FMR LLC increased its holdings in shares of Donaldson Company, Inc. (NYSE:DCI - Free Report) by 6.2% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 3,994,275 shares of the industrial products company's stock after purchasing an additional 231,424 shares during the period. FMR LLC owned 3.34% of Donaldson worth $269,014,000 as of its most recent SEC filing.

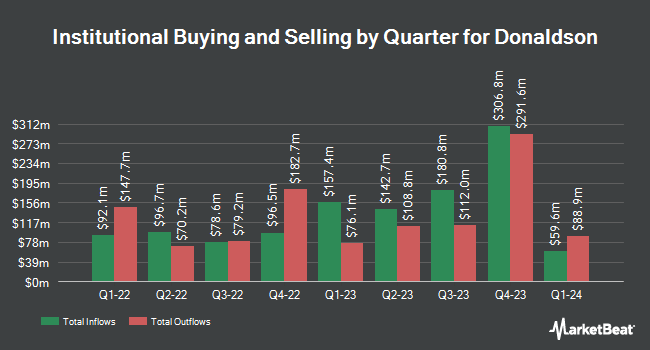

A number of other institutional investors also recently bought and sold shares of DCI. Smartleaf Asset Management LLC grew its holdings in Donaldson by 43.2% during the 4th quarter. Smartleaf Asset Management LLC now owns 597 shares of the industrial products company's stock valued at $40,000 after buying an additional 180 shares during the last quarter. Venturi Wealth Management LLC lifted its holdings in Donaldson by 89.6% in the 4th quarter. Venturi Wealth Management LLC now owns 781 shares of the industrial products company's stock valued at $53,000 after purchasing an additional 369 shares in the last quarter. GAMMA Investing LLC raised its holdings in Donaldson by 28.7% in the 4th quarter. GAMMA Investing LLC now owns 925 shares of the industrial products company's stock valued at $62,000 after acquiring an additional 206 shares during the last quarter. EverSource Wealth Advisors LLC increased its stake in Donaldson by 45.0% in the fourth quarter. EverSource Wealth Advisors LLC now owns 1,137 shares of the industrial products company's stock valued at $77,000 after purchasing an additional 353 shares during the last quarter. Finally, National Bank of Canada FI lifted its holdings in shares of Donaldson by 61.9% during the 4th quarter. National Bank of Canada FI now owns 1,206 shares of the industrial products company's stock worth $81,000 after acquiring an additional 461 shares during the period. 82.81% of the stock is currently owned by institutional investors and hedge funds.

Donaldson Stock Performance

DCI stock traded down $0.65 on Wednesday, reaching $62.58. The company's stock had a trading volume of 403,894 shares, compared to its average volume of 572,688. The company has a market capitalization of $7.48 billion, a P/E ratio of 18.19, a price-to-earnings-growth ratio of 1.82 and a beta of 1.01. The firm has a fifty day moving average of $67.30 and a two-hundred day moving average of $70.73. Donaldson Company, Inc. has a 52 week low of $57.45 and a 52 week high of $78.95. The company has a debt-to-equity ratio of 0.35, a current ratio of 1.85 and a quick ratio of 1.20.

Donaldson (NYSE:DCI - Get Free Report) last issued its quarterly earnings results on Thursday, February 27th. The industrial products company reported $0.83 EPS for the quarter, missing the consensus estimate of $0.85 by ($0.02). The business had revenue of $870.00 million during the quarter, compared to the consensus estimate of $908.32 million. Donaldson had a return on equity of 29.07% and a net margin of 11.56%. As a group, analysts predict that Donaldson Company, Inc. will post 3.64 EPS for the current fiscal year.

Donaldson Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Friday, February 28th. Shareholders of record on Thursday, February 13th were paid a dividend of $0.27 per share. This represents a $1.08 dividend on an annualized basis and a dividend yield of 1.73%. The ex-dividend date was Thursday, February 13th. Donaldson's dividend payout ratio (DPR) is currently 31.58%.

Insiders Place Their Bets

In related news, President Thomas R. Scalf sold 28,500 shares of the stock in a transaction dated Monday, March 17th. The shares were sold at an average price of $69.22, for a total value of $1,972,770.00. Following the completion of the sale, the president now owns 28,334 shares in the company, valued at approximately $1,961,279.48. This trade represents a 50.15 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, Director James Owens sold 18,700 shares of the business's stock in a transaction that occurred on Thursday, April 10th. The shares were sold at an average price of $62.02, for a total value of $1,159,774.00. Following the sale, the director now owns 20,246 shares in the company, valued at approximately $1,255,656.92. This represents a 48.02 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 76,700 shares of company stock valued at $5,164,799 in the last three months. Insiders own 2.70% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on DCI shares. Stifel Nicolaus cut their price target on shares of Donaldson from $70.00 to $63.00 and set a "hold" rating on the stock in a report on Monday. StockNews.com cut Donaldson from a "strong-buy" rating to a "buy" rating in a report on Tuesday, March 4th. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus target price of $71.33.

Check Out Our Latest Report on Donaldson

Donaldson Company Profile

(

Free Report)

Donaldson Company, Inc manufactures and sells filtration systems and replacement parts worldwide. The company operates through three segments: Mobile Solutions, Industrial Solutions, and Life Sciences. Its Mobile Solutions segment provides replacement filters for air and liquid filtration applications, such as air filtration systems; liquid filtration systems for fuel, lube, and hydraulic applications; exhaust and emissions systems and sensors; indicators; and monitoring systems.

Featured Stories

Before you consider Donaldson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Donaldson wasn't on the list.

While Donaldson currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.