FMR LLC increased its position in shares of Cal-Maine Foods, Inc. (NASDAQ:CALM - Free Report) by 716.8% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 29,226 shares of the basic materials company's stock after acquiring an additional 25,648 shares during the period. FMR LLC owned approximately 0.06% of Cal-Maine Foods worth $2,187,000 as of its most recent filing with the Securities and Exchange Commission.

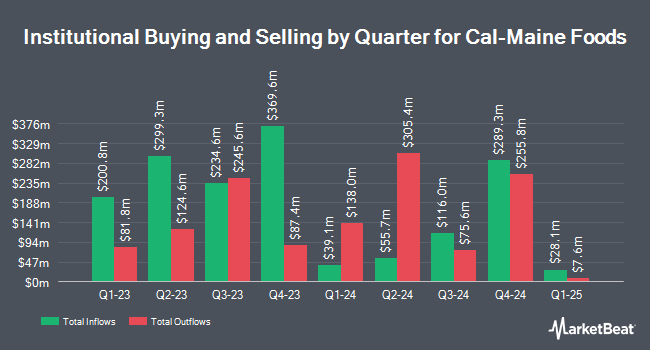

Other institutional investors and hedge funds have also bought and sold shares of the company. Harbor Capital Advisors Inc. purchased a new stake in shares of Cal-Maine Foods in the third quarter worth $29,000. Hantz Financial Services Inc. bought a new position in shares of Cal-Maine Foods in the 2nd quarter worth $25,000. Hexagon Capital Partners LLC raised its position in shares of Cal-Maine Foods by 57.0% during the 3rd quarter. Hexagon Capital Partners LLC now owns 427 shares of the basic materials company's stock valued at $32,000 after buying an additional 155 shares in the last quarter. Krane Funds Advisors LLC bought a new stake in shares of Cal-Maine Foods during the 3rd quarter worth $33,000. Finally, Quarry LP grew its position in Cal-Maine Foods by 1,975.0% in the second quarter. Quarry LP now owns 581 shares of the basic materials company's stock worth $36,000 after acquiring an additional 553 shares in the last quarter. 84.67% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of equities research analysts have weighed in on the company. StockNews.com downgraded Cal-Maine Foods from a "buy" rating to a "hold" rating in a research report on Saturday, November 23rd. Stephens initiated coverage on Cal-Maine Foods in a research note on Thursday, October 3rd. They issued an "equal weight" rating and a $82.00 target price for the company.

Check Out Our Latest Report on Cal-Maine Foods

Cal-Maine Foods Stock Performance

CALM traded up $2.23 on Friday, hitting $108.12. 592,178 shares of the company were exchanged, compared to its average volume of 591,483. The firm has a fifty day simple moving average of $93.60 and a two-hundred day simple moving average of $76.52. The stock has a market capitalization of $5.30 billion, a PE ratio of 12.38 and a beta of -0.10. Cal-Maine Foods, Inc. has a 12 month low of $53.02 and a 12 month high of $108.22.

Cal-Maine Foods (NASDAQ:CALM - Get Free Report) last issued its earnings results on Tuesday, October 1st. The basic materials company reported $3.06 earnings per share (EPS) for the quarter, missing the consensus estimate of $3.36 by ($0.30). The firm had revenue of $785.87 million during the quarter, compared to the consensus estimate of $704.65 million. Cal-Maine Foods had a return on equity of 24.25% and a net margin of 16.09%. The firm's revenue for the quarter was up 71.1% on a year-over-year basis. During the same quarter in the prior year, the business posted $0.02 EPS. On average, equities analysts expect that Cal-Maine Foods, Inc. will post 8.54 earnings per share for the current year.

Cal-Maine Foods Profile

(

Free Report)

Cal-Maine Foods, Inc, together with its subsidiaries, produces, grades, packages, markets, and distributes shell eggs. The company offers specialty shell eggs, such as nutritionally enhanced, cage free, organic, free-range, pasture-raised, and brown eggs under the Egg-Land's Best, Land O' Lakes, Farmhouse Eggs, Sunups, Sunny Meadow, and 4Grain brand names.

Featured Articles

Before you consider Cal-Maine Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cal-Maine Foods wasn't on the list.

While Cal-Maine Foods currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.