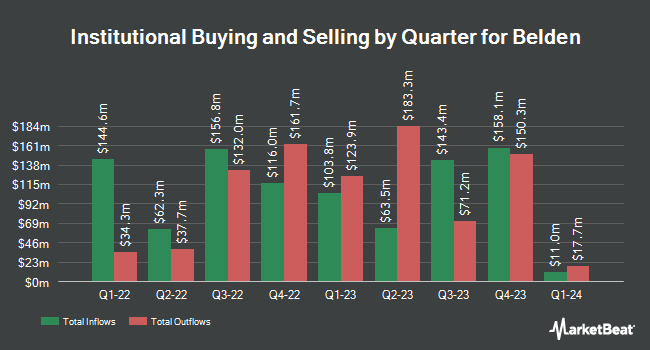

FMR LLC raised its holdings in Belden Inc. (NYSE:BDC - Free Report) by 14.8% during the third quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 4,486,337 shares of the industrial products company's stock after purchasing an additional 576,768 shares during the quarter. FMR LLC owned about 11.12% of Belden worth $525,485,000 as of its most recent filing with the SEC.

A number of other institutional investors and hedge funds have also made changes to their positions in BDC. Tidal Investments LLC lifted its holdings in shares of Belden by 198.4% during the first quarter. Tidal Investments LLC now owns 12,286 shares of the industrial products company's stock worth $1,138,000 after purchasing an additional 8,169 shares during the period. GSA Capital Partners LLP purchased a new stake in shares of Belden during the 3rd quarter worth $687,000. Los Angeles Capital Management LLC acquired a new position in shares of Belden during the 3rd quarter worth $608,000. Foster & Motley Inc. increased its holdings in shares of Belden by 25.3% in the 3rd quarter. Foster & Motley Inc. now owns 38,675 shares of the industrial products company's stock valued at $4,530,000 after purchasing an additional 7,819 shares in the last quarter. Finally, AdvisorShares Investments LLC acquired a new stake in shares of Belden in the second quarter valued at about $503,000. 98.75% of the stock is owned by hedge funds and other institutional investors.

Belden Price Performance

BDC traded up $0.53 during midday trading on Friday, reaching $122.40. 131,964 shares of the company's stock were exchanged, compared to its average volume of 269,032. Belden Inc. has a 1-year low of $65.64 and a 1-year high of $131.82. The stock has a market capitalization of $4.94 billion, a PE ratio of 28.47 and a beta of 1.07. The company has a debt-to-equity ratio of 0.99, a current ratio of 2.07 and a quick ratio of 1.43. The business's 50-day moving average price is $119.37 and its 200 day moving average price is $105.01.

Belden (NYSE:BDC - Get Free Report) last issued its quarterly earnings data on Thursday, October 31st. The industrial products company reported $1.70 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.61 by $0.09. The firm had revenue of $654.90 million during the quarter, compared to the consensus estimate of $643.63 million. Belden had a return on equity of 20.55% and a net margin of 7.61%. The company's quarterly revenue was up 4.5% compared to the same quarter last year. During the same period in the previous year, the firm posted $1.78 EPS. As a group, equities analysts anticipate that Belden Inc. will post 6.12 EPS for the current fiscal year.

Belden Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, January 9th. Shareholders of record on Thursday, December 12th will be paid a dividend of $0.05 per share. This represents a $0.20 dividend on an annualized basis and a dividend yield of 0.16%. The ex-dividend date of this dividend is Thursday, December 12th. Belden's dividend payout ratio is presently 4.65%.

Wall Street Analyst Weigh In

BDC has been the topic of several recent analyst reports. Truist Financial upped their target price on shares of Belden from $124.00 to $136.00 and gave the stock a "buy" rating in a research report on Friday, November 1st. Benchmark raised their price objective on Belden from $120.00 to $130.00 and gave the company a "buy" rating in a research note on Friday, November 1st. Five investment analysts have rated the stock with a buy rating, Based on data from MarketBeat, the stock presently has an average rating of "Buy" and an average price target of $122.75.

Check Out Our Latest Research Report on Belden

Insider Transactions at Belden

In related news, CAO Doug Zink sold 3,000 shares of the business's stock in a transaction that occurred on Thursday, November 7th. The shares were sold at an average price of $128.82, for a total value of $386,460.00. Following the completion of the sale, the chief accounting officer now directly owns 6,643 shares in the company, valued at approximately $855,751.26. The trade was a 31.11 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Insiders own 1.59% of the company's stock.

Belden Profile

(

Free Report)

Belden Inc designs, manufactures, and markets a portfolio of signal transmission solutions for mission critical applications in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. It operates in two segments, Enterprise Solutions and Industrial Automation Solutions. The Enterprise Solutions segment offers copper cable and connectivity solutions, fiber cable and connectivity solutions, interconnect panels, racks and enclosures, and signal extension and matrix switching systems for use in applications, such as local area networks, data centers, access control, 5G, fiber to the home, and building automation.

Further Reading

Before you consider Belden, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Belden wasn't on the list.

While Belden currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.