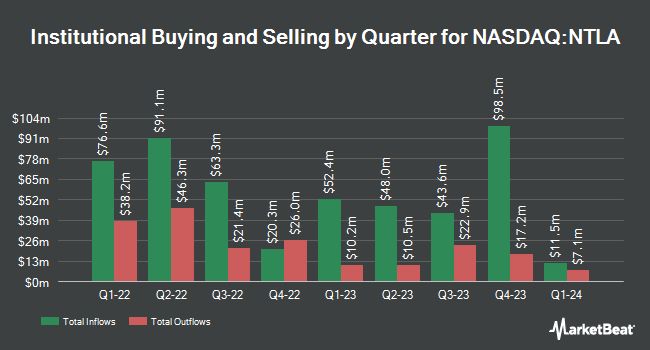

FMR LLC grew its position in shares of Intellia Therapeutics, Inc. (NASDAQ:NTLA - Free Report) by 5.0% in the third quarter, according to its most recent filing with the SEC. The fund owned 2,339,522 shares of the company's stock after acquiring an additional 111,104 shares during the quarter. FMR LLC owned about 2.30% of Intellia Therapeutics worth $48,077,000 at the end of the most recent reporting period.

Other hedge funds and other institutional investors have also recently modified their holdings of the company. Blue Trust Inc. lifted its position in Intellia Therapeutics by 1,664.3% in the second quarter. Blue Trust Inc. now owns 1,482 shares of the company's stock worth $33,000 after buying an additional 1,398 shares during the last quarter. EverSource Wealth Advisors LLC lifted its position in Intellia Therapeutics by 763.5% in the second quarter. EverSource Wealth Advisors LLC now owns 1,753 shares of the company's stock worth $39,000 after buying an additional 1,550 shares during the last quarter. Eastern Bank bought a new stake in Intellia Therapeutics in the third quarter worth $41,000. First Horizon Advisors Inc. lifted its position in Intellia Therapeutics by 22.1% in the second quarter. First Horizon Advisors Inc. now owns 2,604 shares of the company's stock worth $58,000 after buying an additional 472 shares during the last quarter. Finally, Values First Advisors Inc. bought a new stake in Intellia Therapeutics in the third quarter worth $54,000. 88.77% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several research firms have recently weighed in on NTLA. Barclays decreased their target price on Intellia Therapeutics from $76.00 to $55.00 and set an "overweight" rating for the company in a research report on Friday, November 8th. StockNews.com upgraded Intellia Therapeutics to a "sell" rating in a research report on Friday, November 8th. Chardan Capital lifted their target price on Intellia Therapeutics from $88.00 to $91.00 and gave the stock a "buy" rating in a research report on Monday, November 18th. William Blair restated a "neutral" rating and issued a $14.00 price objective on shares of Intellia Therapeutics in a report on Monday, November 18th. Finally, Royal Bank of Canada restated an "outperform" rating and issued a $54.00 price objective on shares of Intellia Therapeutics in a report on Thursday, September 19th. One research analyst has rated the stock with a sell rating, six have issued a hold rating, eleven have issued a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $54.94.

View Our Latest Analysis on NTLA

Insider Activity at Intellia Therapeutics

In related news, CAO Michael P. Dube sold 2,012 shares of the company's stock in a transaction that occurred on Wednesday, October 2nd. The stock was sold at an average price of $19.01, for a total value of $38,248.12. Following the sale, the chief accounting officer now owns 47,012 shares in the company, valued at $893,698.12. This represents a 4.10 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. 3.20% of the stock is owned by insiders.

Intellia Therapeutics Trading Up 7.8 %

Shares of NTLA stock traded up $1.07 during trading hours on Friday, reaching $14.72. 2,821,292 shares of the company's stock were exchanged, compared to its average volume of 2,724,545. Intellia Therapeutics, Inc. has a 1 year low of $12.82 and a 1 year high of $34.87. The stock has a market cap of $1.50 billion, a PE ratio of -2.71 and a beta of 1.76. The stock's fifty day moving average price is $16.61 and its two-hundred day moving average price is $20.98.

Intellia Therapeutics (NASDAQ:NTLA - Get Free Report) last issued its quarterly earnings results on Thursday, November 7th. The company reported ($1.34) earnings per share for the quarter, topping analysts' consensus estimates of ($1.37) by $0.03. The business had revenue of $9.10 million for the quarter, compared to analysts' expectations of $8.28 million. During the same quarter in the previous year, the firm posted ($1.38) EPS. Intellia Therapeutics's revenue was down 24.1% on a year-over-year basis. On average, equities analysts expect that Intellia Therapeutics, Inc. will post -5.12 EPS for the current fiscal year.

Intellia Therapeutics Company Profile

(

Free Report)

Intellia Therapeutics, Inc, a genome editing company, focuses on the development of curative therapeutics. The company's in vivo programs include NTLA-2001, which is in Phase 1 clinical trial for the treatment of transthyretin amyloidosis; NTLA-2002 for the treatment of hereditary angioedema; and NTLA-3001 for alpha-1 antitrypsin deficiency associated lung disease.

Featured Articles

Before you consider Intellia Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Intellia Therapeutics wasn't on the list.

While Intellia Therapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.