FMR LLC decreased its position in Ingredion Incorporated (NYSE:INGR - Free Report) by 46.3% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 373,120 shares of the company's stock after selling 321,852 shares during the quarter. FMR LLC owned 0.57% of Ingredion worth $51,278,000 at the end of the most recent quarter.

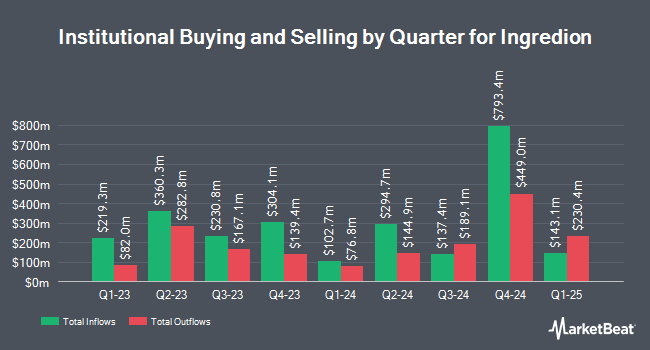

Several other hedge funds have also recently added to or reduced their stakes in INGR. Cetera Advisors LLC raised its holdings in Ingredion by 60.6% in the first quarter. Cetera Advisors LLC now owns 4,864 shares of the company's stock valued at $568,000 after acquiring an additional 1,835 shares in the last quarter. CWM LLC increased its stake in Ingredion by 59.7% in the second quarter. CWM LLC now owns 3,923 shares of the company's stock valued at $450,000 after purchasing an additional 1,467 shares during the last quarter. Aspire Private Capital LLC increased its stake in Ingredion by 21.6% in the second quarter. Aspire Private Capital LLC now owns 3,213 shares of the company's stock valued at $369,000 after purchasing an additional 571 shares during the last quarter. Patrick M Sweeney & Associates Inc. increased its stake in Ingredion by 15.9% in the second quarter. Patrick M Sweeney & Associates Inc. now owns 2,524 shares of the company's stock valued at $289,000 after purchasing an additional 346 shares during the last quarter. Finally, Wedge Capital Management L L P NC increased its stake in Ingredion by 2.5% in the second quarter. Wedge Capital Management L L P NC now owns 69,118 shares of the company's stock valued at $7,928,000 after purchasing an additional 1,664 shares during the last quarter. Institutional investors and hedge funds own 85.27% of the company's stock.

Insider Activity at Ingredion

In other Ingredion news, SVP Larry Fernandes sold 4,700 shares of the firm's stock in a transaction on Wednesday, November 6th. The stock was sold at an average price of $153.41, for a total value of $721,027.00. Following the completion of the sale, the senior vice president now owns 29,034 shares of the company's stock, valued at approximately $4,454,105.94. This trade represents a 13.93 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CFO James D. Gray sold 54,869 shares of the firm's stock in a transaction on Friday, November 29th. The shares were sold at an average price of $146.76, for a total value of $8,052,574.44. Following the completion of the sale, the chief financial officer now directly owns 12,795 shares of the company's stock, valued at approximately $1,877,794.20. This trade represents a 81.09 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 66,197 shares of company stock worth $9,702,315 in the last three months. Insiders own 1.80% of the company's stock.

Ingredion Stock Performance

NYSE:INGR traded down $2.62 during midday trading on Friday, reaching $145.23. The stock had a trading volume of 531,254 shares, compared to its average volume of 467,299. The firm has a fifty day simple moving average of $140.76 and a two-hundred day simple moving average of $129.59. Ingredion Incorporated has a 12-month low of $104.68 and a 12-month high of $155.44. The company has a quick ratio of 1.69, a current ratio of 2.67 and a debt-to-equity ratio of 0.44. The stock has a market cap of $9.46 billion, a P/E ratio of 14.17, a P/E/G ratio of 1.28 and a beta of 0.74.

Ingredion (NYSE:INGR - Get Free Report) last posted its quarterly earnings data on Tuesday, November 5th. The company reported $3.05 earnings per share for the quarter, beating analysts' consensus estimates of $2.58 by $0.47. Ingredion had a net margin of 9.05% and a return on equity of 17.75%. The firm had revenue of $1.87 billion for the quarter, compared to analyst estimates of $1.94 billion. During the same period last year, the firm posted $2.33 EPS. Ingredion's quarterly revenue was down 8.0% on a year-over-year basis. On average, equities analysts expect that Ingredion Incorporated will post 10.59 EPS for the current year.

Wall Street Analysts Forecast Growth

Several brokerages have commented on INGR. Oppenheimer increased their price target on shares of Ingredion from $147.00 to $178.00 and gave the company an "outperform" rating in a research note on Wednesday, November 6th. UBS Group increased their price target on shares of Ingredion from $165.00 to $173.00 and gave the company a "buy" rating in a research note on Friday, November 15th. Barclays raised their target price on shares of Ingredion from $145.00 to $168.00 and gave the stock an "overweight" rating in a research report on Wednesday, November 6th. BMO Capital Markets raised their target price on shares of Ingredion from $128.00 to $147.00 and gave the stock a "market perform" rating in a research report on Wednesday, November 6th. Finally, Stephens upgraded shares of Ingredion to a "hold" rating in a research report on Monday, December 2nd. Two research analysts have rated the stock with a hold rating and five have assigned a buy rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average target price of $155.17.

Check Out Our Latest Research Report on Ingredion

Ingredion Profile

(

Free Report)

Ingredion Incorporated, together with its subsidiaries, manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions derived from wet milling and processing corn, and other starch-based materials to a range of industries in North America, South America, the Asia Pacific, Europe, the Middle East, and Africa.

Featured Articles

Before you consider Ingredion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ingredion wasn't on the list.

While Ingredion currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.