FMR LLC grew its position in Crocs, Inc. (NASDAQ:CROX - Free Report) by 4.8% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 8,907,591 shares of the textile maker's stock after purchasing an additional 406,287 shares during the quarter. FMR LLC owned about 15.28% of Crocs worth $1,289,908,000 as of its most recent SEC filing.

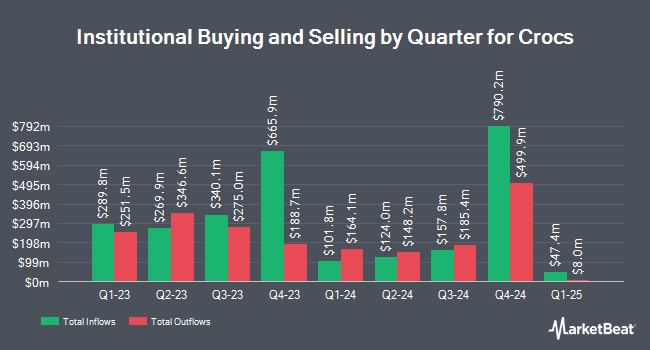

A number of other hedge funds and other institutional investors also recently modified their holdings of the company. Pacer Advisors Inc. lifted its holdings in shares of Crocs by 33.8% during the 3rd quarter. Pacer Advisors Inc. now owns 1,459,654 shares of the textile maker's stock worth $211,372,000 after acquiring an additional 368,557 shares during the period. National Bank of Canada FI lifted its stake in shares of Crocs by 8,437.1% in the second quarter. National Bank of Canada FI now owns 182,695 shares of the textile maker's stock worth $26,993,000 after acquiring an additional 180,555 shares during the period. Marshall Wace LLP bought a new stake in shares of Crocs in the 2nd quarter valued at $19,598,000. Distillate Capital Partners LLC acquired a new stake in Crocs during the 2nd quarter worth about $13,483,000. Finally, Dimensional Fund Advisors LP grew its position in shares of Crocs by 12.8% during the 2nd quarter. Dimensional Fund Advisors LP now owns 790,225 shares of the textile maker's stock worth $115,322,000 after buying an additional 89,610 shares during the period. Institutional investors and hedge funds own 93.44% of the company's stock.

Insider Buying and Selling

In other news, Director John B. Replogle bought 2,240 shares of the company's stock in a transaction dated Wednesday, October 30th. The shares were acquired at an average cost of $112.60 per share, with a total value of $252,224.00. Following the completion of the transaction, the director now directly owns 9,304 shares in the company, valued at approximately $1,047,630.40. The trade was a 31.71 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CFO Susan L. Healy acquired 1,000 shares of the firm's stock in a transaction on Wednesday, November 13th. The shares were acquired at an average price of $99.70 per share, with a total value of $99,700.00. Following the completion of the transaction, the chief financial officer now directly owns 22,652 shares in the company, valued at approximately $2,258,404.40. This trade represents a 4.62 % increase in their position. The disclosure for this purchase can be found here. 2.72% of the stock is currently owned by company insiders.

Crocs Price Performance

NASDAQ:CROX traded up $2.70 during mid-day trading on Wednesday, hitting $106.76. 409,364 shares of the company's stock traded hands, compared to its average volume of 1,348,582. The company has a debt-to-equity ratio of 0.82, a quick ratio of 0.90 and a current ratio of 1.43. The firm's 50 day simple moving average is $124.58 and its 200 day simple moving average is $135.52. Crocs, Inc. has a 1 year low of $85.71 and a 1 year high of $165.32. The company has a market cap of $6.22 billion, a PE ratio of 7.55, a price-to-earnings-growth ratio of 1.10 and a beta of 2.01.

Crocs (NASDAQ:CROX - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The textile maker reported $3.60 earnings per share for the quarter, beating analysts' consensus estimates of $3.10 by $0.50. Crocs had a net margin of 20.50% and a return on equity of 49.70%. The firm had revenue of $1.06 billion for the quarter, compared to analysts' expectations of $1.05 billion. During the same period in the previous year, the company posted $3.25 earnings per share. Crocs's revenue was up 1.6% compared to the same quarter last year. Sell-side analysts expect that Crocs, Inc. will post 12.93 EPS for the current year.

Analyst Upgrades and Downgrades

Several research firms have recently issued reports on CROX. UBS Group reduced their target price on shares of Crocs from $146.00 to $122.00 and set a "neutral" rating for the company in a research note on Wednesday, October 30th. Guggenheim lowered their price target on shares of Crocs from $182.00 to $155.00 and set a "buy" rating on the stock in a research report on Wednesday, October 30th. KeyCorp decreased their price target on Crocs from $155.00 to $150.00 and set an "overweight" rating on the stock in a research report on Wednesday, October 30th. Piper Sandler reaffirmed an "overweight" rating and issued a $170.00 price target on shares of Crocs in a report on Friday, August 23rd. Finally, Monness Crespi & Hardt cut their target price on shares of Crocs from $170.00 to $140.00 and set a "buy" rating for the company in a research report on Wednesday, October 30th. Five analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company. According to MarketBeat.com, Crocs has an average rating of "Moderate Buy" and a consensus price target of $148.80.

Check Out Our Latest Stock Analysis on Crocs

Crocs Company Profile

(

Free Report)

Crocs, Inc, together with its subsidiaries, designs, develops, manufactures, markets, distributes, and sells casual lifestyle footwear and accessories for men, women, and children under Crocs and HEYDUDE Brand in the United States and internationally. The company offers various footwear products, including clogs, sandals, slides, flips, wedges, platforms, socks, boots, charms, flip flops, sneakers, and slippers.

Read More

Before you consider Crocs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crocs wasn't on the list.

While Crocs currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report