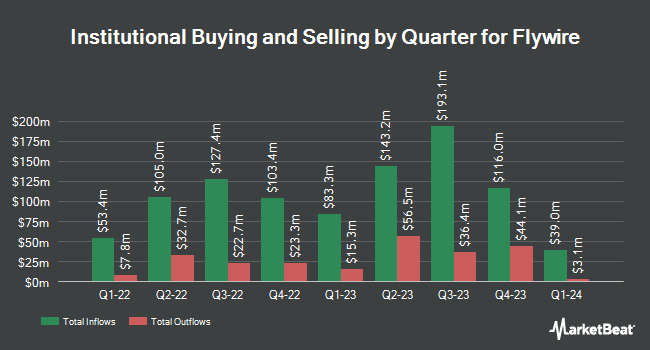

Assenagon Asset Management S.A. raised its holdings in shares of Flywire Co. (NASDAQ:FLYW - Free Report) by 33.1% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 393,200 shares of the company's stock after purchasing an additional 97,687 shares during the period. Assenagon Asset Management S.A. owned 0.32% of Flywire worth $8,108,000 as of its most recent SEC filing.

Other large investors have also recently made changes to their positions in the company. Oppenheimer Asset Management Inc. increased its holdings in shares of Flywire by 7.1% during the second quarter. Oppenheimer Asset Management Inc. now owns 21,295 shares of the company's stock valued at $349,000 after acquiring an additional 1,411 shares in the last quarter. XTX Topco Ltd bought a new stake in Flywire during the 2nd quarter valued at about $222,000. Sompo Asset Management Co. Ltd. raised its holdings in Flywire by 30.1% in the second quarter. Sompo Asset Management Co. Ltd. now owns 31,550 shares of the company's stock worth $517,000 after buying an additional 7,300 shares during the last quarter. Ensign Peak Advisors Inc bought a new position in shares of Flywire in the second quarter worth approximately $734,000. Finally, Bank of Montreal Can purchased a new stake in shares of Flywire during the second quarter valued at approximately $405,000. 95.90% of the stock is currently owned by hedge funds and other institutional investors.

Flywire Stock Performance

Shares of Flywire stock traded down $0.06 on Monday, hitting $20.03. 1,026,591 shares of the company's stock were exchanged, compared to its average volume of 1,039,711. The stock has a market capitalization of $2.49 billion, a PE ratio of 133.53, a PEG ratio of 1.47 and a beta of 1.10. Flywire Co. has a 1 year low of $15.19 and a 1 year high of $31.54. The company has a 50-day simple moving average of $20.99 and a 200-day simple moving average of $18.68.

Analysts Set New Price Targets

A number of equities analysts recently weighed in on the stock. Citigroup decreased their price objective on shares of Flywire from $27.00 to $26.00 and set a "buy" rating for the company in a report on Tuesday, January 14th. Wells Fargo & Company downgraded Flywire from an "overweight" rating to an "equal weight" rating and lowered their price target for the company from $20.00 to $18.00 in a report on Friday, October 11th. Deutsche Bank Aktiengesellschaft lifted their price objective on Flywire from $23.00 to $26.00 and gave the stock a "buy" rating in a report on Monday, December 2nd. Seaport Res Ptn cut shares of Flywire from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, January 14th. Finally, B. Riley reiterated a "buy" rating and issued a $30.00 price target on shares of Flywire in a research note on Wednesday, October 2nd. Five equities research analysts have rated the stock with a hold rating, ten have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $25.36.

Get Our Latest Report on FLYW

About Flywire

(

Free Report)

Flywire Corporation, together with its subsidiaries, operates as a payments enablement and software company in the United States and internationally. Its payment platform and network, and vertical-specific software help clients to get paid and help their customers to pay. The company's platform facilitates payment flows across multiple currencies, payment types, and payment options, as well as provides direct connections to alternative payment methods, such as Alipay, Boleto, PayPal/Venmo, and Trustly.

Read More

Before you consider Flywire, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flywire wasn't on the list.

While Flywire currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.