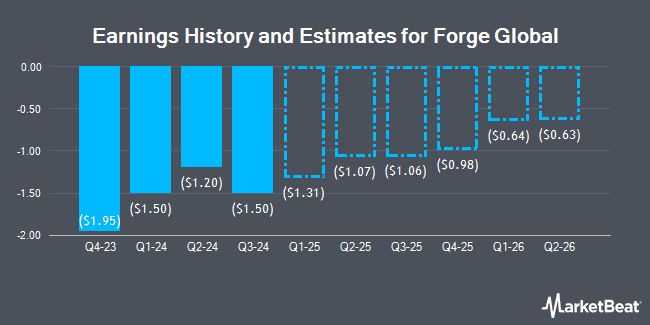

Forge Global Holdings, Inc. (NYSE:FRGE - Free Report) - Equities researchers at William Blair dropped their Q1 2025 earnings per share estimates for Forge Global in a report released on Tuesday, April 15th. William Blair analyst J. Schmitt now forecasts that the company will post earnings per share of ($1.31) for the quarter, down from their prior estimate of ($1.20). The consensus estimate for Forge Global's current full-year earnings is ($0.37) per share. William Blair also issued estimates for Forge Global's Q2 2025 earnings at ($1.07) EPS, Q3 2025 earnings at ($1.06) EPS, Q4 2025 earnings at ($0.98) EPS, FY2025 earnings at ($4.42) EPS, Q1 2026 earnings at ($0.64) EPS, Q2 2026 earnings at ($0.63) EPS, Q3 2026 earnings at ($0.62) EPS, Q4 2026 earnings at ($0.51) EPS and FY2026 earnings at ($2.40) EPS.

Other equities research analysts also recently issued reports about the stock. JPMorgan Chase & Co. reissued an "underweight" rating on shares of Forge Global in a research report on Tuesday, January 7th. JMP Securities cut their price target on Forge Global from $75.00 to $60.00 and set a "market outperform" rating on the stock in a research note on Tuesday, April 8th.

Check Out Our Latest Analysis on Forge Global

Forge Global Stock Performance

FRGE stock traded up $1.00 during mid-day trading on Friday, reaching $12.81. The company had a trading volume of 74,267 shares, compared to its average volume of 46,184. Forge Global has a fifty-two week low of $6.60 and a fifty-two week high of $31.65. The company has a market capitalization of $160.75 million, a price-to-earnings ratio of -29.79 and a beta of 2.39. The firm has a fifty day simple moving average of $10.65 and a 200 day simple moving average of $13.38.

Institutional Trading of Forge Global

A number of large investors have recently bought and sold shares of the business. Prudential Financial Inc. acquired a new stake in shares of Forge Global during the fourth quarter worth about $27,000. ProShare Advisors LLC increased its stake in Forge Global by 51.3% in the 4th quarter. ProShare Advisors LLC now owns 32,807 shares of the company's stock valued at $31,000 after buying an additional 11,126 shares during the period. D. E. Shaw & Co. Inc. acquired a new stake in shares of Forge Global in the 4th quarter worth $32,000. Focus Partners Wealth purchased a new stake in shares of Forge Global in the fourth quarter valued at about $37,000. Finally, Intech Investment Management LLC raised its holdings in Forge Global by 361.3% during the fourth quarter. Intech Investment Management LLC now owns 55,500 shares of the company's stock worth $52,000 after purchasing an additional 43,468 shares in the last quarter. Institutional investors and hedge funds own 40.67% of the company's stock.

Insiders Place Their Bets

In other news, CRO Jennifer Phillips sold 16,150 shares of the firm's stock in a transaction that occurred on Tuesday, April 15th. The shares were sold at an average price of $15.11, for a total transaction of $244,026.50. Following the transaction, the executive now directly owns 22,226 shares in the company, valued at approximately $335,834.86. This trade represents a 42.08 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Corporate insiders own 7.22% of the company's stock.

Forge Global declared that its Board of Directors has initiated a share buyback plan on Wednesday, March 5th that authorizes the company to repurchase $10.00 million in shares. This repurchase authorization authorizes the company to reacquire up to 6.3% of its stock through open market purchases. Stock repurchase plans are generally a sign that the company's leadership believes its stock is undervalued.

About Forge Global

(

Get Free Report)

Forge Global Holdings, Inc operates a financial services platform in California. The company's platform solutions include trading solutions, a platform that connects investors with private company stockholders and enables them to facilitate private share transactions; and custody solutions, a non-depository trust company that enables clients to securely custody and manage assets through an online portal.

Featured Articles

Before you consider Forge Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Forge Global wasn't on the list.

While Forge Global currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.