FMR LLC boosted its position in Axcelis Technologies, Inc. (NASDAQ:ACLS - Free Report) by 51.4% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 263,332 shares of the semiconductor company's stock after purchasing an additional 89,453 shares during the period. FMR LLC owned approximately 0.81% of Axcelis Technologies worth $27,610,000 as of its most recent SEC filing.

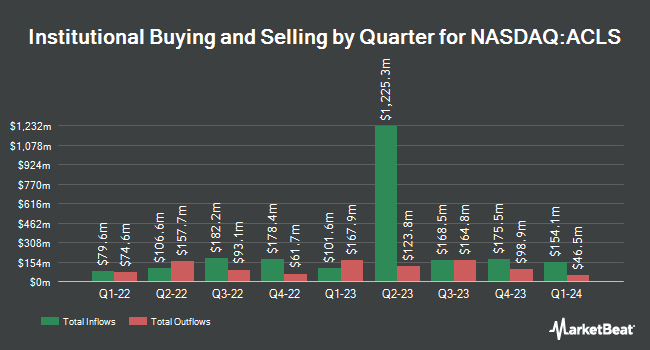

Other institutional investors have also recently added to or reduced their stakes in the company. Signaturefd LLC lifted its position in Axcelis Technologies by 348.9% in the second quarter. Signaturefd LLC now owns 211 shares of the semiconductor company's stock worth $30,000 after purchasing an additional 164 shares during the period. Blue Trust Inc. lifted its position in Axcelis Technologies by 223.8% in the second quarter. Blue Trust Inc. now owns 272 shares of the semiconductor company's stock worth $39,000 after purchasing an additional 188 shares during the period. Ashton Thomas Private Wealth LLC acquired a new stake in Axcelis Technologies in the second quarter worth approximately $39,000. Isthmus Partners LLC lifted its position in Axcelis Technologies by 87.3% in the second quarter. Isthmus Partners LLC now owns 33,270 shares of the semiconductor company's stock worth $47,000 after purchasing an additional 15,507 shares during the period. Finally, Meeder Asset Management Inc. bought a new position in shares of Axcelis Technologies in the second quarter valued at $69,000. 89.98% of the stock is currently owned by institutional investors and hedge funds.

Axcelis Technologies Stock Down 0.8 %

NASDAQ:ACLS traded down $0.61 during trading hours on Tuesday, hitting $76.49. 615,204 shares of the stock traded hands, compared to its average volume of 633,446. The firm has a 50 day moving average price of $85.48 and a 200 day moving average price of $108.04. The company has a current ratio of 4.45, a quick ratio of 3.29 and a debt-to-equity ratio of 0.04. Axcelis Technologies, Inc. has a fifty-two week low of $69.35 and a fifty-two week high of $158.61. The firm has a market cap of $2.49 billion, a price-to-earnings ratio of 11.32, a PEG ratio of 2.31 and a beta of 1.53.

Analysts Set New Price Targets

ACLS has been the topic of several research reports. Needham & Company LLC reaffirmed a "hold" rating on shares of Axcelis Technologies in a report on Friday, November 8th. Benchmark cut Axcelis Technologies from a "buy" rating to a "hold" rating in a report on Friday, November 8th. Three equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and an average price target of $167.33.

Read Our Latest Analysis on Axcelis Technologies

Axcelis Technologies Company Profile

(

Free Report)

Axcelis Technologies, Inc designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and Asia Pacific. The company offers high energy, high current, and medium current implanters for various application requirements.

Further Reading

Before you consider Axcelis Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axcelis Technologies wasn't on the list.

While Axcelis Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.