FMR LLC lessened its holdings in Rentokil Initial plc (NYSE:RTO - Free Report) by 19.5% during the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm owned 96,448 shares of the company's stock after selling 23,314 shares during the quarter. FMR LLC's holdings in Rentokil Initial were worth $2,404,000 as of its most recent filing with the Securities & Exchange Commission.

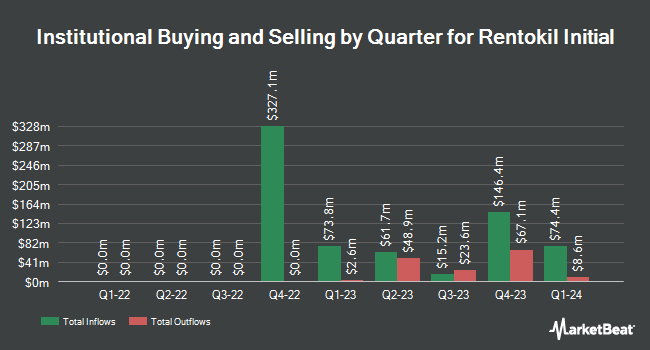

Several other hedge funds have also added to or reduced their stakes in the business. Rothschild Investment LLC bought a new stake in shares of Rentokil Initial in the 2nd quarter valued at about $29,000. Valley Wealth Managers Inc. bought a new stake in Rentokil Initial during the 3rd quarter valued at approximately $29,000. Northwestern Mutual Wealth Management Co. grew its stake in Rentokil Initial by 403.3% in the second quarter. Northwestern Mutual Wealth Management Co. now owns 1,052 shares of the company's stock worth $31,000 after purchasing an additional 843 shares during the period. Assetmark Inc. purchased a new stake in shares of Rentokil Initial in the 3rd quarter worth about $36,000. Finally, Sunbelt Securities Inc. bought a new position in shares of Rentokil Initial in the 2nd quarter worth about $40,000. 9.91% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Separately, Redburn Atlantic cut shares of Rentokil Initial from a "buy" rating to a "neutral" rating in a report on Thursday, September 19th. Five equities research analysts have rated the stock with a hold rating, one has issued a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, Rentokil Initial has a consensus rating of "Hold" and a consensus target price of $29.00.

Check Out Our Latest Report on RTO

Rentokil Initial Trading Up 3.3 %

Shares of NYSE:RTO traded up $0.84 on Friday, hitting $26.35. 967,424 shares of the company traded hands, compared to its average volume of 700,866. The stock has a 50 day simple moving average of $25.39 and a 200-day simple moving average of $27.86. The company has a debt-to-equity ratio of 0.75, a current ratio of 1.04 and a quick ratio of 0.96. Rentokil Initial plc has a 52 week low of $22.40 and a 52 week high of $34.07.

Rentokil Initial Profile

(

Free Report)

Rentokil Initial plc, together with its subsidiaries, provides route-based services in North America, the United Kingdom, rest of Europe, Asia, the Pacific, and internationally. It offers a range of pest control services for rodents, and flying and crawling insects, as well as other forms of wildlife management for commercial customers.

Recommended Stories

Before you consider Rentokil Initial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rentokil Initial wasn't on the list.

While Rentokil Initial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.