FMR LLC decreased its holdings in Restaurant Brands International Inc. (NYSE:QSR - Free Report) TSE: QSR by 13.2% in the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 7,736,439 shares of the restaurant operator's stock after selling 1,179,885 shares during the quarter. FMR LLC owned 2.39% of Restaurant Brands International worth $558,246,000 at the end of the most recent reporting period.

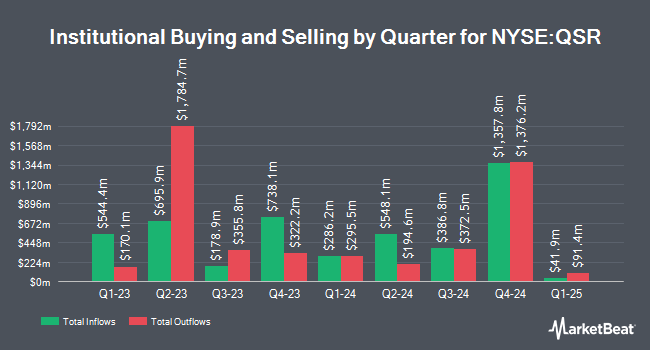

A number of other institutional investors have also recently made changes to their positions in the business. Farther Finance Advisors LLC boosted its position in Restaurant Brands International by 79.4% in the 3rd quarter. Farther Finance Advisors LLC now owns 418 shares of the restaurant operator's stock valued at $30,000 after buying an additional 185 shares during the period. Plato Investment Management Ltd acquired a new stake in shares of Restaurant Brands International in the third quarter valued at $61,000. Crewe Advisors LLC boosted its holdings in Restaurant Brands International by 78.8% in the second quarter. Crewe Advisors LLC now owns 1,071 shares of the restaurant operator's stock valued at $75,000 after purchasing an additional 472 shares during the period. Blue Trust Inc. grew its stake in Restaurant Brands International by 123.9% during the 3rd quarter. Blue Trust Inc. now owns 1,388 shares of the restaurant operator's stock worth $98,000 after purchasing an additional 768 shares in the last quarter. Finally, GAMMA Investing LLC increased its holdings in Restaurant Brands International by 67.0% during the 3rd quarter. GAMMA Investing LLC now owns 1,754 shares of the restaurant operator's stock worth $126,000 after purchasing an additional 704 shares during the period. Institutional investors and hedge funds own 82.29% of the company's stock.

Restaurant Brands International Stock Performance

Shares of QSR stock traded down $0.57 during midday trading on Friday, hitting $69.61. The company had a trading volume of 820,114 shares, compared to its average volume of 1,579,471. Restaurant Brands International Inc. has a 52-week low of $65.87 and a 52-week high of $83.29. The company has a debt-to-equity ratio of 2.75, a current ratio of 1.02 and a quick ratio of 0.94. The company's 50 day simple moving average is $70.23 and its 200 day simple moving average is $69.98. The stock has a market cap of $22.53 billion, a price-to-earnings ratio of 17.59, a PEG ratio of 2.28 and a beta of 0.94.

Restaurant Brands International Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, January 3rd. Shareholders of record on Friday, December 20th will be paid a $0.58 dividend. The ex-dividend date of this dividend is Friday, December 20th. This represents a $2.32 annualized dividend and a yield of 3.33%. Restaurant Brands International's dividend payout ratio is currently 58.15%.

Insiders Place Their Bets

In other Restaurant Brands International news, insider Thomas Benjamin Curtis sold 6,536 shares of Restaurant Brands International stock in a transaction that occurred on Tuesday, September 3rd. The stock was sold at an average price of $68.63, for a total value of $448,565.68. Following the sale, the insider now owns 37,179 shares of the company's stock, valued at approximately $2,551,594.77. The trade was a 14.95 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. 1.36% of the stock is owned by insiders.

Wall Street Analyst Weigh In

Several brokerages have recently issued reports on QSR. Royal Bank of Canada decreased their price objective on Restaurant Brands International from $95.00 to $90.00 and set an "outperform" rating for the company in a research note on Wednesday, November 6th. Oppenheimer decreased their price target on shares of Restaurant Brands International from $89.00 to $86.00 and set an "outperform" rating for the company in a research note on Tuesday, October 22nd. KeyCorp dropped their price objective on shares of Restaurant Brands International from $80.00 to $78.00 and set an "overweight" rating on the stock in a research report on Wednesday, November 6th. Truist Financial decreased their price objective on shares of Restaurant Brands International from $87.00 to $86.00 and set a "buy" rating for the company in a research report on Monday, August 19th. Finally, Evercore ISI dropped their target price on Restaurant Brands International from $93.00 to $90.00 and set an "outperform" rating on the stock in a report on Wednesday, November 6th. One equities research analyst has rated the stock with a sell rating, eight have issued a hold rating and seventeen have issued a buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $82.37.

Get Our Latest Research Report on QSR

Restaurant Brands International Profile

(

Free Report)

Restaurant Brands International Inc operates as a quick-service restaurant company in Canada, the United States, and internationally. It operates through four segments: Tim Hortons (TH), Burger King (BK), Popeyes Louisiana Kitchen (PLK), and Firehouse Subs (FHS). The company owns and franchises TH chain of donut/coffee/tea restaurants that offer blend coffee, tea, and espresso-based hot and cold specialty drinks; and fresh baked goods, including donuts, Timbits, bagels, muffins, cookies and pastries, grilled paninis, classic sandwiches, wraps, soups, and other food products.

Featured Articles

Before you consider Restaurant Brands International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Restaurant Brands International wasn't on the list.

While Restaurant Brands International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.