FMR LLC trimmed its position in shares of Iron Mountain Incorporated (NYSE:IRM - Free Report) by 81.4% during the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 611,049 shares of the financial services provider's stock after selling 2,681,971 shares during the period. FMR LLC owned about 0.21% of Iron Mountain worth $72,611,000 as of its most recent SEC filing.

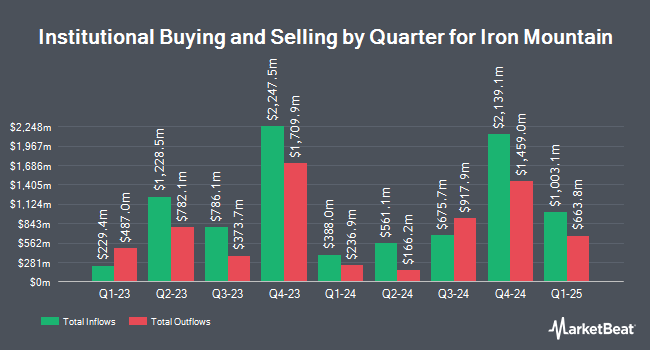

Several other hedge funds also recently added to or reduced their stakes in IRM. Legal & General Group Plc grew its stake in Iron Mountain by 49.2% in the 2nd quarter. Legal & General Group Plc now owns 3,899,276 shares of the financial services provider's stock worth $349,453,000 after acquiring an additional 1,286,694 shares in the last quarter. AGF Management Ltd. grew its stake in Iron Mountain by 76.3% in the 2nd quarter. AGF Management Ltd. now owns 2,245,393 shares of the financial services provider's stock worth $201,232,000 after acquiring an additional 972,101 shares in the last quarter. Mizuho Securities USA LLC lifted its position in shares of Iron Mountain by 2,193.9% in the 3rd quarter. Mizuho Securities USA LLC now owns 518,501 shares of the financial services provider's stock worth $61,613,000 after purchasing an additional 495,898 shares during the period. International Assets Investment Management LLC lifted its position in shares of Iron Mountain by 12,953.4% in the 3rd quarter. International Assets Investment Management LLC now owns 448,644 shares of the financial services provider's stock worth $53,312,000 after purchasing an additional 445,207 shares during the period. Finally, Duff & Phelps Investment Management Co. lifted its position in shares of Iron Mountain by 45.0% in the 2nd quarter. Duff & Phelps Investment Management Co. now owns 1,298,330 shares of the financial services provider's stock worth $116,356,000 after purchasing an additional 402,625 shares during the period. 80.13% of the stock is currently owned by institutional investors.

Insiders Place Their Bets

In other Iron Mountain news, CEO William L. Meaney sold 15,875 shares of the stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $118.97, for a total value of $1,888,648.75. Following the sale, the chief executive officer now directly owns 295,650 shares of the company's stock, valued at approximately $35,173,480.50. This represents a 5.10 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this link. Also, Director Wendy J. Murdock sold 8,500 shares of the company's stock in a transaction on Tuesday, September 17th. The shares were sold at an average price of $116.38, for a total transaction of $989,230.00. Following the completion of the transaction, the director now owns 14,829 shares of the company's stock, valued at approximately $1,725,799.02. The trade was a 36.44 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 56,125 shares of company stock valued at $6,613,584 over the last ninety days. Company insiders own 2.10% of the company's stock.

Iron Mountain Trading Up 1.5 %

IRM stock traded up $1.77 during trading on Friday, reaching $120.14. 1,131,775 shares of the stock were exchanged, compared to its average volume of 1,588,296. The company has a current ratio of 0.75, a quick ratio of 0.75 and a debt-to-equity ratio of 674.63. The business has a 50 day moving average price of $120.69 and a 200-day moving average price of $106.90. Iron Mountain Incorporated has a 1 year low of $64.66 and a 1 year high of $130.24. The firm has a market capitalization of $35.26 billion, a price-to-earnings ratio of 333.78, a P/E/G ratio of 7.19 and a beta of 0.98.

Iron Mountain Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, January 7th. Shareholders of record on Monday, December 16th will be paid a dividend of $0.715 per share. This represents a $2.86 dividend on an annualized basis and a yield of 2.38%. The ex-dividend date is Monday, December 16th. Iron Mountain's dividend payout ratio (DPR) is presently 794.44%.

Analysts Set New Price Targets

Several equities research analysts have recently weighed in on the stock. Stifel Nicolaus upped their price target on shares of Iron Mountain from $117.00 to $140.00 and gave the stock a "buy" rating in a research report on Monday, September 23rd. BNP Paribas upgraded shares of Iron Mountain to a "strong-buy" rating in a research note on Wednesday, November 6th. Wells Fargo & Company increased their price objective on shares of Iron Mountain from $120.00 to $135.00 and gave the stock an "overweight" rating in a research note on Thursday, October 17th. Royal Bank of Canada increased their price objective on shares of Iron Mountain from $135.00 to $139.00 and gave the stock an "outperform" rating in a research note on Wednesday, November 27th. Finally, Barclays decreased their price target on shares of Iron Mountain from $133.00 to $131.00 and set an "overweight" rating on the stock in a research note on Monday, November 18th. Six equities research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Buy" and an average target price of $131.00.

Check Out Our Latest Stock Report on Iron Mountain

Iron Mountain Profile

(

Free Report)

Iron Mountain Incorporated NYSE: IRM is a global leader in information management services. Founded in 1951 and trusted by more than 240,000 customers worldwide, Iron Mountain serves to protect and elevate the power of our customers' work. Through a range of offerings including digital transformation, data centers, secure records storage, information management, asset lifecycle management, secure destruction and art storage and logistics, Iron Mountain helps businesses bring light to their dark data, enabling customers to unlock value and intelligence from their stored digital and physical assets at speed and with security, while helping them meet their environmental goals.

See Also

Before you consider Iron Mountain, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Iron Mountain wasn't on the list.

While Iron Mountain currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.