Ford Motor (NYSE:F - Get Free Report) was upgraded by analysts at BNP Paribas to a "hold" rating in a note issued to investors on Monday,Zacks.com reports.

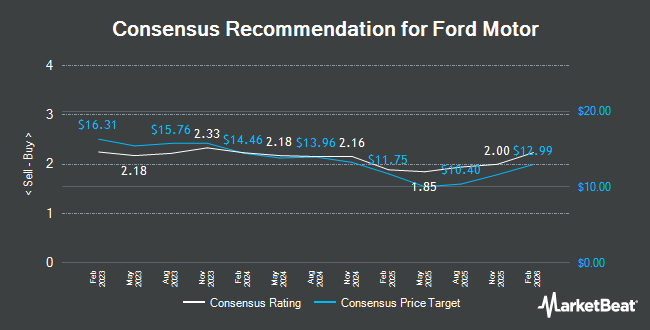

F has been the subject of several other research reports. Deutsche Bank Aktiengesellschaft cut their target price on Ford Motor from $11.00 to $10.00 and set a "hold" rating for the company in a research note on Wednesday, October 30th. Sanford C. Bernstein downgraded Ford Motor from an "outperform" rating to a "market perform" rating and set a $11.00 target price for the company. in a research report on Thursday, November 7th. Wolfe Research reaffirmed an "underperform" rating on shares of Ford Motor in a research note on Thursday, December 5th. Bank of America reduced their target price on Ford Motor from $19.00 to $15.50 and set a "buy" rating on the stock in a research note on Thursday, February 6th. Finally, Barclays cut Ford Motor from an "overweight" rating to an "equal weight" rating and reduced their target price for the company from $13.00 to $11.00 in a research note on Wednesday, January 22nd. Three equities research analysts have rated the stock with a sell rating, ten have issued a hold rating and four have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and a consensus price target of $11.89.

Read Our Latest Stock Analysis on F

Ford Motor Stock Performance

F traded up $0.13 during trading hours on Monday, hitting $9.48. The stock had a trading volume of 53,503,079 shares, compared to its average volume of 77,278,144. The company's fifty day simple moving average is $9.92 and its 200 day simple moving average is $10.47. Ford Motor has a 1 year low of $9.10 and a 1 year high of $14.85. The stock has a market cap of $37.66 billion, a PE ratio of 6.49, a price-to-earnings-growth ratio of 1.80 and a beta of 1.63. The company has a quick ratio of 0.98, a current ratio of 1.16 and a debt-to-equity ratio of 2.31.

Ford Motor (NYSE:F - Get Free Report) last announced its quarterly earnings data on Wednesday, February 5th. The auto manufacturer reported $0.39 earnings per share for the quarter, topping the consensus estimate of $0.35 by $0.04. Ford Motor had a return on equity of 16.88% and a net margin of 3.18%. Equities analysts anticipate that Ford Motor will post 1.7 earnings per share for the current year.

Hedge Funds Weigh In On Ford Motor

Hedge funds have recently made changes to their positions in the company. Hager Investment Management Services LLC purchased a new position in Ford Motor in the fourth quarter valued at $26,000. Bank of Jackson Hole Trust purchased a new stake in Ford Motor in the 4th quarter valued at approximately $29,000. Flagship Wealth Advisors LLC purchased a new stake in Ford Motor in the 4th quarter valued at approximately $30,000. Reston Wealth Management LLC purchased a new stake in shares of Ford Motor during the 3rd quarter worth approximately $33,000. Finally, Kentucky Trust Co purchased a new stake in shares of Ford Motor during the 4th quarter worth approximately $31,000. Institutional investors and hedge funds own 58.74% of the company's stock.

Ford Motor Company Profile

(

Get Free Report)

Ford Motor Company develops, delivers, and services a range of Ford trucks, commercial cars and vans, sport utility vehicles, and Lincoln luxury vehicles worldwide. It operates through Ford Blue, Ford Model e, and Ford Pro; Ford Next; and Ford Credit segments. The company sells Ford and Lincoln vehicles, service parts, and accessories through distributors and dealers, as well as through dealerships to commercial fleet customers, daily rental car companies, and governments.

Read More

Before you consider Ford Motor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ford Motor wasn't on the list.

While Ford Motor currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.