93. The business's fifty day moving average price is $30.35 and its 200 day moving average price is $28.84. The company has a debt-to-equity ratio of 0.06, a current ratio of 1.10 and a quick ratio of 2.99. Fiverr International has a 12 month low of $18.83 and a 12 month high of $36.11.

Fiverr International announced that its board has approved a stock buyback program on Tuesday, March 11th that permits the company to repurchase $100.00 million in shares. This repurchase authorization permits the company to repurchase up to 10.6% of its shares through open market purchases. Shares repurchase programs are often a sign that the company's board believes its shares are undervalued.

Institutional Trading of Fiverr International

Hedge funds and other institutional investors have recently bought and sold shares of the company. Jones Financial Companies Lllp grew its stake in Fiverr International by 134.9% in the 4th quarter. Jones Financial Companies Lllp now owns 1,031 shares of the company's stock worth $33,000 after acquiring an additional 592 shares during the period. Huntington National Bank grew its stake in Fiverr International by 35,200.0% in the 3rd quarter. Huntington National Bank now owns 1,059 shares of the company's stock worth $27,000 after acquiring an additional 1,056 shares during the period. SBI Securities Co. Ltd. purchased a new stake in Fiverr International in the 4th quarter worth approximately $57,000. KLP Kapitalforvaltning AS purchased a new stake in Fiverr International in the 4th quarter worth approximately $187,000. Finally, New York State Common Retirement Fund grew its stake in shares of Fiverr International by 5.9% during the 4th quarter. New York State Common Retirement Fund now owns 24,824 shares of the company's stock valued at $788,000 after buying an additional 1,382 shares during the period. 59.00% of the stock is owned by hedge funds and other institutional investors.

About Fiverr International

(

Get Free Report)

Fiverr International Ltd. operates an online marketplace worldwide. Its platform enables sellers to sell their services and buyers to buy them. The company's platform includes various categories in ten verticals, including graphic and design, digital marketing, writing and translation, video and animation, music and audio, programming and tech, business, data, lifestyle, and photography.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fiverr International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiverr International wasn't on the list.

While Fiverr International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.