FMR LLC lessened its position in shares of Novo Nordisk A/S (NYSE:NVO - Free Report) by 8.0% in the third quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 17,931,577 shares of the company's stock after selling 1,563,065 shares during the period. FMR LLC owned 0.40% of Novo Nordisk A/S worth $2,135,113,000 at the end of the most recent reporting period.

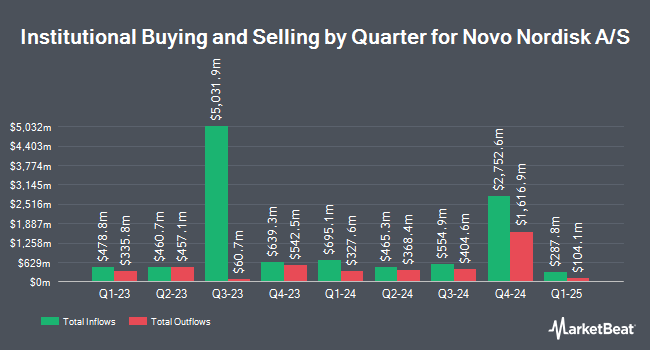

Other institutional investors have also bought and sold shares of the company. 1620 Investment Advisors Inc. bought a new stake in shares of Novo Nordisk A/S during the 2nd quarter valued at about $25,000. Strategic Investment Solutions Inc. IL bought a new position in shares of Novo Nordisk A/S during the 2nd quarter worth approximately $25,000. Gilliland Jeter Wealth Management LLC grew its position in shares of Novo Nordisk A/S by 200.0% during the 2nd quarter. Gilliland Jeter Wealth Management LLC now owns 180 shares of the company's stock worth $26,000 after buying an additional 120 shares during the period. Daiwa Securities Group Inc. bought a new stake in shares of Novo Nordisk A/S in the 3rd quarter valued at $28,000. Finally, Halpern Financial Inc. lifted its position in shares of Novo Nordisk A/S by 113.0% during the 2nd quarter. Halpern Financial Inc. now owns 213 shares of the company's stock valued at $30,000 after acquiring an additional 113 shares during the period. Institutional investors own 11.54% of the company's stock.

Novo Nordisk A/S Stock Down 0.8 %

NYSE NVO traded down $0.82 during trading hours on Wednesday, hitting $105.31. The company's stock had a trading volume of 574,739 shares, compared to its average volume of 4,501,858. The company has a market capitalization of $472.58 billion, a PE ratio of 34.35, a price-to-earnings-growth ratio of 1.35 and a beta of 0.42. The company has a current ratio of 0.94, a quick ratio of 0.75 and a debt-to-equity ratio of 0.43. Novo Nordisk A/S has a 52 week low of $94.73 and a 52 week high of $148.15. The company's 50-day simple moving average is $114.32 and its two-hundred day simple moving average is $128.49.

Wall Street Analyst Weigh In

NVO has been the subject of a number of research reports. StockNews.com upgraded shares of Novo Nordisk A/S from a "buy" rating to a "strong-buy" rating in a report on Friday, November 1st. BMO Capital Markets reduced their target price on Novo Nordisk A/S from $160.00 to $156.00 and set an "outperform" rating for the company in a research note on Thursday, October 17th. Finally, Cantor Fitzgerald reaffirmed an "overweight" rating and set a $160.00 price target on shares of Novo Nordisk A/S in a research note on Wednesday, November 6th. One equities research analyst has rated the stock with a hold rating, six have issued a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat.com, Novo Nordisk A/S presently has a consensus rating of "Buy" and an average price target of $144.50.

View Our Latest Report on NVO

Novo Nordisk A/S Profile

(

Free Report)

Novo Nordisk A/S, together with its subsidiaries, engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally. It operates in two segments, Diabetes and Obesity Care, and Rare Disease.

Further Reading

Before you consider Novo Nordisk A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novo Nordisk A/S wasn't on the list.

While Novo Nordisk A/S currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.