Flowers Foods (NYSE:FLO - Get Free Report) updated its FY 2024 earnings guidance on Friday. The company provided earnings per share (EPS) guidance of 1.240-1.280 for the period, compared to the consensus estimate of 1.250. The company issued revenue guidance of $5.1 billion-$5.1 billion, compared to the consensus revenue estimate of $5.1 billion. Flowers Foods also updated its FY24 guidance to $1.24-1.28 EPS.

Analysts Set New Price Targets

Separately, StockNews.com lowered shares of Flowers Foods from a "strong-buy" rating to a "buy" rating in a research note on Wednesday, September 18th. One research analyst has rated the stock with a sell rating, three have assigned a hold rating and one has assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $22.75.

Read Our Latest Analysis on Flowers Foods

Flowers Foods Stock Performance

NYSE FLO traded down $0.59 during trading hours on Friday, hitting $21.44. 2,655,146 shares of the company's stock traded hands, compared to its average volume of 1,167,399. The company has a current ratio of 1.19, a quick ratio of 0.91 and a debt-to-equity ratio of 0.77. Flowers Foods has a 52 week low of $19.64 and a 52 week high of $26.12. The firm has a market capitalization of $4.52 billion, a P/E ratio of 35.39, a P/E/G ratio of 4.32 and a beta of 0.36. The business's fifty day moving average price is $22.85 and its two-hundred day moving average price is $23.03.

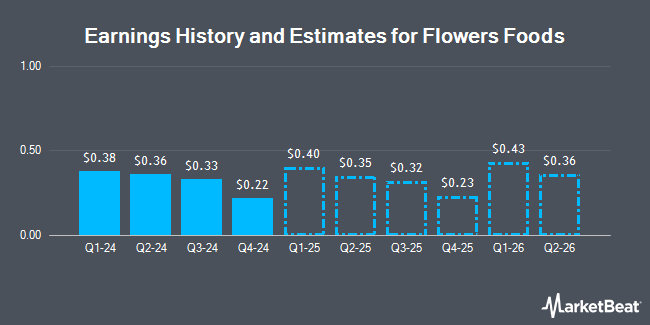

Flowers Foods (NYSE:FLO - Get Free Report) last announced its earnings results on Friday, August 16th. The company reported $0.36 EPS for the quarter, topping analysts' consensus estimates of $0.33 by $0.03. The company had revenue of $1.23 billion for the quarter, compared to analysts' expectations of $1.24 billion. Flowers Foods had a return on equity of 18.97% and a net margin of 2.51%. Flowers Foods's revenue for the quarter was down .3% compared to the same quarter last year. During the same period last year, the firm earned $0.33 EPS. Equities research analysts predict that Flowers Foods will post 1.25 EPS for the current year.

Flowers Foods Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Friday, September 20th. Stockholders of record on Friday, September 6th were given a dividend of $0.24 per share. The ex-dividend date of this dividend was Friday, September 6th. This represents a $0.96 annualized dividend and a dividend yield of 4.48%. Flowers Foods's payout ratio is 157.38%.

Flowers Foods Company Profile

(

Get Free Report)

Flowers Foods, Inc produces and markets packaged bakery food products in the United States. Its principal products include fresh breads, buns, rolls, snack items, bagels, English muffins, and tortillas, as well as frozen breads and rolls under the Nature's Own, Dave's Killer Bread, Wonder, Canyon Bakehouse, Mrs.

Read More

Before you consider Flowers Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flowers Foods wasn't on the list.

While Flowers Foods currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.