FMR LLC lessened its position in shares of Upbound Group, Inc. (NASDAQ:UPBD - Free Report) by 25.0% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 4,320,993 shares of the company's stock after selling 1,436,968 shares during the period. FMR LLC owned about 7.90% of Upbound Group worth $138,229,000 as of its most recent SEC filing.

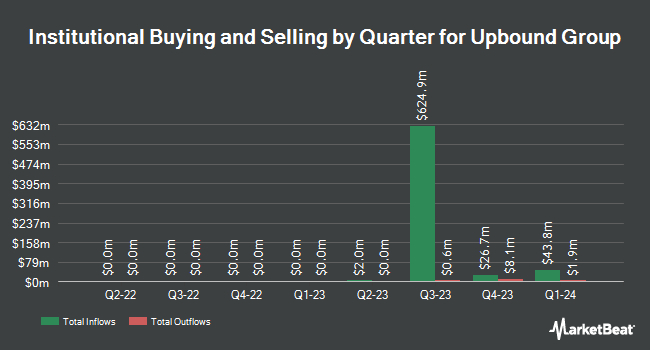

A number of other large investors also recently bought and sold shares of the company. Blue Trust Inc. lifted its holdings in Upbound Group by 47.9% during the 2nd quarter. Blue Trust Inc. now owns 1,118 shares of the company's stock worth $34,000 after buying an additional 362 shares during the last quarter. New York State Teachers Retirement System raised its position in shares of Upbound Group by 0.5% during the 3rd quarter. New York State Teachers Retirement System now owns 80,578 shares of the company's stock worth $2,578,000 after purchasing an additional 393 shares during the period. Amalgamated Bank lifted its holdings in shares of Upbound Group by 3.5% in the 3rd quarter. Amalgamated Bank now owns 14,491 shares of the company's stock worth $464,000 after purchasing an additional 496 shares during the last quarter. Louisiana State Employees Retirement System lifted its holdings in shares of Upbound Group by 2.3% in the 2nd quarter. Louisiana State Employees Retirement System now owns 22,500 shares of the company's stock worth $691,000 after purchasing an additional 500 shares during the last quarter. Finally, Covestor Ltd lifted its holdings in shares of Upbound Group by 268.8% in the 3rd quarter. Covestor Ltd now owns 1,136 shares of the company's stock worth $37,000 after purchasing an additional 828 shares during the last quarter. Institutional investors own 90.30% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts recently issued reports on UPBD shares. Jefferies Financial Group cut their price target on Upbound Group from $37.00 to $35.00 and set a "hold" rating on the stock in a report on Tuesday, October 1st. TD Cowen raised Upbound Group to a "strong-buy" rating in a report on Friday, November 29th. Loop Capital cut their price target on Upbound Group from $36.00 to $33.00 and set a "hold" rating on the stock in a report on Friday, November 1st. Finally, Stephens initiated coverage on Upbound Group in a research note on Wednesday, November 13th. They set an "overweight" rating and a $38.00 target price on the stock. Two equities research analysts have rated the stock with a hold rating, three have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, Upbound Group currently has an average rating of "Moderate Buy" and an average price target of $39.17.

Read Our Latest Research Report on UPBD

Insider Activity

In other news, Director Jeffrey J. Brown acquired 1,065 shares of Upbound Group stock in a transaction that occurred on Tuesday, October 22nd. The stock was purchased at an average price of $29.25 per share, with a total value of $31,151.25. Following the completion of the transaction, the director now owns 85,234 shares in the company, valued at approximately $2,493,094.50. This trade represents a 1.27 % increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this hyperlink. 2.70% of the stock is currently owned by corporate insiders.

Upbound Group Price Performance

Shares of UPBD traded down $0.15 during midday trading on Wednesday, reaching $34.09. The stock had a trading volume of 325,672 shares, compared to its average volume of 448,017. Upbound Group, Inc. has a 52 week low of $26.50 and a 52 week high of $38.72. The company has a debt-to-equity ratio of 2.02, a current ratio of 3.66 and a quick ratio of 0.86. The firm's 50 day moving average price is $31.03 and its 200-day moving average price is $31.66. The company has a market capitalization of $1.86 billion, a P/E ratio of 23.51 and a beta of 2.03.

Upbound Group (NASDAQ:UPBD - Get Free Report) last posted its quarterly earnings data on Thursday, October 31st. The company reported $0.95 EPS for the quarter, topping analysts' consensus estimates of $0.89 by $0.06. The company had revenue of $1.07 billion for the quarter, compared to the consensus estimate of $1.04 billion. Upbound Group had a return on equity of 34.15% and a net margin of 1.91%. The company's quarterly revenue was up 9.2% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.79 EPS. On average, analysts forecast that Upbound Group, Inc. will post 3.79 earnings per share for the current fiscal year.

Upbound Group Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Tuesday, October 22nd. Stockholders of record on Tuesday, October 1st were issued a dividend of $0.37 per share. The ex-dividend date was Tuesday, October 1st. This represents a $1.48 dividend on an annualized basis and a dividend yield of 4.34%. Upbound Group's dividend payout ratio is 102.07%.

About Upbound Group

(

Free Report)

Upbound Group, Inc leases household durable goods to customers on a lease-to-own basis in the United States, Puerto Rico, and Mexico. It operates through four segments: Rent-A-Center, Acima, Mexico, and Franchising. The company's brands, such as Rent-A-Center and Acima that facilitate consumer transactions across a range of store-based and virtual channels.

Featured Articles

Before you consider Upbound Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Upbound Group wasn't on the list.

While Upbound Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.