Forsta AP Fonden raised its stake in Seagate Technology Holdings plc (NASDAQ:STX - Free Report) by 40.7% during the 4th quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 63,300 shares of the data storage provider's stock after buying an additional 18,300 shares during the quarter. Forsta AP Fonden's holdings in Seagate Technology were worth $5,463,000 at the end of the most recent reporting period.

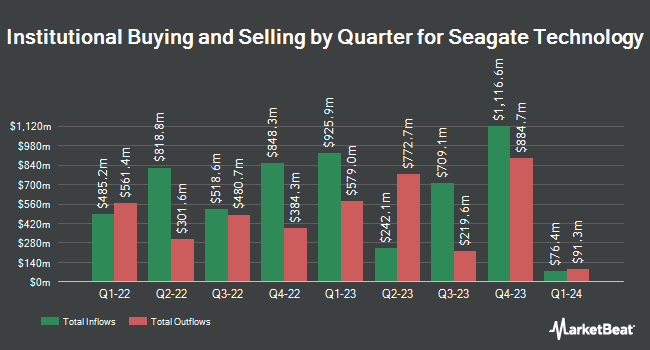

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the stock. Ashton Thomas Securities LLC bought a new position in shares of Seagate Technology during the 3rd quarter valued at $26,000. Quarry LP acquired a new stake in shares of Seagate Technology in the second quarter worth about $27,000. Advisors Asset Management Inc. increased its holdings in shares of Seagate Technology by 177.9% during the 3rd quarter. Advisors Asset Management Inc. now owns 403 shares of the data storage provider's stock valued at $44,000 after acquiring an additional 258 shares during the last quarter. JFS Wealth Advisors LLC raised its stake in shares of Seagate Technology by 232.5% in the 3rd quarter. JFS Wealth Advisors LLC now owns 419 shares of the data storage provider's stock valued at $46,000 after acquiring an additional 293 shares in the last quarter. Finally, Harvest Fund Management Co. Ltd acquired a new stake in Seagate Technology in the 3rd quarter worth approximately $53,000. Hedge funds and other institutional investors own 92.87% of the company's stock.

Insider Buying and Selling

In other Seagate Technology news, SVP Kian Fatt Chong sold 9,182 shares of the business's stock in a transaction dated Friday, November 8th. The stock was sold at an average price of $105.50, for a total value of $968,701.00. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO William D. Mosley sold 20,000 shares of the firm's stock in a transaction dated Monday, December 2nd. The stock was sold at an average price of $102.83, for a total value of $2,056,600.00. Following the sale, the chief executive officer now directly owns 622,497 shares in the company, valued at approximately $64,011,366.51. This represents a 3.11 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 30,073 shares of company stock valued at $3,115,549 in the last 90 days. 0.81% of the stock is owned by insiders.

Seagate Technology Stock Down 2.0 %

Shares of Seagate Technology stock traded down $1.92 during trading on Friday, reaching $96.36. 2,799,188 shares of the company were exchanged, compared to its average volume of 3,372,411. Seagate Technology Holdings plc has a twelve month low of $82.31 and a twelve month high of $115.32. The firm has a market capitalization of $20.40 billion, a price-to-earnings ratio of 17.62 and a beta of 1.06. The business has a 50-day moving average price of $95.10 and a 200-day moving average price of $100.11.

Seagate Technology Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Wednesday, April 2nd. Investors of record on Wednesday, March 19th will be given a $0.72 dividend. The ex-dividend date is Wednesday, March 19th. This represents a $2.88 dividend on an annualized basis and a dividend yield of 2.99%. Seagate Technology's dividend payout ratio is 52.65%.

Wall Street Analyst Weigh In

STX has been the topic of a number of research analyst reports. UBS Group raised their target price on shares of Seagate Technology from $95.00 to $105.00 and gave the company a "neutral" rating in a research note on Wednesday, January 22nd. Mizuho dropped their price objective on Seagate Technology from $130.00 to $110.00 and set an "outperform" rating on the stock in a research note on Friday, January 10th. Susquehanna increased their target price on Seagate Technology from $65.00 to $68.00 and gave the company a "negative" rating in a research note on Wednesday, January 22nd. Evercore ISI raised their target price on Seagate Technology from $125.00 to $135.00 and gave the company an "outperform" rating in a report on Wednesday, October 23rd. Finally, Benchmark raised Seagate Technology from a "hold" rating to a "buy" rating and set a $120.00 price objective for the company in a research report on Wednesday, January 22nd. One research analyst has rated the stock with a sell rating, five have issued a hold rating and fourteen have given a buy rating to the company's stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $122.56.

View Our Latest Stock Report on STX

Seagate Technology Company Profile

(

Free Report)

Seagate Technology Holdings plc provides data storage technology and solutions in Singapore, the United States, the Netherlands, and internationally. It provides mass capacity storage products, including enterprise nearline hard disk drives (HDDs), enterprise nearline solid state drives (SSDs), enterprise nearline systems, video and image HDDs, and network-attached storage drives.

Featured Articles

Before you consider Seagate Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Seagate Technology wasn't on the list.

While Seagate Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.