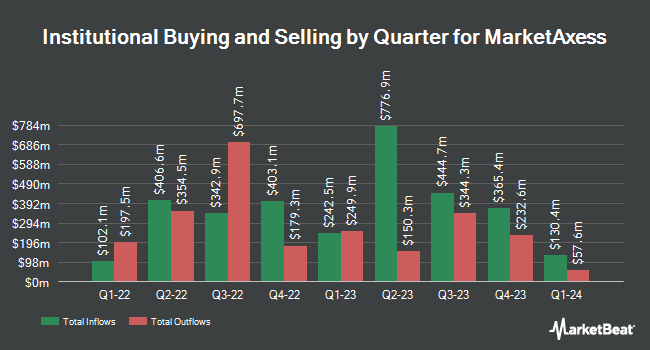

FMR LLC increased its holdings in MarketAxess Holdings Inc. (NASDAQ:MKTX - Free Report) by 17.5% in the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 1,959,043 shares of the financial services provider's stock after purchasing an additional 291,134 shares during the period. FMR LLC owned approximately 5.20% of MarketAxess worth $501,907,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in MKTX. Accent Capital Management LLC bought a new stake in shares of MarketAxess in the 3rd quarter worth about $25,000. Goodman Advisory Group LLC bought a new stake in MarketAxess during the second quarter worth about $27,000. Blue Trust Inc. increased its holdings in shares of MarketAxess by 405.1% during the second quarter. Blue Trust Inc. now owns 197 shares of the financial services provider's stock worth $43,000 after buying an additional 158 shares in the last quarter. CVA Family Office LLC raised its stake in shares of MarketAxess by 47.4% in the second quarter. CVA Family Office LLC now owns 252 shares of the financial services provider's stock valued at $51,000 after acquiring an additional 81 shares during the last quarter. Finally, Exchange Traded Concepts LLC bought a new position in shares of MarketAxess in the third quarter valued at approximately $54,000. Institutional investors own 99.01% of the company's stock.

Insider Activity at MarketAxess

In other MarketAxess news, Chairman Richard M. Mcvey sold 10,000 shares of the firm's stock in a transaction on Thursday, November 14th. The stock was sold at an average price of $267.67, for a total value of $2,676,700.00. Following the sale, the chairman now owns 562,029 shares of the company's stock, valued at approximately $150,438,302.43. This trade represents a 1.75 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. 2.66% of the stock is owned by insiders.

MarketAxess Trading Down 1.2 %

Shares of NASDAQ:MKTX traded down $3.02 during midday trading on Friday, hitting $258.69. The company had a trading volume of 230,227 shares, compared to its average volume of 404,515. MarketAxess Holdings Inc. has a 12 month low of $192.42 and a 12 month high of $297.97. The stock has a market cap of $9.75 billion, a price-to-earnings ratio of 35.05, a PEG ratio of 11.75 and a beta of 1.05. The firm has a fifty day simple moving average of $273.49 and a 200 day simple moving average of $239.58.

MarketAxess (NASDAQ:MKTX - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The financial services provider reported $1.90 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.85 by $0.05. MarketAxess had a return on equity of 20.93% and a net margin of 34.32%. The business had revenue of $206.70 million during the quarter, compared to analysts' expectations of $207.17 million. During the same period in the previous year, the company posted $1.46 earnings per share. The firm's revenue for the quarter was up 20.0% compared to the same quarter last year. Equities analysts forecast that MarketAxess Holdings Inc. will post 7.37 EPS for the current fiscal year.

MarketAxess announced that its board has authorized a stock repurchase plan on Tuesday, August 6th that allows the company to repurchase $250.00 million in outstanding shares. This repurchase authorization allows the financial services provider to purchase up to 2.8% of its shares through open market purchases. Shares repurchase plans are typically a sign that the company's leadership believes its stock is undervalued.

MarketAxess Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Wednesday, December 4th. Investors of record on Wednesday, November 20th will be given a $0.74 dividend. This represents a $2.96 dividend on an annualized basis and a dividend yield of 1.14%. The ex-dividend date of this dividend is Wednesday, November 20th. MarketAxess's payout ratio is currently 40.11%.

Analysts Set New Price Targets

MKTX has been the subject of a number of recent analyst reports. Keefe, Bruyette & Woods raised their price target on MarketAxess from $270.00 to $276.00 and gave the company a "market perform" rating in a report on Thursday, November 7th. Bank of America cut their price target on MarketAxess from $193.00 to $185.00 and set an "underperform" rating for the company in a report on Thursday, October 3rd. The Goldman Sachs Group upped their price target on shares of MarketAxess from $204.00 to $233.00 and gave the stock a "neutral" rating in a research report on Monday, September 30th. Barclays raised their price objective on shares of MarketAxess from $237.00 to $268.00 and gave the company an "equal weight" rating in a research report on Monday, October 7th. Finally, Deutsche Bank Aktiengesellschaft upped their target price on shares of MarketAxess from $258.00 to $264.00 and gave the stock a "hold" rating in a research report on Monday, November 11th. Two equities research analysts have rated the stock with a sell rating, seven have issued a hold rating and three have given a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average price target of $267.50.

Get Our Latest Research Report on MKTX

About MarketAxess

(

Free Report)

MarketAxess Holdings Inc, together with its subsidiaries, operates an electronic trading platform for institutional investor and broker-dealer companies worldwide. The company offers trading technology that provides liquidity access in U.S. high-grade bonds, U.S. high-yield bonds, emerging market debt, eurobonds, municipal bonds, U.S.

Featured Articles

Before you consider MarketAxess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarketAxess wasn't on the list.

While MarketAxess currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.