FMR LLC lifted its position in Eni S.p.A. (NYSE:E - Free Report) by 33.5% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 583,677 shares of the oil and gas exploration company's stock after buying an additional 146,431 shares during the period. FMR LLC's holdings in ENI were worth $17,691,000 as of its most recent SEC filing.

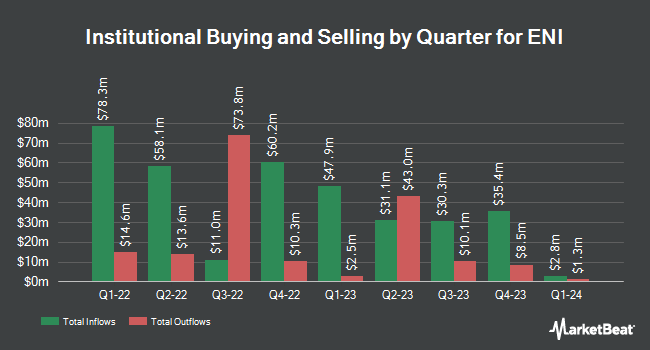

Several other hedge funds and other institutional investors have also recently made changes to their positions in E. GAMMA Investing LLC increased its holdings in ENI by 25.9% in the third quarter. GAMMA Investing LLC now owns 3,075 shares of the oil and gas exploration company's stock valued at $93,000 after buying an additional 633 shares in the last quarter. Allspring Global Investments Holdings LLC boosted its stake in ENI by 138.5% during the second quarter. Allspring Global Investments Holdings LLC now owns 5,542 shares of the oil and gas exploration company's stock worth $171,000 after buying an additional 3,218 shares during the period. Wealth Enhancement Advisory Services LLC acquired a new position in ENI during the third quarter worth $212,000. Aaron Wealth Advisors LLC acquired a new position in ENI in the 3rd quarter valued at about $239,000. Finally, Atomi Financial Group Inc. increased its stake in ENI by 13.3% during the 2nd quarter. Atomi Financial Group Inc. now owns 8,151 shares of the oil and gas exploration company's stock worth $251,000 after buying an additional 956 shares during the period. Hedge funds and other institutional investors own 1.18% of the company's stock.

Wall Street Analyst Weigh In

E has been the subject of a number of research analyst reports. Sanford C. Bernstein cut ENI from an "outperform" rating to a "market perform" rating in a research report on Monday, September 23rd. Jefferies Financial Group reaffirmed a "buy" rating on shares of ENI in a report on Tuesday, October 15th. Morgan Stanley raised shares of ENI from an "equal weight" rating to an "overweight" rating and set a $39.60 price objective for the company in a research note on Thursday, August 29th. StockNews.com upgraded shares of ENI from a "hold" rating to a "buy" rating in a report on Friday, November 1st. Finally, BNP Paribas upgraded ENI from an "underperform" rating to a "neutral" rating in a report on Friday, September 13th. Four research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average target price of $39.60.

Check Out Our Latest Research Report on E

ENI Stock Performance

Shares of NYSE E traded up $0.04 during midday trading on Wednesday, hitting $28.08. 262,482 shares of the company's stock were exchanged, compared to its average volume of 290,703. Eni S.p.A. has a twelve month low of $27.79 and a twelve month high of $34.30. The firm has a market cap of $47.40 billion, a P/E ratio of 16.73, a PEG ratio of 1.23 and a beta of 0.93. The stock's 50 day moving average price is $29.89 and its 200-day moving average price is $30.67. The company has a debt-to-equity ratio of 0.41, a current ratio of 1.27 and a quick ratio of 1.07.

About ENI

(

Free Report)

Eni S.p.A. operates as an integrated energy company worldwide. The company engages in exploration, development, extracting, manufacturing, and marketing crude oil and natural gas, oil-based fuels, chemical products, and gas-fired power, as well as energy products from renewable sources. It operates through Exploration & Production; Global Gas & LNG Portfolio (GGP); Enilive, Refining and Chemicals; Plenitude & Power; and Corporate and Other Activities segments.

See Also

Before you consider ENI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ENI wasn't on the list.

While ENI currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.