Forsta AP Fonden increased its position in Agnico Eagle Mines Limited (NYSE:AEM - Free Report) TSE: AEM by 8.9% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 195,100 shares of the mining company's stock after buying an additional 16,000 shares during the quarter. Forsta AP Fonden's holdings in Agnico Eagle Mines were worth $15,256,000 at the end of the most recent reporting period.

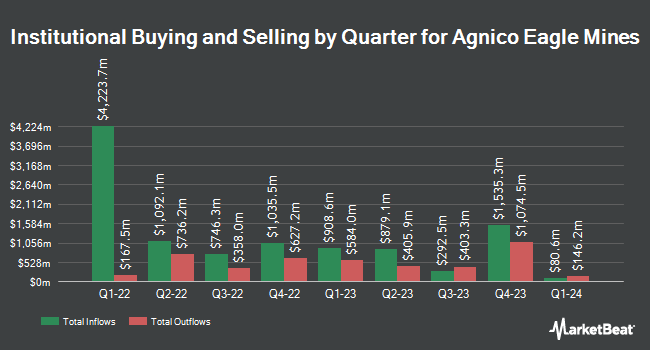

Several other large investors have also bought and sold shares of AEM. Charles Schwab Investment Management Inc. increased its stake in Agnico Eagle Mines by 3.0% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 1,136,854 shares of the mining company's stock worth $91,681,000 after purchasing an additional 32,991 shares in the last quarter. Bridgewater Associates LP increased its position in shares of Agnico Eagle Mines by 123.2% in the third quarter. Bridgewater Associates LP now owns 204,168 shares of the mining company's stock worth $16,448,000 after acquiring an additional 112,712 shares in the last quarter. Caldwell Investment Management Ltd. raised its holdings in shares of Agnico Eagle Mines by 12.0% during the fourth quarter. Caldwell Investment Management Ltd. now owns 87,700 shares of the mining company's stock valued at $6,812,000 after acquiring an additional 9,400 shares during the period. Caisse DE Depot ET Placement DU Quebec lifted its position in shares of Agnico Eagle Mines by 14.8% in the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 225,965 shares of the mining company's stock valued at $18,223,000 after acquiring an additional 29,106 shares in the last quarter. Finally, Geode Capital Management LLC boosted its stake in Agnico Eagle Mines by 8.6% in the 3rd quarter. Geode Capital Management LLC now owns 2,256,714 shares of the mining company's stock worth $183,491,000 after purchasing an additional 178,999 shares during the period. Institutional investors own 68.34% of the company's stock.

Agnico Eagle Mines Stock Down 1.5 %

Shares of AEM traded down $1.41 during midday trading on Friday, reaching $93.05. 1,848,054 shares of the stock were exchanged, compared to its average volume of 1,466,203. The company has a market cap of $46.73 billion, a price-to-earnings ratio of 46.52, a P/E/G ratio of 0.60 and a beta of 1.08. The company has a quick ratio of 0.83, a current ratio of 1.75 and a debt-to-equity ratio of 0.06. Agnico Eagle Mines Limited has a 12-month low of $44.37 and a 12-month high of $95.38. The firm has a 50 day simple moving average of $83.69 and a 200-day simple moving average of $81.61.

Analyst Ratings Changes

A number of analysts have recently issued reports on the company. Jefferies Financial Group increased their target price on Agnico Eagle Mines from $85.00 to $88.00 and gave the company a "hold" rating in a report on Tuesday, January 7th. Scotiabank raised their price objective on Agnico Eagle Mines from $103.00 to $105.00 and gave the stock a "sector outperform" rating in a research report on Tuesday, January 21st. One analyst has rated the stock with a hold rating and seven have issued a buy rating to the company. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $90.50.

Get Our Latest Stock Analysis on Agnico Eagle Mines

Agnico Eagle Mines Company Profile

(

Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

See Also

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.