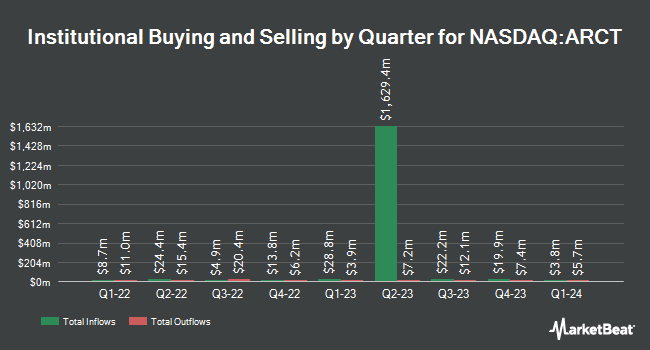

FMR LLC trimmed its holdings in Arcturus Therapeutics Holdings Inc. (NASDAQ:ARCT - Free Report) by 20.3% during the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 443,008 shares of the biotechnology company's stock after selling 112,516 shares during the period. FMR LLC owned about 1.64% of Arcturus Therapeutics worth $10,282,000 as of its most recent filing with the Securities & Exchange Commission.

Other hedge funds have also recently made changes to their positions in the company. Charles Schwab Investment Management Inc. lifted its holdings in shares of Arcturus Therapeutics by 1.7% in the third quarter. Charles Schwab Investment Management Inc. now owns 197,622 shares of the biotechnology company's stock worth $4,587,000 after buying an additional 3,224 shares in the last quarter. Massachusetts Financial Services Co. MA increased its holdings in Arcturus Therapeutics by 28.1% in the 3rd quarter. Massachusetts Financial Services Co. MA now owns 48,957 shares of the biotechnology company's stock valued at $1,136,000 after acquiring an additional 10,728 shares during the last quarter. Quest Partners LLC lifted its stake in Arcturus Therapeutics by 437.1% in the 3rd quarter. Quest Partners LLC now owns 19,810 shares of the biotechnology company's stock worth $460,000 after purchasing an additional 16,122 shares in the last quarter. Royce & Associates LP boosted its holdings in shares of Arcturus Therapeutics by 18.3% during the 3rd quarter. Royce & Associates LP now owns 155,803 shares of the biotechnology company's stock valued at $3,616,000 after purchasing an additional 24,085 shares during the last quarter. Finally, Sumitomo Mitsui Trust Group Inc. boosted its holdings in shares of Arcturus Therapeutics by 45.6% during the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 2,275,715 shares of the biotechnology company's stock valued at $52,819,000 after purchasing an additional 712,650 shares during the last quarter. Institutional investors own 94.54% of the company's stock.

Insider Buying and Selling

In related news, COO Pad Chivukula sold 12,000 shares of the company's stock in a transaction dated Tuesday, October 15th. The shares were sold at an average price of $20.76, for a total transaction of $249,120.00. Following the transaction, the chief operating officer now directly owns 435,334 shares in the company, valued at approximately $9,037,533.84. This represents a 2.68 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 15.30% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

A number of equities research analysts recently commented on ARCT shares. Cantor Fitzgerald reiterated an "overweight" rating on shares of Arcturus Therapeutics in a research report on Monday, September 9th. HC Wainwright reaffirmed a "buy" rating and issued a $63.00 price objective on shares of Arcturus Therapeutics in a research note on Friday, November 8th. Seven research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, Arcturus Therapeutics currently has an average rating of "Buy" and a consensus target price of $71.40.

Get Our Latest Stock Report on ARCT

Arcturus Therapeutics Trading Down 2.2 %

Shares of NASDAQ:ARCT traded down $0.40 during trading on Thursday, reaching $17.55. The company's stock had a trading volume of 316,555 shares, compared to its average volume of 466,384. The stock has a market capitalization of $475.38 million, a PE ratio of -8.09 and a beta of 2.62. Arcturus Therapeutics Holdings Inc. has a 12 month low of $14.93 and a 12 month high of $45.00. The firm's 50 day simple moving average is $19.18 and its two-hundred day simple moving average is $22.55.

Arcturus Therapeutics (NASDAQ:ARCT - Get Free Report) last posted its quarterly earnings data on Thursday, November 7th. The biotechnology company reported ($0.26) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.70) by $0.44. The business had revenue of $41.67 million during the quarter, compared to analyst estimates of $49.16 million. Arcturus Therapeutics had a negative return on equity of 22.39% and a negative net margin of 36.39%. During the same period last year, the company earned ($0.61) EPS. Research analysts anticipate that Arcturus Therapeutics Holdings Inc. will post -2.31 EPS for the current fiscal year.

About Arcturus Therapeutics

(

Free Report)

Arcturus Therapeutics Holdings Inc, a late-stage clinical messenger RNA medicines and vaccine company, focuses on the development of infectious disease vaccines and other products within liver and respiratory rare diseases. Its technology platforms include LUNAR lipid-mediated delivery and STARR mRNA.

See Also

Before you consider Arcturus Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcturus Therapeutics wasn't on the list.

While Arcturus Therapeutics currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.