FMR LLC increased its position in V2X, Inc. (NYSE:VVX - Free Report) by 17.2% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 2,997,474 shares of the company's stock after acquiring an additional 439,852 shares during the quarter. FMR LLC owned about 9.50% of V2X worth $167,439,000 at the end of the most recent quarter.

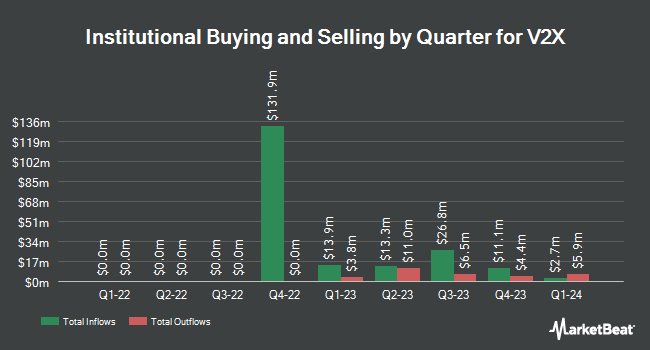

Several other hedge funds and other institutional investors also recently bought and sold shares of VVX. Vanguard Group Inc. lifted its holdings in V2X by 0.9% during the 1st quarter. Vanguard Group Inc. now owns 588,232 shares of the company's stock valued at $27,476,000 after purchasing an additional 5,259 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its holdings in shares of V2X by 6.2% in the first quarter. Price T Rowe Associates Inc. MD now owns 21,587 shares of the company's stock valued at $1,009,000 after buying an additional 1,267 shares during the period. Hennion & Walsh Asset Management Inc. boosted its holdings in V2X by 50.3% during the second quarter. Hennion & Walsh Asset Management Inc. now owns 13,212 shares of the company's stock worth $634,000 after purchasing an additional 4,419 shares during the last quarter. Harel Insurance Investments & Financial Services Ltd. boosted its holdings in V2X by 200.2% during the second quarter. Harel Insurance Investments & Financial Services Ltd. now owns 1,258 shares of the company's stock worth $60,000 after purchasing an additional 839 shares during the last quarter. Finally, Cornerstone Wealth Group LLC bought a new stake in V2X during the second quarter worth $371,000. 95.18% of the stock is currently owned by institutional investors and hedge funds.

Analysts Set New Price Targets

VVX has been the topic of several research reports. Raymond James upped their price target on shares of V2X from $60.00 to $72.00 and gave the company a "strong-buy" rating in a research note on Tuesday, November 5th. BTIG Research started coverage on shares of V2X in a report on Monday, November 25th. They issued a "buy" rating and a $80.00 price objective for the company. JMP Securities raised their price target on shares of V2X from $65.00 to $80.00 and gave the stock a "market outperform" rating in a report on Tuesday, November 5th. Royal Bank of Canada reiterated an "outperform" rating and issued a $70.00 price objective on shares of V2X in a research note on Tuesday, November 5th. Finally, Robert W. Baird assumed coverage on shares of V2X in a research report on Friday, October 11th. They issued an "outperform" rating and a $75.00 price target for the company. One analyst has rated the stock with a hold rating, four have assigned a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Buy" and an average price target of $72.17.

Check Out Our Latest Analysis on V2X

V2X Trading Down 0.3 %

NYSE:VVX traded down $0.17 during trading hours on Wednesday, reaching $59.90. The company's stock had a trading volume of 358,560 shares, compared to its average volume of 125,014. The company has a debt-to-equity ratio of 1.09, a quick ratio of 1.08 and a current ratio of 1.08. The firm has a market capitalization of $1.89 billion, a price-to-earnings ratio of 213.94 and a beta of 0.55. The firm has a 50-day simple moving average of $61.27 and a 200-day simple moving average of $53.62. V2X, Inc. has a 1 year low of $37.04 and a 1 year high of $69.75.

V2X (NYSE:VVX - Get Free Report) last posted its quarterly earnings results on Monday, November 4th. The company reported $1.29 EPS for the quarter, beating analysts' consensus estimates of $1.07 by $0.22. V2X had a net margin of 0.22% and a return on equity of 13.49%. The company had revenue of $1.08 billion during the quarter, compared to analyst estimates of $1.07 billion. During the same period in the prior year, the business posted $0.73 EPS. The firm's revenue was up 8.0% compared to the same quarter last year. Research analysts expect that V2X, Inc. will post 4.14 EPS for the current fiscal year.

Insider Buying and Selling at V2X

In other news, CEO Jeremy C. Wensinger acquired 6,250 shares of the firm's stock in a transaction that occurred on Friday, September 6th. The stock was bought at an average cost of $48.00 per share, for a total transaction of $300,000.00. Following the acquisition, the chief executive officer now directly owns 6,250 shares in the company, valued at approximately $300,000. The trade was a ∞ increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which can be accessed through this link. Also, CAO William Boyd Noon acquired 1,000 shares of the firm's stock in a transaction that occurred on Friday, September 6th. The stock was purchased at an average price of $48.00 per share, with a total value of $48,000.00. Following the completion of the acquisition, the chief accounting officer now owns 10,931 shares in the company, valued at $524,688. The trade was a 10.07 % increase in their ownership of the stock. The disclosure for this purchase can be found here. In the last three months, insiders have bought 11,936 shares of company stock valued at $572,928. 1.10% of the stock is currently owned by corporate insiders.

V2X Company Profile

(

Free Report)

V2X, Inc provides critical mission solutions and support services to defense clients worldwide. It offers a suite of integrated solutions across the operations and logistics, aerospace, training, and technology markets to national security, defense, civilian, and international clients. The company was incorporated in 2014 and is headquartered in Mclean, Virginia.

Featured Stories

Before you consider V2X, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and V2X wasn't on the list.

While V2X currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.