FMR LLC cut its holdings in Generac Holdings Inc. (NYSE:GNRC - Free Report) by 18.4% during the fourth quarter, according to its most recent Form 13F filing with the SEC. The fund owned 1,423,414 shares of the technology company's stock after selling 321,772 shares during the period. FMR LLC owned 2.39% of Generac worth $220,700,000 at the end of the most recent reporting period.

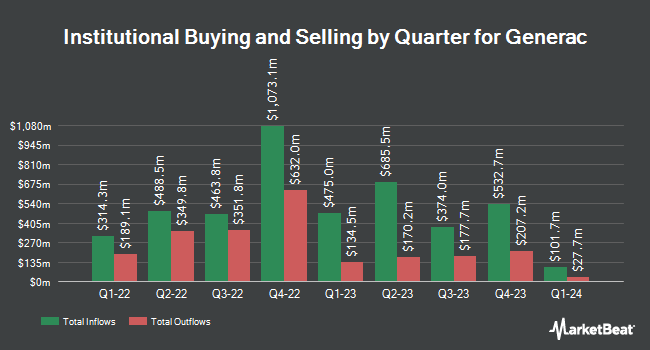

Other hedge funds also recently added to or reduced their stakes in the company. Federated Hermes Inc. raised its stake in shares of Generac by 37.7% in the 4th quarter. Federated Hermes Inc. now owns 303,468 shares of the technology company's stock valued at $47,053,000 after acquiring an additional 83,035 shares during the period. Quadrant Capital Group LLC increased its holdings in Generac by 61.7% in the 4th quarter. Quadrant Capital Group LLC now owns 228 shares of the technology company's stock valued at $35,000 after purchasing an additional 87 shares during the last quarter. Hurley Capital LLC acquired a new position in Generac during the fourth quarter worth $26,000. Wedbush Securities Inc. lifted its stake in Generac by 3.9% during the fourth quarter. Wedbush Securities Inc. now owns 2,235 shares of the technology company's stock worth $347,000 after purchasing an additional 84 shares in the last quarter. Finally, Envestnet Asset Management Inc. grew its stake in shares of Generac by 1.3% in the fourth quarter. Envestnet Asset Management Inc. now owns 542,197 shares of the technology company's stock valued at $84,068,000 after buying an additional 6,933 shares in the last quarter. 84.04% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

Several equities analysts recently issued reports on GNRC shares. UBS Group increased their target price on Generac from $200.00 to $205.00 and gave the stock a "buy" rating in a research note on Thursday, February 13th. The Goldman Sachs Group lowered their price objective on shares of Generac from $193.00 to $168.00 and set a "buy" rating for the company in a research note on Thursday, February 13th. Wells Fargo & Company cut their target price on shares of Generac from $175.00 to $165.00 and set an "equal weight" rating on the stock in a research note on Thursday, February 13th. Robert W. Baird decreased their price target on shares of Generac from $172.00 to $171.00 and set a "neutral" rating for the company in a research report on Thursday, February 13th. Finally, Citigroup cut their price objective on Generac from $172.00 to $162.00 and set a "neutral" rating on the stock in a research report on Wednesday, January 8th. Ten research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Generac presently has an average rating of "Moderate Buy" and a consensus target price of $175.60.

Read Our Latest Report on GNRC

Generac Stock Performance

Shares of Generac stock traded down $0.35 on Tuesday, hitting $113.08. The stock had a trading volume of 597,072 shares, compared to its average volume of 888,118. The stock has a market cap of $6.74 billion, a price-to-earnings ratio of 20.94, a P/E/G ratio of 1.44 and a beta of 1.58. The company has a current ratio of 1.97, a quick ratio of 0.97 and a debt-to-equity ratio of 0.48. Generac Holdings Inc. has a 52-week low of $99.50 and a 52-week high of $195.94. The company's 50 day moving average price is $130.76 and its 200 day moving average price is $154.87.

Generac (NYSE:GNRC - Get Free Report) last issued its quarterly earnings data on Wednesday, February 12th. The technology company reported $2.80 earnings per share for the quarter, beating analysts' consensus estimates of $2.49 by $0.31. Generac had a return on equity of 18.17% and a net margin of 7.36%. On average, research analysts anticipate that Generac Holdings Inc. will post 8 EPS for the current year.

Insider Buying and Selling

In other Generac news, CEO Aaron Jagdfeld sold 5,000 shares of the company's stock in a transaction that occurred on Monday, February 3rd. The stock was sold at an average price of $145.15, for a total transaction of $725,750.00. Following the completion of the sale, the chief executive officer now directly owns 565,825 shares of the company's stock, valued at $82,129,498.75. This represents a 0.88 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 2.90% of the stock is owned by company insiders.

About Generac

(

Free Report)

Generac Holdings Inc designs, manufactures, and distributes various energy technology products and solution worldwide. The company offers residential automatic standby generators, automatic transfer switch, air-cooled engine residential standby generators, and liquid-cooled engine generators; Mobile Link, a remote monitoring system for home standby generators; residential storage solution, which consists of a system of batteries, an inverter, photovoltaic optimizers, power electronic controls, and other components; smart home solutions, such as smart thermostats and a suite of home monitoring products.

Further Reading

Before you consider Generac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Generac wasn't on the list.

While Generac currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.