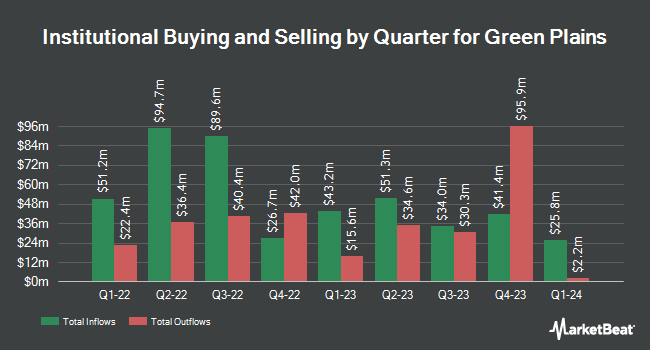

FMR LLC reduced its stake in shares of Green Plains Inc. (NASDAQ:GPRE - Free Report) by 41.7% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 108,366 shares of the specialty chemicals company's stock after selling 77,430 shares during the quarter. FMR LLC owned about 0.17% of Green Plains worth $1,467,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other institutional investors and hedge funds have also recently modified their holdings of the stock. Kailix Advisors LLC lifted its position in shares of Green Plains by 39.8% in the second quarter. Kailix Advisors LLC now owns 1,343,269 shares of the specialty chemicals company's stock worth $22,406,000 after buying an additional 382,517 shares in the last quarter. Lumbard & Kellner LLC purchased a new stake in shares of Green Plains during the 2nd quarter worth approximately $4,685,000. American Century Companies Inc. raised its holdings in shares of Green Plains by 287.6% during the 2nd quarter. American Century Companies Inc. now owns 332,586 shares of the specialty chemicals company's stock worth $5,275,000 after acquiring an additional 246,773 shares in the last quarter. Wolf Hill Capital Management LP boosted its position in shares of Green Plains by 13.7% during the 2nd quarter. Wolf Hill Capital Management LP now owns 1,994,539 shares of the specialty chemicals company's stock valued at $31,633,000 after acquiring an additional 240,849 shares during the last quarter. Finally, Clifford Capital Partners LLC grew its holdings in shares of Green Plains by 53.7% in the second quarter. Clifford Capital Partners LLC now owns 511,026 shares of the specialty chemicals company's stock valued at $8,105,000 after purchasing an additional 178,484 shares in the last quarter.

Analyst Upgrades and Downgrades

A number of research firms recently issued reports on GPRE. UBS Group decreased their price target on shares of Green Plains from $26.00 to $23.50 and set a "buy" rating on the stock in a research note on Monday, August 19th. Stephens upgraded shares of Green Plains to a "hold" rating in a research report on Monday, December 2nd. Truist Financial dropped their price target on Green Plains from $25.00 to $18.00 and set a "buy" rating for the company in a research report on Wednesday, October 16th. Finally, StockNews.com raised Green Plains from a "sell" rating to a "hold" rating in a research note on Friday, December 6th. Four investment analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat, Green Plains currently has a consensus rating of "Moderate Buy" and an average price target of $25.50.

Get Our Latest Analysis on GPRE

Green Plains Trading Down 3.8 %

Shares of NASDAQ:GPRE traded down $0.41 during trading hours on Monday, hitting $10.30. 753,399 shares of the company's stock traded hands, compared to its average volume of 1,103,751. The firm has a market capitalization of $665.91 million, a P/E ratio of -27.03 and a beta of 1.44. The business has a fifty day moving average price of $11.48 and a 200-day moving average price of $13.72. Green Plains Inc. has a 1 year low of $10.18 and a 1 year high of $26.67. The company has a debt-to-equity ratio of 0.46, a current ratio of 1.78 and a quick ratio of 1.16.

Green Plains Profile

(

Free Report)

Green Plains Inc produces low-carbon fuels in the United States and internationally. It operates through three segments: Ethanol Production, Agribusiness and Energy Services, and Partnership. The Ethanol Production segment produces ethanol, distillers grains, and ultra-high protein and renewable corn oil.

Featured Stories

Before you consider Green Plains, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Green Plains wasn't on the list.

While Green Plains currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for January 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.