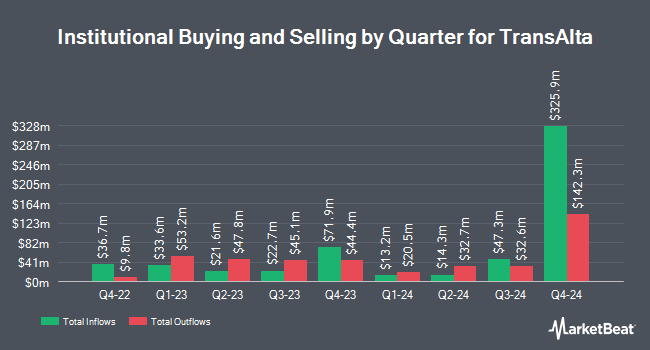

FMR LLC lifted its position in TransAlta Co. (NYSE:TAC - Free Report) TSE: TA by 9.8% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 4,593,023 shares of the utilities provider's stock after buying an additional 408,184 shares during the period. FMR LLC owned about 1.54% of TransAlta worth $47,613,000 as of its most recent SEC filing.

A number of other large investors have also made changes to their positions in the company. Mirabella Financial Services LLP bought a new stake in shares of TransAlta in the 3rd quarter valued at $200,000. PCJ Investment Counsel Ltd. bought a new stake in shares of TransAlta in the 3rd quarter valued at $2,573,000. Metis Global Partners LLC bought a new stake in shares of TransAlta in the 3rd quarter valued at $360,000. Oppenheimer & Co. Inc. bought a new stake in shares of TransAlta in the 3rd quarter valued at $194,000. Finally, Entropy Technologies LP bought a new stake in shares of TransAlta in the 3rd quarter valued at $130,000. Institutional investors own 59.00% of the company's stock.

TransAlta Stock Up 5.4 %

TAC stock traded up $0.69 during trading hours on Friday, reaching $13.48. 2,921,103 shares of the stock were exchanged, compared to its average volume of 874,968. The firm's 50-day moving average is $10.62 and its 200-day moving average is $8.86. The company has a market cap of $4.02 billion, a price-to-earnings ratio of 36.43 and a beta of 0.91. The company has a debt-to-equity ratio of 2.94, a current ratio of 0.74 and a quick ratio of 0.67. TransAlta Co. has a 12 month low of $5.94 and a 12 month high of $13.53.

TransAlta Announces Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 1st. Stockholders of record on Sunday, December 1st will be paid a dividend of $0.044 per share. The ex-dividend date of this dividend is Friday, November 29th. This represents a $0.18 dividend on an annualized basis and a dividend yield of 1.31%. TransAlta's dividend payout ratio is 45.95%.

Wall Street Analysts Forecast Growth

A number of research firms recently commented on TAC. Scotiabank upgraded shares of TransAlta to a "strong-buy" rating in a research report on Thursday. Desjardins reiterated a "hold" rating on shares of TransAlta in a report on Wednesday, November 6th. Finally, StockNews.com cut TransAlta from a "strong-buy" rating to a "buy" rating in a report on Wednesday, November 6th.

Check Out Our Latest Analysis on TransAlta

TransAlta Profile

(

Free Report)

TransAlta Corporation engages in the development, production, and sale of electric energy. It operates through Hydro, Wind and Solar, Gas, Energy Transition, and Energy Marketing segments. The Hydro segment holds interest of approximately 922 megawatts (MW) of owned hydroelectric generating capacity located in Alberta, British Columbia, and Ontario.

Featured Articles

Before you consider TransAlta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TransAlta wasn't on the list.

While TransAlta currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.