Folger Nolan Fleming Douglas Capital Management Inc. trimmed its position in Alphabet Inc. (NASDAQ:GOOG - Free Report) by 3.4% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 120,134 shares of the information services provider's stock after selling 4,223 shares during the quarter. Alphabet makes up 2.4% of Folger Nolan Fleming Douglas Capital Management Inc.'s portfolio, making the stock its 7th biggest position. Folger Nolan Fleming Douglas Capital Management Inc.'s holdings in Alphabet were worth $22,878,000 at the end of the most recent reporting period.

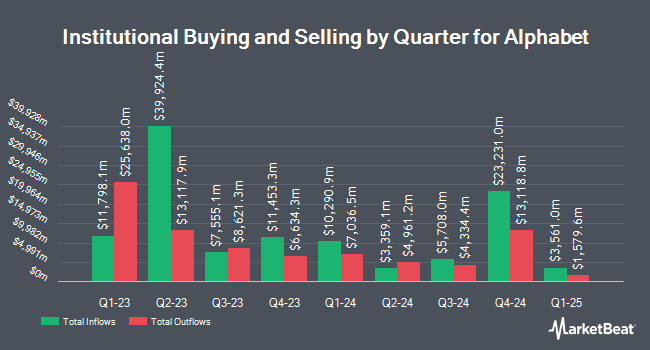

Other institutional investors and hedge funds have also recently added to or reduced their stakes in the company. Beck Bode LLC increased its position in shares of Alphabet by 7.1% in the 2nd quarter. Beck Bode LLC now owns 67,523 shares of the information services provider's stock valued at $12,385,000 after buying an additional 4,456 shares in the last quarter. Merriman Wealth Management LLC raised its position in shares of Alphabet by 21.3% during the second quarter. Merriman Wealth Management LLC now owns 15,524 shares of the information services provider's stock worth $2,847,000 after purchasing an additional 2,722 shares during the period. Barrow Hanley Mewhinney & Strauss LLC lifted its holdings in shares of Alphabet by 11.1% during the 2nd quarter. Barrow Hanley Mewhinney & Strauss LLC now owns 1,144,221 shares of the information services provider's stock valued at $209,873,000 after purchasing an additional 113,916 shares in the last quarter. Circle Wealth Management LLC grew its position in shares of Alphabet by 14.9% in the 2nd quarter. Circle Wealth Management LLC now owns 71,983 shares of the information services provider's stock valued at $13,203,000 after purchasing an additional 9,314 shares during the period. Finally, Frank Rimerman Advisors LLC increased its stake in Alphabet by 8.5% during the 2nd quarter. Frank Rimerman Advisors LLC now owns 153,311 shares of the information services provider's stock worth $28,120,000 after purchasing an additional 11,998 shares in the last quarter. 27.26% of the stock is owned by institutional investors.

Insider Activity

In other news, Director Kavitark Ram Shriram sold 37,134 shares of Alphabet stock in a transaction dated Tuesday, December 10th. The shares were sold at an average price of $185.02, for a total transaction of $6,870,532.68. Following the completion of the transaction, the director now directly owns 282,832 shares in the company, valued at $52,329,576.64. This trade represents a 11.61 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CAO Amie Thuener O'toole sold 2,834 shares of the company's stock in a transaction dated Wednesday, January 15th. The stock was sold at an average price of $194.32, for a total transaction of $550,702.88. Following the completion of the sale, the chief accounting officer now owns 17,847 shares in the company, valued at $3,468,029.04. This represents a 13.70 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 133,387 shares of company stock valued at $24,368,654. 12.99% of the stock is currently owned by insiders.

Alphabet Price Performance

Alphabet stock traded up $3.14 during mid-day trading on Monday, reaching $197.55. The company had a trading volume of 21,974,853 shares, compared to its average volume of 16,381,408. The business has a fifty day simple moving average of $185.92 and a 200 day simple moving average of $174.76. The company has a market cap of $2.42 trillion, a P/E ratio of 26.20, a P/E/G ratio of 1.21 and a beta of 0.99. Alphabet Inc. has a fifty-two week low of $131.55 and a fifty-two week high of $202.88. The company has a current ratio of 1.95, a quick ratio of 1.95 and a debt-to-equity ratio of 0.04.

Alphabet (NASDAQ:GOOG - Get Free Report) last released its quarterly earnings data on Tuesday, October 29th. The information services provider reported $2.12 earnings per share for the quarter, beating the consensus estimate of $1.83 by $0.29. The company had revenue of $88.27 billion for the quarter, compared to the consensus estimate of $86.39 billion. Alphabet had a return on equity of 31.66% and a net margin of 27.74%. Alphabet's revenue for the quarter was up 15.1% on a year-over-year basis. During the same quarter last year, the business posted $1.55 EPS. On average, equities research analysts predict that Alphabet Inc. will post 8.03 earnings per share for the current year.

Alphabet Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, December 16th. Stockholders of record on Monday, December 9th were given a $0.20 dividend. The ex-dividend date was Monday, December 9th. This represents a $0.80 dividend on an annualized basis and a dividend yield of 0.40%. Alphabet's dividend payout ratio (DPR) is currently 10.61%.

Wall Street Analyst Weigh In

A number of research analysts have weighed in on the company. Pivotal Research raised their price target on Alphabet from $215.00 to $225.00 and gave the company a "buy" rating in a research note on Wednesday, October 30th. Wells Fargo & Company upped their target price on shares of Alphabet from $182.00 to $187.00 and gave the company an "equal weight" rating in a report on Wednesday, October 30th. Scotiabank began coverage on Alphabet in a report on Friday, October 11th. They set a "sector outperform" rating and a $212.00 price target for the company. Citigroup raised their price objective on Alphabet from $212.00 to $216.00 and gave the company a "buy" rating in a research report on Wednesday, October 30th. Finally, JPMorgan Chase & Co. lifted their price target on Alphabet from $208.00 to $212.00 and gave the stock an "overweight" rating in a report on Wednesday, October 30th. Six investment analysts have rated the stock with a hold rating, thirteen have issued a buy rating and three have assigned a strong buy rating to the company. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $200.56.

Read Our Latest Stock Analysis on Alphabet

About Alphabet

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

See Also

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report