Jefferies Financial Group lowered shares of Ford Motor (NYSE:F - Free Report) from a hold rating to an underperform rating in a research report sent to investors on Monday, Marketbeat.com reports. They currently have $9.00 target price on the auto manufacturer's stock, down from their prior target price of $12.00.

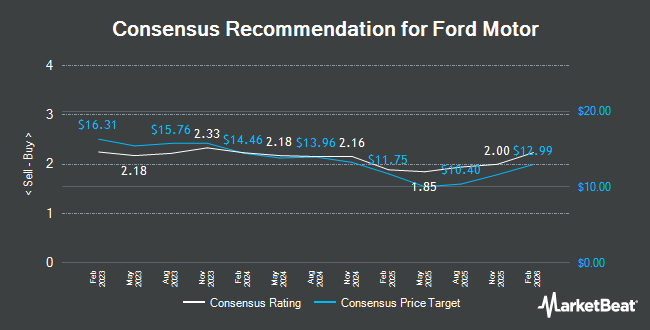

Several other equities analysts have also commented on the company. Wolfe Research restated an "underperform" rating on shares of Ford Motor in a research note on Thursday, December 5th. Royal Bank of Canada reissued a "sector perform" rating and set a $10.00 target price on shares of Ford Motor in a research report on Tuesday, October 29th. Wells Fargo & Company decreased their target price on Ford Motor from $10.00 to $9.00 and set an "underweight" rating for the company in a research note on Tuesday, September 10th. The Goldman Sachs Group upgraded shares of Ford Motor from a "neutral" rating to a "buy" rating and increased their price target for the company from $12.00 to $13.00 in a research note on Tuesday, October 1st. Finally, Barclays reduced their price objective on shares of Ford Motor from $14.00 to $13.00 and set an "overweight" rating for the company in a research report on Tuesday, October 29th. Four investment analysts have rated the stock with a sell rating, eight have issued a hold rating and three have assigned a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $11.83.

Get Our Latest Stock Report on Ford Motor

Ford Motor Stock Down 3.8 %

Shares of F traded down $0.40 during midday trading on Monday, hitting $9.99. The company had a trading volume of 95,458,945 shares, compared to its average volume of 53,978,457. The company's 50-day simple moving average is $10.85 and its 200-day simple moving average is $11.31. The company has a debt-to-equity ratio of 2.34, a quick ratio of 0.98 and a current ratio of 1.15. Ford Motor has a 1 year low of $9.49 and a 1 year high of $14.85. The firm has a market capitalization of $39.70 billion, a P/E ratio of 11.48, a P/E/G ratio of 1.90 and a beta of 1.62.

Ford Motor (NYSE:F - Get Free Report) last issued its quarterly earnings results on Monday, October 28th. The auto manufacturer reported $0.49 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.47 by $0.02. Ford Motor had a net margin of 1.93% and a return on equity of 16.16%. The company had revenue of $46.20 billion during the quarter, compared to the consensus estimate of $45.13 billion. During the same quarter in the previous year, the firm earned $0.39 earnings per share. The firm's quarterly revenue was up 5.5% on a year-over-year basis. As a group, sell-side analysts expect that Ford Motor will post 1.81 EPS for the current year.

Ford Motor Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, December 2nd. Stockholders of record on Thursday, November 7th were issued a $0.15 dividend. The ex-dividend date was Thursday, November 7th. This represents a $0.60 dividend on an annualized basis and a dividend yield of 6.01%. Ford Motor's payout ratio is 68.18%.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of the stock. Family Firm Inc. acquired a new stake in Ford Motor in the second quarter valued at about $26,000. Quarry LP purchased a new position in shares of Ford Motor during the 2nd quarter worth approximately $27,000. Ridgewood Investments LLC acquired a new stake in shares of Ford Motor in the 2nd quarter valued at approximately $28,000. Kimelman & Baird LLC purchased a new stake in shares of Ford Motor in the second quarter valued at approximately $30,000. Finally, Reston Wealth Management LLC acquired a new position in Ford Motor during the third quarter worth $33,000. 58.74% of the stock is currently owned by hedge funds and other institutional investors.

About Ford Motor

(

Get Free Report)

Ford Motor Company develops, delivers, and services a range of Ford trucks, commercial cars and vans, sport utility vehicles, and Lincoln luxury vehicles worldwide. It operates through Ford Blue, Ford Model e, and Ford Pro; Ford Next; and Ford Credit segments. The company sells Ford and Lincoln vehicles, service parts, and accessories through distributors and dealers, as well as through dealerships to commercial fleet customers, daily rental car companies, and governments.

Featured Articles

Before you consider Ford Motor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ford Motor wasn't on the list.

While Ford Motor currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.