FMR LLC lessened its position in Spectrum Brands Holdings, Inc. (NYSE:SPB - Free Report) by 42.1% during the 3rd quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 387,593 shares of the company's stock after selling 282,186 shares during the quarter. FMR LLC owned about 1.38% of Spectrum Brands worth $36,876,000 as of its most recent SEC filing.

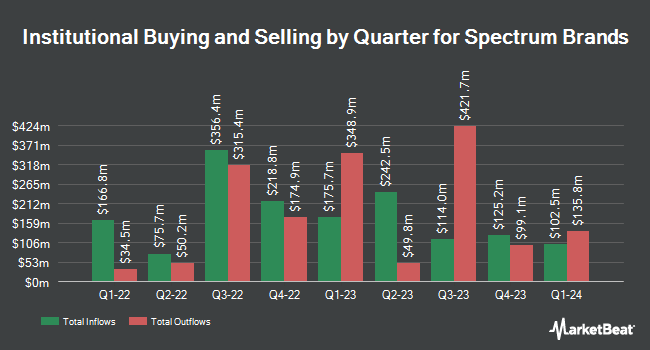

Several other hedge funds have also recently added to or reduced their stakes in the company. Waldron Private Wealth LLC purchased a new position in Spectrum Brands during the third quarter worth about $27,000. International Assets Investment Management LLC lifted its position in Spectrum Brands by 9,420.0% in the third quarter. International Assets Investment Management LLC now owns 476 shares of the company's stock valued at $45,000 after buying an additional 471 shares during the last quarter. Farther Finance Advisors LLC lifted its position in Spectrum Brands by 92.2% in the third quarter. Farther Finance Advisors LLC now owns 544 shares of the company's stock valued at $52,000 after buying an additional 261 shares during the last quarter. Quarry LP lifted its holdings in shares of Spectrum Brands by 375.0% in the 2nd quarter. Quarry LP now owns 570 shares of the company's stock worth $49,000 after acquiring an additional 450 shares during the last quarter. Finally, Headlands Technologies LLC purchased a new position in shares of Spectrum Brands during the 2nd quarter worth approximately $50,000.

Wall Street Analyst Weigh In

Separately, Canaccord Genuity Group boosted their price target on shares of Spectrum Brands from $91.00 to $94.00 and gave the stock a "hold" rating in a research note on Monday, November 18th. Five analysts have rated the stock with a hold rating and four have issued a buy rating to the stock. According to data from MarketBeat, Spectrum Brands has a consensus rating of "Hold" and a consensus price target of $102.38.

View Our Latest Research Report on SPB

Spectrum Brands Stock Up 1.0 %

Shares of NYSE SPB traded up $0.99 during midday trading on Monday, hitting $95.87. 344,029 shares of the company's stock were exchanged, compared to its average volume of 385,189. The firm's fifty day simple moving average is $91.55 and its 200-day simple moving average is $89.68. The company has a market cap of $2.69 billion, a PE ratio of 23.50, a P/E/G ratio of 1.65 and a beta of 1.19. Spectrum Brands Holdings, Inc. has a twelve month low of $74.26 and a twelve month high of $96.74. The company has a debt-to-equity ratio of 0.26, a current ratio of 2.30 and a quick ratio of 1.62.

Spectrum Brands (NYSE:SPB - Get Free Report) last issued its quarterly earnings data on Friday, November 15th. The company reported $0.97 earnings per share for the quarter, missing the consensus estimate of $1.13 by ($0.16). Spectrum Brands had a return on equity of 6.16% and a net margin of 4.21%. The company had revenue of $773.70 million for the quarter, compared to analysts' expectations of $747.80 million. During the same quarter in the prior year, the firm posted $1.36 EPS. The firm's quarterly revenue was up 4.5% compared to the same quarter last year. Research analysts predict that Spectrum Brands Holdings, Inc. will post 5.25 EPS for the current fiscal year.

Spectrum Brands Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, December 17th. Shareholders of record on Tuesday, November 26th will be given a dividend of $0.47 per share. This is a positive change from Spectrum Brands's previous quarterly dividend of $0.42. The ex-dividend date is Tuesday, November 26th. This represents a $1.88 annualized dividend and a yield of 1.96%. Spectrum Brands's payout ratio is 46.08%.

About Spectrum Brands

(

Free Report)

Spectrum Brands Holdings, Inc operates as a branded consumer products and home essentials company in North America, Europe, the Middle East, Africa, and Asia-Pacific regions. It operates through three segments: Home and Personal Care; Global Pet Care; and Home and Garden. The Home and Personal Care segment provides home appliances under the Black & Decker, Russell Hobbs, George Foreman, PowerXL, Emeril Legasse, Copper Chef, Toastmaster, Juiceman, Farberware, and Breadman brands; and personal care products under the Remington brand.

Featured Articles

Before you consider Spectrum Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Spectrum Brands wasn't on the list.

While Spectrum Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.