FMR LLC reduced its position in Nova Ltd. (NASDAQ:NVMI - Free Report) by 8.1% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 2,655,264 shares of the semiconductor company's stock after selling 234,090 shares during the quarter. FMR LLC owned approximately 9.14% of Nova worth $522,996,000 at the end of the most recent quarter.

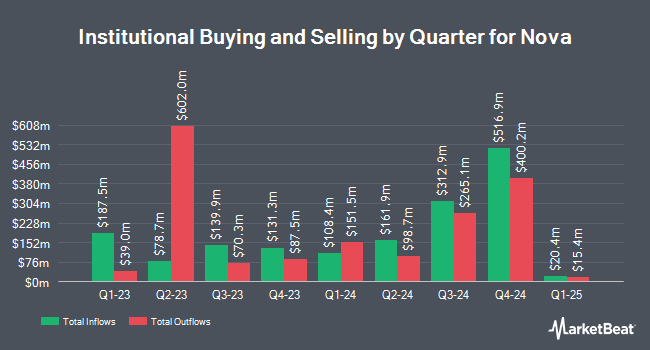

A number of other institutional investors have also recently bought and sold shares of NVMI. Quarry LP lifted its holdings in shares of Nova by 438.5% during the 3rd quarter. Quarry LP now owns 140 shares of the semiconductor company's stock worth $29,000 after acquiring an additional 114 shares during the period. Steward Partners Investment Advisory LLC increased its holdings in shares of Nova by 24.1% in the fourth quarter. Steward Partners Investment Advisory LLC now owns 401 shares of the semiconductor company's stock valued at $79,000 after purchasing an additional 78 shares in the last quarter. SBI Securities Co. Ltd. bought a new stake in shares of Nova during the fourth quarter worth $112,000. Quadrant Capital Group LLC lifted its position in Nova by 5.2% during the 4th quarter. Quadrant Capital Group LLC now owns 1,030 shares of the semiconductor company's stock valued at $203,000 after purchasing an additional 51 shares during the period. Finally, PNC Financial Services Group Inc. lifted its holdings in Nova by 79.6% in the fourth quarter. PNC Financial Services Group Inc. now owns 1,182 shares of the semiconductor company's stock valued at $233,000 after buying an additional 524 shares during the period. Institutional investors and hedge funds own 82.99% of the company's stock.

Nova Stock Performance

NASDAQ:NVMI traded up $4.56 during mid-day trading on Monday, reaching $184.34. 42,620 shares of the company's stock were exchanged, compared to its average volume of 224,979. Nova Ltd. has a one year low of $154.00 and a one year high of $289.90. The business's fifty day simple moving average is $219.26 and its two-hundred day simple moving average is $208.64. The firm has a market capitalization of $5.40 billion, a PE ratio of 32.11, a price-to-earnings-growth ratio of 2.55 and a beta of 1.63.

Nova (NASDAQ:NVMI - Get Free Report) last released its earnings results on Thursday, February 13th. The semiconductor company reported $1.78 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.82 by ($0.04). The company had revenue of $194.77 million for the quarter, compared to analyst estimates of $186.50 million. Nova had a return on equity of 22.33% and a net margin of 27.33%. As a group, equities research analysts forecast that Nova Ltd. will post 7.52 EPS for the current year.

Analyst Ratings Changes

NVMI has been the topic of a number of recent analyst reports. Cantor Fitzgerald reduced their target price on Nova from $315.00 to $300.00 and set an "overweight" rating on the stock in a report on Friday, March 14th. Benchmark boosted their price target on Nova from $245.00 to $295.00 and gave the company a "buy" rating in a report on Friday, February 14th. Citigroup upgraded shares of Nova from a "neutral" rating to a "buy" rating and lifted their price target for the company from $226.00 to $240.00 in a research note on Monday, January 6th. Finally, Needham & Company LLC reissued a "hold" rating on shares of Nova in a report on Friday, February 14th. One equities research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. According to MarketBeat, Nova currently has an average rating of "Moderate Buy" and a consensus price target of $250.83.

Check Out Our Latest Stock Analysis on Nova

Nova Company Profile

(

Free Report)

Nova Ltd. designs, develops, produces, and sells process control systems used in the manufacture of semiconductors in Israel, Taiwan, the United States, China, Korea, and internationally. Its product portfolio includes a set of metrology platforms for dimensional, films, and materials and chemical metrology measurements for process control for various semiconductor manufacturing process steps, including lithography, etch, chemical mechanical planarization, deposition, electrochemical plating, and advanced packaging.

See Also

Before you consider Nova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nova wasn't on the list.

While Nova currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.