FMR LLC raised its holdings in Weave Communications, Inc. (NYSE:WEAV - Free Report) by 161.9% during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 97,991 shares of the company's stock after buying an additional 60,574 shares during the quarter. FMR LLC owned 0.13% of Weave Communications worth $1,254,000 as of its most recent SEC filing.

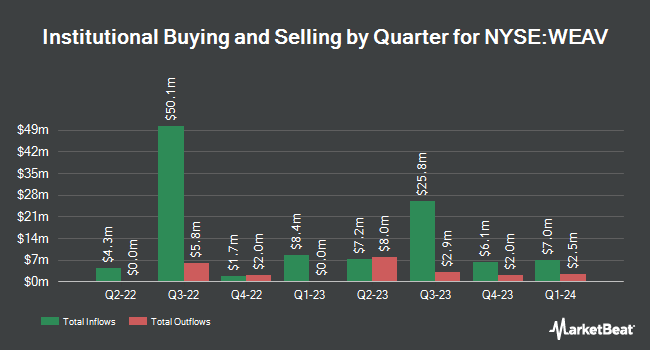

Other hedge funds also recently made changes to their positions in the company. AXA S.A. bought a new stake in shares of Weave Communications during the second quarter worth $11,590,000. Renaissance Technologies LLC grew its holdings in Weave Communications by 17.8% during the 2nd quarter. Renaissance Technologies LLC now owns 593,500 shares of the company's stock worth $5,353,000 after acquiring an additional 89,600 shares during the last quarter. Pathway Capital Management LP acquired a new stake in Weave Communications in the 3rd quarter valued at about $7,308,000. Charles Schwab Investment Management Inc. raised its stake in shares of Weave Communications by 11.7% in the third quarter. Charles Schwab Investment Management Inc. now owns 435,099 shares of the company's stock worth $5,569,000 after acquiring an additional 45,475 shares during the last quarter. Finally, Connor Clark & Lunn Investment Management Ltd. lifted its position in shares of Weave Communications by 20.2% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 347,302 shares of the company's stock worth $4,445,000 after purchasing an additional 58,359 shares in the last quarter. Institutional investors and hedge funds own 86.83% of the company's stock.

Insider Buying and Selling

In related news, Director Blake G. Modersitzki sold 92,930 shares of the company's stock in a transaction on Friday, December 13th. The stock was sold at an average price of $15.47, for a total transaction of $1,437,627.10. Following the completion of the sale, the director now directly owns 207,979 shares in the company, valued at $3,217,435.13. This represents a 30.88 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Also, CFO Alan Taylor sold 8,710 shares of the stock in a transaction dated Thursday, October 31st. The stock was sold at an average price of $14.12, for a total transaction of $122,985.20. Following the completion of the transaction, the chief financial officer now directly owns 392,085 shares of the company's stock, valued at $5,536,240.20. This trade represents a 2.17 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 1,123,158 shares of company stock valued at $16,128,886. 36.30% of the stock is owned by company insiders.

Analyst Ratings Changes

Several equities analysts recently issued reports on WEAV shares. The Goldman Sachs Group raised their price target on Weave Communications from $13.00 to $14.50 and gave the company a "neutral" rating in a report on Friday, November 1st. Piper Sandler lifted their price target on shares of Weave Communications from $16.00 to $17.00 and gave the stock an "overweight" rating in a research report on Thursday, October 31st. Finally, Loop Capital increased their price objective on shares of Weave Communications from $15.00 to $18.00 and gave the company a "buy" rating in a report on Thursday, October 31st. One research analyst has rated the stock with a hold rating, three have issued a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Buy" and a consensus price target of $16.50.

View Our Latest Stock Analysis on Weave Communications

Weave Communications Stock Performance

Weave Communications stock traded down $0.02 during mid-day trading on Tuesday, hitting $15.93. 992,255 shares of the company's stock traded hands, compared to its average volume of 544,597. Weave Communications, Inc. has a fifty-two week low of $8.10 and a fifty-two week high of $16.16. The stock has a market cap of $1.16 billion, a price-to-earnings ratio of -39.81 and a beta of 2.00. The firm has a 50 day simple moving average of $13.83 and a two-hundred day simple moving average of $11.51. The company has a debt-to-equity ratio of 0.09, a current ratio of 1.59 and a quick ratio of 1.59.

About Weave Communications

(

Free Report)

Weave Communications, Inc provides a customer experience and payments software platform in the United States and Canada. Its platform enables small and medium-sized healthcare businesses to maximize the value of their patient interactions and minimize the time and effort spent on manual or mundane tasks.

See Also

Before you consider Weave Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weave Communications wasn't on the list.

While Weave Communications currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.