Taika Capital LP boosted its holdings in Flowserve Co. (NYSE:FLS - Free Report) by 39.9% in the 3rd quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 125,133 shares of the industrial products company's stock after acquiring an additional 35,693 shares during the quarter. Flowserve comprises approximately 4.9% of Taika Capital LP's portfolio, making the stock its 3rd biggest holding. Taika Capital LP owned about 0.10% of Flowserve worth $6,468,000 as of its most recent SEC filing.

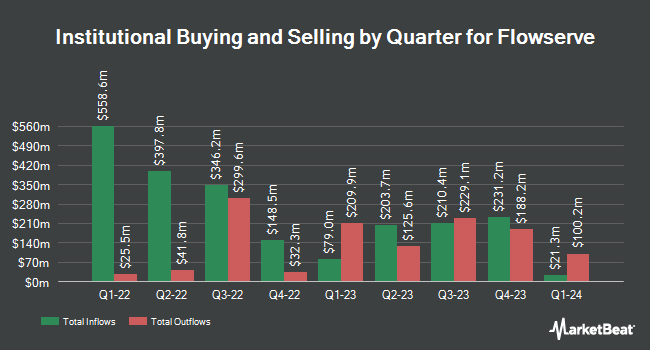

A number of other hedge funds and other institutional investors also recently bought and sold shares of FLS. True Wealth Design LLC acquired a new position in shares of Flowserve during the 3rd quarter worth approximately $25,000. Signaturefd LLC grew its holdings in Flowserve by 185.9% in the 2nd quarter. Signaturefd LLC now owns 569 shares of the industrial products company's stock valued at $27,000 after buying an additional 370 shares during the period. V Square Quantitative Management LLC purchased a new position in Flowserve during the third quarter worth approximately $27,000. Ashton Thomas Securities LLC acquired a new position in shares of Flowserve in the 3rd quarter valued at $29,000. Finally, nVerses Capital LLC purchased a new position in shares of Flowserve in the 2nd quarter worth about $34,000. Institutional investors and hedge funds own 93.93% of the company's stock.

Flowserve Stock Performance

NYSE:FLS traded down $1.00 during trading hours on Friday, reaching $60.71. 465,296 shares of the stock were exchanged, compared to its average volume of 1,101,607. Flowserve Co. has a 52 week low of $38.07 and a 52 week high of $62.32. The company has a quick ratio of 1.39, a current ratio of 1.99 and a debt-to-equity ratio of 0.56. The stock has a market capitalization of $7.98 billion, a P/E ratio of 30.54, a P/E/G ratio of 1.48 and a beta of 1.41. The firm has a 50 day simple moving average of $56.58 and a 200-day simple moving average of $51.09.

Flowserve (NYSE:FLS - Get Free Report) last posted its quarterly earnings results on Monday, October 28th. The industrial products company reported $0.62 EPS for the quarter, missing the consensus estimate of $0.67 by ($0.05). The business had revenue of $1.13 billion during the quarter, compared to analyst estimates of $1.12 billion. Flowserve had a net margin of 5.90% and a return on equity of 17.10%. The company's quarterly revenue was up 3.5% on a year-over-year basis. During the same period last year, the firm posted $0.50 earnings per share. As a group, sell-side analysts forecast that Flowserve Co. will post 2.71 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

FLS has been the topic of a number of research reports. Jefferies Financial Group started coverage on shares of Flowserve in a research note on Friday, October 18th. They issued a "buy" rating and a $65.00 target price on the stock. Bank of America increased their target price on Flowserve from $60.00 to $65.00 and gave the company a "buy" rating in a research note on Wednesday, October 30th. StockNews.com cut Flowserve from a "strong-buy" rating to a "buy" rating in a report on Thursday, August 8th. Mizuho lifted their price objective on shares of Flowserve from $58.00 to $65.00 and gave the company an "outperform" rating in a research note on Thursday, October 17th. Finally, Stifel Nicolaus raised their price target on shares of Flowserve from $60.00 to $61.00 and gave the company a "buy" rating in a report on Wednesday, October 16th. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and nine have given a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $61.30.

Get Our Latest Analysis on Flowserve

Flowserve Profile

(

Free Report)

Flowserve Corporation designs, manufactures, distributes, and services industrial flow management equipment in the United States, Canada, Mexico, Europe, the Middle East, Africa, and the Asia Pacific. It operates through Flowserve Pump Division (FPD) and Flow Control Division (FCD) segments. The FPD segment offers custom and pre-configured pumps and pump systems, mechanical seals, auxiliary systems, replacement parts, upgrades, and related aftermarket services; and equipment services, including installation and commissioning services, seal systems spare parts, repairs, advanced diagnostics, re-rate and upgrade solutions, retrofit programs, and machining and asset management solutions, as well as manufactures a gas-lubricated mechanical seal for use in high-speed compressors for gas pipelines and in the oil and gas production and process markets.

Recommended Stories

Before you consider Flowserve, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flowserve wasn't on the list.

While Flowserve currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.