Forte Capital LLC ADV increased its stake in KLA Co. (NASDAQ:KLAC - Free Report) by 144.2% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 1,751 shares of the semiconductor company's stock after purchasing an additional 1,034 shares during the quarter. Forte Capital LLC ADV's holdings in KLA were worth $1,356,000 at the end of the most recent quarter.

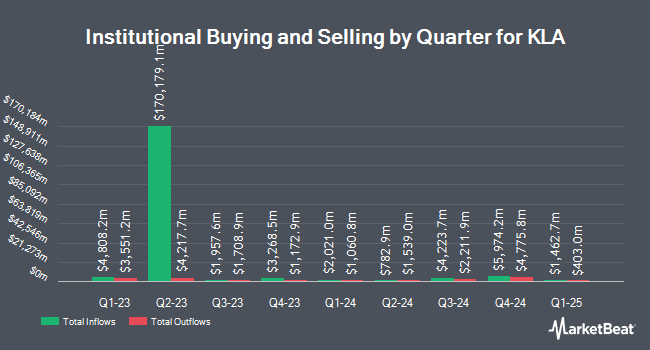

A number of other hedge funds and other institutional investors also recently made changes to their positions in KLAC. Norden Group LLC increased its holdings in shares of KLA by 19.7% in the first quarter. Norden Group LLC now owns 468 shares of the semiconductor company's stock worth $327,000 after purchasing an additional 77 shares during the period. Csenge Advisory Group increased its stake in KLA by 25.8% in the 1st quarter. Csenge Advisory Group now owns 989 shares of the semiconductor company's stock worth $691,000 after acquiring an additional 203 shares during the last quarter. Manchester Capital Management LLC raised its holdings in shares of KLA by 1,333.3% in the 1st quarter. Manchester Capital Management LLC now owns 344 shares of the semiconductor company's stock valued at $240,000 after acquiring an additional 320 shares in the last quarter. Empirical Finance LLC boosted its position in shares of KLA by 3.3% during the 1st quarter. Empirical Finance LLC now owns 5,124 shares of the semiconductor company's stock valued at $3,579,000 after acquiring an additional 165 shares during the last quarter. Finally, Envestnet Portfolio Solutions Inc. grew its holdings in shares of KLA by 29.2% during the first quarter. Envestnet Portfolio Solutions Inc. now owns 8,732 shares of the semiconductor company's stock worth $6,100,000 after purchasing an additional 1,976 shares in the last quarter. 86.65% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

A number of equities research analysts recently weighed in on KLAC shares. Wells Fargo & Company lowered their target price on shares of KLA from $950.00 to $870.00 and set an "overweight" rating on the stock in a research note on Thursday, October 3rd. The Goldman Sachs Group raised their price objective on shares of KLA from $735.00 to $838.00 and gave the company a "buy" rating in a research report on Thursday, July 25th. Susquehanna cut their target price on shares of KLA from $680.00 to $675.00 and set a "neutral" rating for the company in a research report on Friday, October 11th. Argus raised their price target on KLA from $800.00 to $875.00 and gave the company a "buy" rating in a research report on Friday, July 26th. Finally, Cantor Fitzgerald reaffirmed a "neutral" rating and set a $925.00 price target on shares of KLA in a research note on Tuesday, October 8th. Eight analysts have rated the stock with a hold rating and fifteen have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $802.90.

Read Our Latest Analysis on KLAC

KLA Trading Up 2.5 %

Shares of NASDAQ KLAC traded up $16.49 during trading hours on Thursday, hitting $686.15. The company's stock had a trading volume of 1,122,237 shares, compared to its average volume of 950,713. KLA Co. has a 12 month low of $504.66 and a 12 month high of $896.32. The stock has a market cap of $91.78 billion, a price-to-earnings ratio of 31.33, a P/E/G ratio of 1.40 and a beta of 1.29. The company has a debt-to-equity ratio of 1.65, a quick ratio of 1.48 and a current ratio of 2.13. The business has a 50-day simple moving average of $735.90 and a 200-day simple moving average of $763.89.

KLA (NASDAQ:KLAC - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The semiconductor company reported $7.33 EPS for the quarter, topping analysts' consensus estimates of $7.03 by $0.30. KLA had a return on equity of 105.16% and a net margin of 28.92%. The company had revenue of $2.84 billion during the quarter, compared to analyst estimates of $2.75 billion. During the same quarter last year, the firm posted $5.74 earnings per share. The firm's revenue was up 18.5% on a year-over-year basis. On average, analysts anticipate that KLA Co. will post 30.91 earnings per share for the current fiscal year.

KLA Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 3rd. Shareholders of record on Monday, November 18th will be issued a dividend of $1.70 per share. This is an increase from KLA's previous quarterly dividend of $1.45. This represents a $6.80 dividend on an annualized basis and a dividend yield of 0.99%. KLA's dividend payout ratio is 26.48%.

About KLA

(

Free Report)

KLA Corporation, together with its subsidiaries, engages in the design, manufacture, and marketing of process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide. It operates through three segments: Semiconductor Process Control; Specialty Semiconductor Process; and PCB and Component Inspection.

Further Reading

Before you consider KLA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KLA wasn't on the list.

While KLA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.