FORA Capital LLC purchased a new stake in shares of Clearwater Analytics Holdings, Inc. (NYSE:CWAN - Free Report) during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund purchased 41,829 shares of the company's stock, valued at approximately $1,056,000.

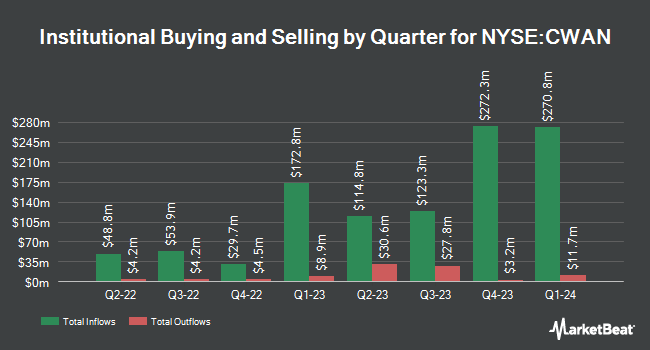

Several other hedge funds have also made changes to their positions in the company. Kayne Anderson Rudnick Investment Management LLC grew its stake in Clearwater Analytics by 1.1% during the 2nd quarter. Kayne Anderson Rudnick Investment Management LLC now owns 11,374,673 shares of the company's stock valued at $210,659,000 after acquiring an additional 128,402 shares in the last quarter. William Blair Investment Management LLC boosted its holdings in shares of Clearwater Analytics by 0.6% during the second quarter. William Blair Investment Management LLC now owns 10,430,794 shares of the company's stock worth $193,178,000 after purchasing an additional 66,528 shares during the period. Conestoga Capital Advisors LLC grew its position in Clearwater Analytics by 1.6% during the third quarter. Conestoga Capital Advisors LLC now owns 6,778,457 shares of the company's stock valued at $171,156,000 after purchasing an additional 107,210 shares in the last quarter. Loomis Sayles & Co. L P increased its stake in Clearwater Analytics by 11.1% in the 3rd quarter. Loomis Sayles & Co. L P now owns 3,294,482 shares of the company's stock valued at $83,186,000 after buying an additional 327,880 shares during the period. Finally, Hood River Capital Management LLC purchased a new stake in Clearwater Analytics in the 2nd quarter worth approximately $43,280,000. Hedge funds and other institutional investors own 50.10% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts have recently weighed in on the stock. The Goldman Sachs Group upped their price target on shares of Clearwater Analytics from $20.00 to $22.00 and gave the stock a "sell" rating in a research note on Thursday, November 7th. Piper Sandler upped their target price on Clearwater Analytics from $23.00 to $28.00 and gave the stock a "neutral" rating in a research report on Thursday, November 7th. Royal Bank of Canada lifted their price target on Clearwater Analytics from $32.00 to $36.00 and gave the company an "outperform" rating in a report on Friday, November 22nd. DA Davidson downgraded Clearwater Analytics from a "buy" rating to a "neutral" rating and increased their price objective for the stock from $31.00 to $35.00 in a report on Friday, November 8th. Finally, Wells Fargo & Company lifted their target price on shares of Clearwater Analytics from $23.00 to $33.00 and gave the company an "overweight" rating in a research note on Thursday, November 7th. One research analyst has rated the stock with a sell rating, three have given a hold rating and five have assigned a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus price target of $31.11.

Check Out Our Latest Research Report on Clearwater Analytics

Clearwater Analytics Stock Performance

CWAN stock traded down $0.13 during midday trading on Friday, hitting $31.04. 1,608,663 shares of the company traded hands, compared to its average volume of 1,613,181. The business has a 50 day simple moving average of $27.69 and a 200-day simple moving average of $23.32. The company has a quick ratio of 4.66, a current ratio of 4.66 and a debt-to-equity ratio of 0.10. Clearwater Analytics Holdings, Inc. has a twelve month low of $15.62 and a twelve month high of $35.71. The stock has a market capitalization of $7.67 billion, a price-to-earnings ratio of 3,120.12, a price-to-earnings-growth ratio of 11.13 and a beta of 0.61.

Insider Buying and Selling

In related news, CFO James S. Cox sold 18,700 shares of the business's stock in a transaction on Monday, September 16th. The shares were sold at an average price of $24.44, for a total transaction of $457,028.00. Following the transaction, the chief financial officer now owns 227,503 shares of the company's stock, valued at approximately $5,560,173.32. The trade was a 7.60 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CRO Scott Stanley Erickson sold 3,890 shares of the company's stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $23.75, for a total transaction of $92,387.50. Following the transaction, the executive now owns 4,844 shares of the company's stock, valued at approximately $115,045. The trade was a 44.54 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 67,770 shares of company stock worth $1,826,606 in the last quarter. 4.60% of the stock is currently owned by company insiders.

Clearwater Analytics Company Profile

(

Free Report)

Clearwater Analytics Holdings, Inc develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

See Also

Before you consider Clearwater Analytics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clearwater Analytics wasn't on the list.

While Clearwater Analytics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for January 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.