FMR LLC lifted its position in shares of FactSet Research Systems Inc. (NYSE:FDS - Free Report) by 14.0% during the 3rd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 77,447 shares of the business services provider's stock after purchasing an additional 9,506 shares during the quarter. FMR LLC owned about 0.20% of FactSet Research Systems worth $35,614,000 as of its most recent filing with the Securities & Exchange Commission.

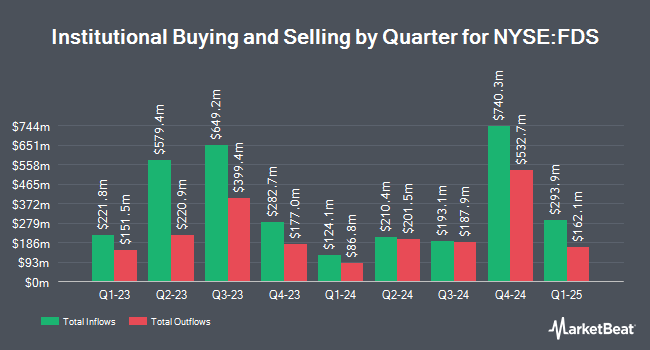

Several other hedge funds also recently made changes to their positions in the company. Ninety One UK Ltd raised its stake in FactSet Research Systems by 0.9% during the second quarter. Ninety One UK Ltd now owns 1,216,461 shares of the business services provider's stock valued at $496,645,000 after buying an additional 10,928 shares during the last quarter. Charles Schwab Investment Management Inc. raised its stake in FactSet Research Systems by 1.1% during the third quarter. Charles Schwab Investment Management Inc. now owns 373,386 shares of the business services provider's stock valued at $171,702,000 after buying an additional 4,113 shares during the last quarter. Boston Trust Walden Corp raised its stake in FactSet Research Systems by 9.3% during the third quarter. Boston Trust Walden Corp now owns 296,329 shares of the business services provider's stock valued at $136,267,000 after buying an additional 25,294 shares during the last quarter. PineStone Asset Management Inc. raised its stake in FactSet Research Systems by 0.4% during the third quarter. PineStone Asset Management Inc. now owns 274,003 shares of the business services provider's stock valued at $126,000,000 after buying an additional 1,030 shares during the last quarter. Finally, Tandem Investment Advisors Inc. raised its stake in FactSet Research Systems by 1.4% during the second quarter. Tandem Investment Advisors Inc. now owns 250,028 shares of the business services provider's stock valued at $102,079,000 after buying an additional 3,485 shares during the last quarter. 91.24% of the stock is currently owned by institutional investors.

FactSet Research Systems Price Performance

Shares of NYSE FDS traded down $1.99 during mid-day trading on Monday, reaching $477.98. The company's stock had a trading volume of 213,861 shares, compared to its average volume of 260,353. The firm has a market capitalization of $18.16 billion, a PE ratio of 34.53, a P/E/G ratio of 3.08 and a beta of 0.76. The company has a debt-to-equity ratio of 0.65, a current ratio of 1.25 and a quick ratio of 1.25. The stock has a fifty day moving average of $471.63 and a two-hundred day moving average of $438.58. FactSet Research Systems Inc. has a 52 week low of $391.84 and a 52 week high of $499.87.

FactSet Research Systems (NYSE:FDS - Get Free Report) last posted its earnings results on Thursday, September 19th. The business services provider reported $3.74 EPS for the quarter, topping analysts' consensus estimates of $3.62 by $0.12. The company had revenue of $562.20 million for the quarter, compared to the consensus estimate of $547.06 million. FactSet Research Systems had a return on equity of 34.77% and a net margin of 24.38%. The firm's revenue for the quarter was up 4.9% on a year-over-year basis. During the same period in the previous year, the business earned $2.93 earnings per share. As a group, sell-side analysts anticipate that FactSet Research Systems Inc. will post 17.2 EPS for the current fiscal year.

FactSet Research Systems Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, December 19th. Investors of record on Friday, November 29th will be issued a dividend of $1.04 per share. The ex-dividend date is Friday, November 29th. This represents a $4.16 annualized dividend and a yield of 0.87%. FactSet Research Systems's payout ratio is presently 29.93%.

Insider Buying and Selling

In related news, EVP Christopher R. Ellis sold 13,952 shares of the stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of $456.15, for a total value of $6,364,204.80. Following the sale, the executive vice president now directly owns 23,515 shares of the company's stock, valued at $10,726,367.25. This represents a 37.24 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, insider John Costigan sold 1,622 shares of the business's stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $481.00, for a total value of $780,182.00. Following the transaction, the insider now owns 299 shares of the company's stock, valued at $143,819. This trade represents a 84.44 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 23,984 shares of company stock worth $10,981,107 over the last three months. 1.10% of the stock is owned by insiders.

Wall Street Analyst Weigh In

FDS has been the subject of several recent analyst reports. BMO Capital Markets boosted their price target on FactSet Research Systems from $471.00 to $521.00 and gave the stock a "market perform" rating in a research note on Friday, November 15th. Redburn Atlantic cut FactSet Research Systems from a "neutral" rating to a "sell" rating and decreased their price target for the stock from $420.00 to $380.00 in a research note on Wednesday, October 9th. Royal Bank of Canada restated a "sector perform" rating and issued a $503.00 price target on shares of FactSet Research Systems in a research note on Friday, November 15th. Wells Fargo & Company boosted their price target on FactSet Research Systems from $435.00 to $503.00 and gave the stock an "equal weight" rating in a research note on Friday, September 20th. Finally, Evercore ISI initiated coverage on FactSet Research Systems in a research note on Wednesday, October 2nd. They issued an "inline" rating and a $470.00 price target for the company. Five research analysts have rated the stock with a sell rating and eight have assigned a hold rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $447.69.

Check Out Our Latest Stock Analysis on FDS

FactSet Research Systems Company Profile

(

Free Report)

FactSet Research Systems Inc, a financial data company, provides integrated financial information and analytical applications to the investment community in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company delivers insight and information through the workflow solutions of research, analytics and trading, content and technology solutions, and wealth.

Read More

Before you consider FactSet Research Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FactSet Research Systems wasn't on the list.

While FactSet Research Systems currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.