Foot Locker (NYSE:FL - Free Report) had its price target decreased by Morgan Stanley from $17.00 to $16.00 in a research report report published on Friday,Benzinga reports. Morgan Stanley currently has an underweight rating on the athletic footwear retailer's stock.

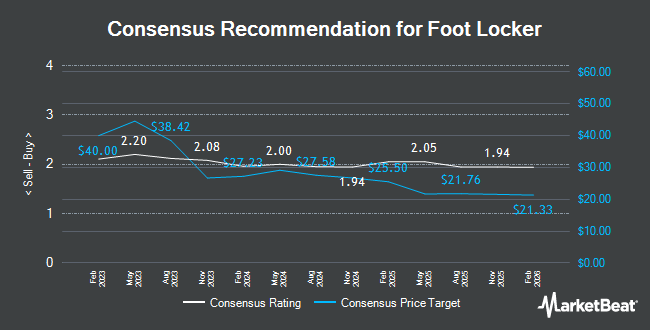

A number of other research analysts have also recently weighed in on the stock. Robert W. Baird dropped their price objective on shares of Foot Locker from $27.00 to $24.00 and set a "neutral" rating for the company in a research note on Thursday. Piper Sandler decreased their target price on shares of Foot Locker from $30.00 to $28.00 and set a "neutral" rating on the stock in a research report on Monday, December 2nd. Citigroup boosted their price target on Foot Locker from $27.00 to $33.00 and gave the company a "neutral" rating in a report on Tuesday, August 20th. StockNews.com cut Foot Locker from a "hold" rating to a "sell" rating in a report on Friday, September 20th. Finally, Telsey Advisory Group cut their price objective on shares of Foot Locker from $30.00 to $24.00 and set a "market perform" rating on the stock in a report on Thursday. Four analysts have rated the stock with a sell rating, nine have assigned a hold rating and five have assigned a buy rating to the company's stock. According to MarketBeat.com, Foot Locker currently has a consensus rating of "Hold" and an average price target of $25.29.

Get Our Latest Stock Analysis on Foot Locker

Foot Locker Price Performance

FL traded up $0.83 on Friday, hitting $22.00. 5,436,217 shares of the company were exchanged, compared to its average volume of 4,214,639. Foot Locker has a fifty-two week low of $19.33 and a fifty-two week high of $35.60. The company has a debt-to-equity ratio of 0.15, a quick ratio of 0.49 and a current ratio of 1.67. The firm has a market capitalization of $2.09 billion, a P/E ratio of -4.88, a price-to-earnings-growth ratio of 0.64 and a beta of 1.46. The business's fifty day moving average is $23.87 and its 200 day moving average is $25.82.

Foot Locker (NYSE:FL - Get Free Report) last released its quarterly earnings results on Wednesday, December 4th. The athletic footwear retailer reported $0.33 earnings per share for the quarter, missing analysts' consensus estimates of $0.40 by ($0.07). The firm had revenue of $1.96 billion during the quarter, compared to analyst estimates of $2.01 billion. Foot Locker had a positive return on equity of 2.91% and a negative net margin of 5.24%. The business's revenue was down 1.4% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.30 EPS. As a group, sell-side analysts anticipate that Foot Locker will post 1.25 EPS for the current year.

Hedge Funds Weigh In On Foot Locker

Several hedge funds and other institutional investors have recently bought and sold shares of FL. Price T Rowe Associates Inc. MD boosted its position in Foot Locker by 6.0% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 51,589 shares of the athletic footwear retailer's stock valued at $1,471,000 after buying an additional 2,906 shares during the last quarter. Kessler Investment Group LLC grew its stake in Foot Locker by 25.9% during the 2nd quarter. Kessler Investment Group LLC now owns 7,613 shares of the athletic footwear retailer's stock valued at $190,000 after purchasing an additional 1,567 shares in the last quarter. Nisa Investment Advisors LLC increased its holdings in Foot Locker by 1.2% during the 2nd quarter. Nisa Investment Advisors LLC now owns 41,541 shares of the athletic footwear retailer's stock worth $1,035,000 after purchasing an additional 483 shares during the last quarter. Fifth Third Bancorp raised its position in shares of Foot Locker by 116.0% in the 2nd quarter. Fifth Third Bancorp now owns 1,365 shares of the athletic footwear retailer's stock valued at $34,000 after purchasing an additional 733 shares in the last quarter. Finally, SummerHaven Investment Management LLC boosted its stake in shares of Foot Locker by 2.5% during the 2nd quarter. SummerHaven Investment Management LLC now owns 27,671 shares of the athletic footwear retailer's stock valued at $690,000 after buying an additional 667 shares during the last quarter.

About Foot Locker

(

Get Free Report)

Foot Locker, Inc, through its subsidiaries, operates as a footwear and apparel retailer in North America, Europe, Australia, New Zealand, Asia, and the Middle East. Its brand portfolio includes Foot Locker, a brand comprising sneakers and apparel; Kids Foot Locker, which offers athletic footwear, apparel, and accessories for children; and Champs Sports that operates as a mall-based specialty athletic footwear and apparel retailer.

Featured Articles

Before you consider Foot Locker, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Foot Locker wasn't on the list.

While Foot Locker currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.