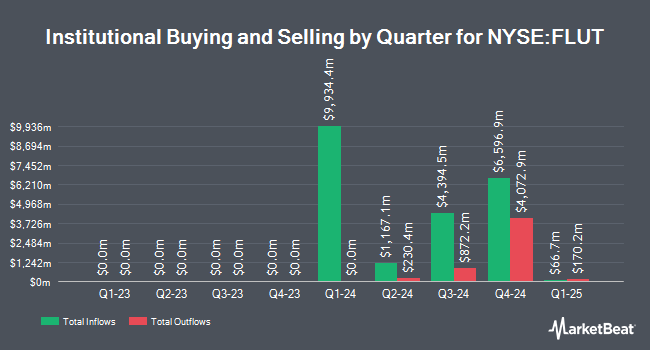

Cantillon Capital Management LLC grew its position in shares of Flutter Entertainment plc (NYSE:FLUT - Free Report) by 3,827.8% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 2,397,384 shares of the company's stock after acquiring an additional 2,336,347 shares during the quarter. Flutter Entertainment comprises about 3.5% of Cantillon Capital Management LLC's investment portfolio, making the stock its 7th largest holding. Cantillon Capital Management LLC owned about 1.35% of Flutter Entertainment worth $568,851,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors also recently modified their holdings of the company. Capital World Investors bought a new stake in Flutter Entertainment in the first quarter worth about $2,880,796,000. Capital Research Global Investors acquired a new position in shares of Flutter Entertainment in the 1st quarter valued at about $2,418,032,000. Vanguard Group Inc. acquired a new position in shares of Flutter Entertainment in the 1st quarter valued at about $1,578,442,000. Capital International Investors acquired a new position in shares of Flutter Entertainment in the 1st quarter valued at about $507,170,000. Finally, Marathon Asset Management Ltd acquired a new position in shares of Flutter Entertainment in the 3rd quarter valued at about $451,631,000.

Analysts Set New Price Targets

Several equities research analysts recently commented on the company. Berenberg Bank raised Flutter Entertainment to a "strong-buy" rating in a research note on Tuesday, August 27th. Bank of America began coverage on Flutter Entertainment in a research report on Monday, October 14th. They set a "buy" rating and a $300.00 target price for the company. UBS Group started coverage on Flutter Entertainment in a research report on Friday, November 8th. They set a "buy" rating and a $306.00 target price for the company. JMP Securities upped their price target on Flutter Entertainment from $287.00 to $299.00 and gave the stock a "market outperform" rating in a report on Wednesday, November 13th. Finally, Moffett Nathanson upped their target price on Flutter Entertainment from $245.00 to $275.00 and gave the company a "buy" rating in a research note on Thursday, September 26th. Fourteen research analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Buy" and a consensus price target of $296.08.

Check Out Our Latest Stock Analysis on Flutter Entertainment

Flutter Entertainment Price Performance

Flutter Entertainment stock traded down $3.61 during mid-day trading on Tuesday, hitting $263.39. The stock had a trading volume of 1,725,544 shares, compared to its average volume of 1,144,506. The stock has a 50-day simple moving average of $234.90 and a two-hundred day simple moving average of $210.86. Flutter Entertainment plc has a 12 month low of $150.65 and a 12 month high of $269.90.

Flutter Entertainment announced that its board has approved a share buyback program on Wednesday, September 25th that allows the company to buyback $5.00 billion in outstanding shares. This buyback authorization allows the company to reacquire up to 11.7% of its shares through open market purchases. Shares buyback programs are usually an indication that the company's board of directors believes its stock is undervalued.

Flutter Entertainment Company Profile

(

Free Report)

Flutter Entertainment plc operates as a sports betting and gaming company in the United Kingdom, Ireland, Australia, the United States, Italy, and internationally. The company operates through four segments: UK & Ireland, Australia, International, and US. It offers sports betting, iGaming, daily fantasy sports, online racing wagering, and TV broadcasting products; sportsbooks and exchange sports betting products, and gaming products; and online sports betting.

Further Reading

Before you consider Flutter Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flutter Entertainment wasn't on the list.

While Flutter Entertainment currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.