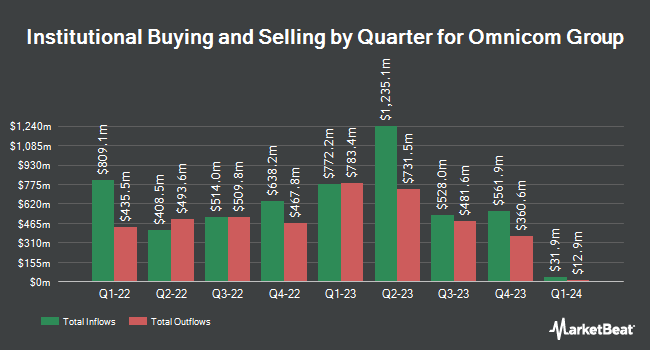

FMR LLC reduced its stake in Omnicom Group Inc. (NYSE:OMC - Free Report) by 3.4% during the 3rd quarter, according to the company in its most recent filing with the SEC. The fund owned 574,316 shares of the business services provider's stock after selling 20,186 shares during the quarter. FMR LLC owned 0.29% of Omnicom Group worth $59,378,000 at the end of the most recent reporting period.

Several other large investors have also recently made changes to their positions in the stock. Bank of Montreal Can lifted its holdings in shares of Omnicom Group by 23.6% in the 3rd quarter. Bank of Montreal Can now owns 705,806 shares of the business services provider's stock worth $72,465,000 after acquiring an additional 134,927 shares during the last quarter. Dynamic Technology Lab Private Ltd purchased a new stake in Omnicom Group during the 3rd quarter worth approximately $258,000. Daiwa Securities Group Inc. increased its stake in Omnicom Group by 20.8% during the 3rd quarter. Daiwa Securities Group Inc. now owns 25,825 shares of the business services provider's stock worth $2,670,000 after buying an additional 4,440 shares during the period. Summit Trail Advisors LLC increased its stake in Omnicom Group by 1.8% during the 3rd quarter. Summit Trail Advisors LLC now owns 6,561 shares of the business services provider's stock worth $683,000 after buying an additional 113 shares during the period. Finally, Larson Financial Group LLC increased its stake in Omnicom Group by 55.1% during the 3rd quarter. Larson Financial Group LLC now owns 8,161 shares of the business services provider's stock worth $844,000 after buying an additional 2,900 shares during the period. 91.97% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Omnicom Group

In other news, CAO Andrew Castellaneta sold 4,000 shares of the firm's stock in a transaction on Friday, October 18th. The shares were sold at an average price of $105.29, for a total value of $421,160.00. Following the completion of the sale, the chief accounting officer now owns 23,545 shares in the company, valued at approximately $2,479,053.05. This trade represents a 14.52 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Company insiders own 1.30% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts recently weighed in on OMC shares. JPMorgan Chase & Co. upped their target price on shares of Omnicom Group from $118.00 to $119.00 and gave the stock an "overweight" rating in a research note on Wednesday, October 16th. Barclays increased their price objective on shares of Omnicom Group from $110.00 to $121.00 and gave the company an "overweight" rating in a research report on Thursday, October 17th. UBS Group increased their price objective on shares of Omnicom Group from $120.00 to $124.00 and gave the company a "buy" rating in a research report on Wednesday, October 16th. Macquarie increased their price objective on shares of Omnicom Group from $110.00 to $120.00 and gave the company an "outperform" rating in a research report on Wednesday, October 16th. Finally, Bank of America increased their price objective on shares of Omnicom Group from $87.00 to $89.00 and gave the company an "underperform" rating in a research report on Thursday, September 5th. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating and seven have issued a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $110.11.

Read Our Latest Analysis on Omnicom Group

Omnicom Group Stock Performance

NYSE:OMC traded up $0.28 during trading hours on Friday, reaching $103.42. 1,115,249 shares of the company's stock were exchanged, compared to its average volume of 1,701,565. The firm has a market capitalization of $20.18 billion, a price-to-earnings ratio of 14.13, a P/E/G ratio of 2.32 and a beta of 0.94. The company has a 50-day moving average of $102.63 and a 200 day moving average of $97.27. The company has a quick ratio of 0.86, a current ratio of 0.98 and a debt-to-equity ratio of 1.37. Omnicom Group Inc. has a 1-year low of $81.41 and a 1-year high of $107.00.

Omnicom Group (NYSE:OMC - Get Free Report) last issued its quarterly earnings results on Tuesday, October 15th. The business services provider reported $2.03 earnings per share for the quarter, topping analysts' consensus estimates of $2.02 by $0.01. The firm had revenue of $3.88 billion during the quarter, compared to analysts' expectations of $3.79 billion. Omnicom Group had a net margin of 9.45% and a return on equity of 36.59%. During the same quarter in the prior year, the business earned $1.86 EPS. Research analysts anticipate that Omnicom Group Inc. will post 7.94 EPS for the current year.

Omnicom Group Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, January 10th. Stockholders of record on Friday, December 20th will be paid a $0.70 dividend. This represents a $2.80 annualized dividend and a dividend yield of 2.71%. The ex-dividend date of this dividend is Friday, December 20th. Omnicom Group's dividend payout ratio (DPR) is presently 38.25%.

Omnicom Group Company Profile

(

Free Report)

Omnicom Group Inc, together with its subsidiaries, offers advertising, marketing, and corporate communications services. It provides a range of services in the areas of advertising and media, precision marketing, commerce and branding, experiential, execution and support, public relations, and healthcare.

Read More

Before you consider Omnicom Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Omnicom Group wasn't on the list.

While Omnicom Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.