FMR LLC grew its stake in shares of Darling Ingredients Inc. (NYSE:DAR - Free Report) by 17.3% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The firm owned 3,324,217 shares of the company's stock after buying an additional 491,477 shares during the period. FMR LLC owned 2.09% of Darling Ingredients worth $123,528,000 as of its most recent SEC filing.

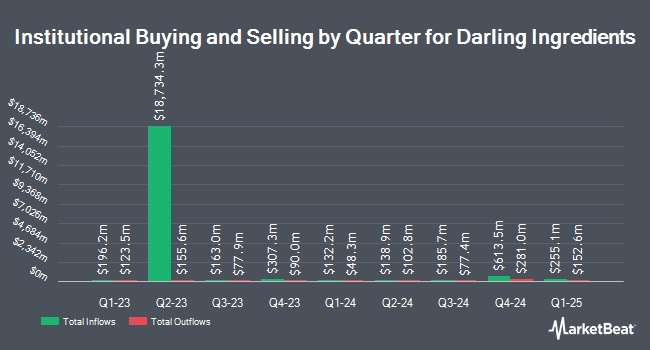

Other institutional investors and hedge funds have also made changes to their positions in the company. GAMMA Investing LLC lifted its position in Darling Ingredients by 173.9% during the third quarter. GAMMA Investing LLC now owns 830 shares of the company's stock valued at $31,000 after buying an additional 527 shares in the last quarter. Signaturefd LLC lifted its holdings in shares of Darling Ingredients by 75.0% during the 3rd quarter. Signaturefd LLC now owns 901 shares of the company's stock valued at $33,000 after acquiring an additional 386 shares in the last quarter. Blue Trust Inc. boosted its position in Darling Ingredients by 38.0% during the 3rd quarter. Blue Trust Inc. now owns 1,046 shares of the company's stock worth $38,000 after purchasing an additional 288 shares during the period. Ashton Thomas Securities LLC acquired a new stake in Darling Ingredients in the 3rd quarter valued at $58,000. Finally, Farther Finance Advisors LLC raised its position in Darling Ingredients by 69.2% in the third quarter. Farther Finance Advisors LLC now owns 1,854 shares of the company's stock valued at $69,000 after purchasing an additional 758 shares during the period. 94.44% of the stock is currently owned by institutional investors and hedge funds.

Darling Ingredients Stock Performance

Shares of Darling Ingredients stock traded down $0.97 during midday trading on Thursday, hitting $35.57. The company had a trading volume of 2,125,421 shares, compared to its average volume of 2,189,124. The business's 50 day simple moving average is $38.97 and its two-hundred day simple moving average is $38.26. The stock has a market cap of $5.66 billion, a PE ratio of 22.56 and a beta of 1.19. Darling Ingredients Inc. has a 1-year low of $32.67 and a 1-year high of $51.36. The company has a debt-to-equity ratio of 0.89, a current ratio of 1.41 and a quick ratio of 0.83.

Darling Ingredients (NYSE:DAR - Get Free Report) last posted its quarterly earnings data on Thursday, October 24th. The company reported $0.11 earnings per share for the quarter, missing the consensus estimate of $0.40 by ($0.29). The company had revenue of $1.42 billion during the quarter, compared to analyst estimates of $1.48 billion. Darling Ingredients had a net margin of 4.42% and a return on equity of 5.98%. The company's revenue was down 12.5% compared to the same quarter last year. During the same quarter in the previous year, the business posted $0.77 EPS. As a group, equities analysts predict that Darling Ingredients Inc. will post 1.88 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on DAR shares. Piper Sandler dropped their price target on shares of Darling Ingredients from $50.00 to $48.00 and set an "overweight" rating on the stock in a research note on Friday, October 11th. TD Cowen reduced their price target on Darling Ingredients from $45.00 to $43.00 and set a "hold" rating for the company in a report on Friday, September 13th. Jefferies Financial Group lifted their price objective on Darling Ingredients from $44.00 to $46.00 and gave the stock a "buy" rating in a report on Friday, October 25th. Finally, JPMorgan Chase & Co. increased their target price on Darling Ingredients from $58.00 to $59.00 and gave the company an "overweight" rating in a research note on Wednesday, October 30th. Two investment analysts have rated the stock with a hold rating and seven have given a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $53.44.

View Our Latest Research Report on DAR

Darling Ingredients Company Profile

(

Free Report)

Darling Ingredients Inc develops, produces, and sells natural ingredients from edible and inedible bio-nutrients in North America, Europe, China, South America, and internationally. The company operates through three segments: Feed Ingredients, Food Ingredients, and Fuel Ingredients. It offers ingredients and customized specialty solutions for customers in the pharmaceutical, food, pet food, feed, industrial, fuel, bioenergy, and fertilizer industries.

Read More

Before you consider Darling Ingredients, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Darling Ingredients wasn't on the list.

While Darling Ingredients currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.