Vestcor Inc reduced its holdings in Flex Ltd. (NASDAQ:FLEX - Free Report) by 41.1% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 21,812 shares of the technology company's stock after selling 15,198 shares during the quarter. Vestcor Inc's holdings in Flex were worth $729,000 as of its most recent filing with the SEC.

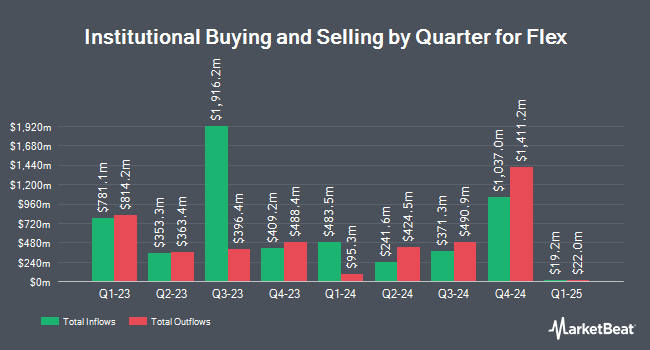

Several other institutional investors also recently added to or reduced their stakes in the business. SG Americas Securities LLC increased its position in Flex by 441.6% during the second quarter. SG Americas Securities LLC now owns 47,477 shares of the technology company's stock worth $1,400,000 after acquiring an additional 38,711 shares during the period. Diversified Trust Co bought a new stake in shares of Flex in the second quarter valued at about $217,000. Envestnet Portfolio Solutions Inc. grew its position in Flex by 2.4% during the second quarter. Envestnet Portfolio Solutions Inc. now owns 66,126 shares of the technology company's stock worth $1,950,000 after buying an additional 1,552 shares in the last quarter. Assenagon Asset Management S.A. raised its holdings in Flex by 3.0% in the 2nd quarter. Assenagon Asset Management S.A. now owns 71,434 shares of the technology company's stock valued at $2,107,000 after acquiring an additional 2,090 shares in the last quarter. Finally, Blue Trust Inc. lifted its position in shares of Flex by 37.4% in the 2nd quarter. Blue Trust Inc. now owns 4,299 shares of the technology company's stock worth $123,000 after acquiring an additional 1,170 shares during the period. 94.30% of the stock is owned by institutional investors.

Flex Trading Up 0.6 %

Shares of FLEX stock traded up $0.21 on Friday, reaching $38.38. 2,183,676 shares of the stock were exchanged, compared to its average volume of 4,345,582. The stock has a 50 day moving average price of $37.07 and a 200 day moving average price of $33.19. The stock has a market cap of $14.88 billion, a PE ratio of 16.98, a P/E/G ratio of 2.43 and a beta of 1.10. Flex Ltd. has a one year low of $21.84 and a one year high of $42.47. The company has a debt-to-equity ratio of 0.64, a current ratio of 1.43 and a quick ratio of 0.85.

Analysts Set New Price Targets

A number of research firms have weighed in on FLEX. The Goldman Sachs Group set a $39.00 price target on shares of Flex in a research note on Thursday, October 17th. Craig Hallum increased their target price on shares of Flex from $39.00 to $45.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Barclays lifted their target price on shares of Flex from $39.00 to $43.00 and gave the company an "overweight" rating in a research note on Thursday, October 31st. KeyCorp initiated coverage on Flex in a report on Tuesday, October 22nd. They set an "overweight" rating and a $41.00 price target for the company. Finally, StockNews.com raised Flex from a "hold" rating to a "buy" rating in a research note on Tuesday, October 29th. Six equities research analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and an average target price of $42.67.

View Our Latest Research Report on FLEX

Insider Buying and Selling at Flex

In other Flex news, insider Kwang Hooi Tan sold 8,028 shares of Flex stock in a transaction dated Monday, October 28th. The stock was sold at an average price of $35.39, for a total transaction of $284,110.92. Following the transaction, the insider now directly owns 240,018 shares in the company, valued at approximately $8,494,237.02. The trade was a 3.24 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Charles K. Stevens III sold 13,157 shares of the stock in a transaction dated Wednesday, November 6th. The stock was sold at an average price of $38.69, for a total value of $509,044.33. Following the completion of the sale, the director now owns 55,713 shares of the company's stock, valued at $2,155,535.97. This trade represents a 19.10 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 0.82% of the company's stock.

Flex Profile

(

Free Report)

Flex Ltd. provides technology, supply chain, and manufacturing solutions in Asia, the Americas, and Europe. It operates through three segments: Flex Agility Solutions (FAS), Flex Reliability Solutions (FRS), and Nextracker. The FAS segment offers flexible supply and manufacturing system comprising communications, enterprise and cloud solution, which includes data, edge, and communications infrastructure; lifestyle solution including appliances, consumer packaging, floorcare, micro mobility, and audio; and consumer devices, such as mobile and high velocity consumer devices.

Featured Articles

Before you consider Flex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flex wasn't on the list.

While Flex currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.