FMR LLC decreased its stake in Vestis Co. (NYSE:VSTS - Free Report) by 5.7% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 9,610,647 shares of the company's stock after selling 579,989 shares during the quarter. FMR LLC owned approximately 7.31% of Vestis worth $143,199,000 as of its most recent SEC filing.

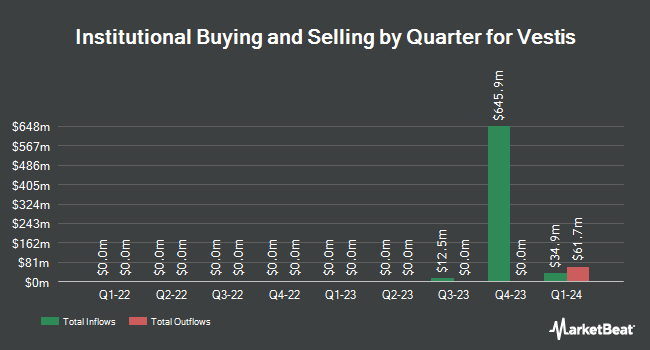

Other hedge funds and other institutional investors have also bought and sold shares of the company. Capital Performance Advisors LLP bought a new position in shares of Vestis in the third quarter worth about $41,000. Canada Pension Plan Investment Board bought a new position in shares of Vestis in the second quarter worth about $44,000. GAMMA Investing LLC boosted its stake in Vestis by 143.5% during the third quarter. GAMMA Investing LLC now owns 3,960 shares of the company's stock valued at $59,000 after buying an additional 2,334 shares during the last quarter. Copeland Capital Management LLC bought a new position in Vestis during the third quarter valued at approximately $60,000. Finally, nVerses Capital LLC bought a new position in Vestis during the second quarter valued at approximately $61,000. Hedge funds and other institutional investors own 97.40% of the company's stock.

Analyst Ratings Changes

VSTS has been the subject of a number of research reports. The Goldman Sachs Group increased their price target on Vestis from $13.60 to $15.00 and gave the company a "neutral" rating in a research note on Friday, November 22nd. Robert W. Baird lowered Vestis from an "outperform" rating to a "neutral" rating and set a $13.00 price target for the company. in a research note on Thursday, August 8th. Baird R W lowered Vestis from a "strong-buy" rating to a "hold" rating in a research note on Thursday, August 8th. Barclays raised their price objective on Vestis from $10.00 to $13.00 and gave the company an "underweight" rating in a research note on Friday, November 22nd. Finally, JPMorgan Chase & Co. raised their price objective on Vestis from $15.00 to $16.00 and gave the company a "neutral" rating in a research note on Friday, November 22nd. One equities research analyst has rated the stock with a sell rating, seven have given a hold rating and two have given a buy rating to the company's stock. According to MarketBeat, the company has an average rating of "Hold" and a consensus target price of $16.91.

View Our Latest Research Report on VSTS

Vestis Trading Down 0.2 %

Shares of NYSE VSTS traded down $0.03 during midday trading on Wednesday, hitting $16.36. The company's stock had a trading volume of 1,286,562 shares, compared to its average volume of 2,131,353. The company has a current ratio of 1.73, a quick ratio of 1.36 and a debt-to-equity ratio of 1.40. The business's 50 day moving average is $14.74 and its two-hundred day moving average is $13.56. Vestis Co. has a 12-month low of $8.92 and a 12-month high of $22.37. The firm has a market cap of $2.15 billion, a P/E ratio of 102.25 and a beta of 1.17.

Vestis (NYSE:VSTS - Get Free Report) last issued its quarterly earnings results on Thursday, November 21st. The company reported $0.11 earnings per share for the quarter, missing the consensus estimate of $0.13 by ($0.02). The business had revenue of $684.28 million during the quarter, compared to analysts' expectations of $693.54 million. Vestis had a return on equity of 9.07% and a net margin of 0.75%. The company's revenue for the quarter was down 4.4% compared to the same quarter last year. As a group, equities research analysts expect that Vestis Co. will post 0.66 EPS for the current year.

Vestis Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, January 6th. Shareholders of record on Friday, December 13th will be issued a dividend of $0.035 per share. The ex-dividend date is Friday, December 13th. This represents a $0.14 annualized dividend and a yield of 0.86%. Vestis's payout ratio is currently 87.50%.

Vestis Company Profile

(

Free Report)

Vestis Corporation provides uniform rentals and workplace supplies in the United States and Canada. Its products include uniform options, such as shirts, pants, outerwear, gowns, scrubs, high visibility garments, particulate-free garments, and flame-resistant garments, as well as shoes and accessories; and workplace supplies, including managed restroom supply services, first-aid supplies and safety products, floor mats, towels, and linens.

Recommended Stories

Before you consider Vestis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vestis wasn't on the list.

While Vestis currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.