Forum Financial Management LP purchased a new position in Fresenius Medical Care AG (NYSE:FMS - Free Report) during the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm purchased 10,891 shares of the company's stock, valued at approximately $247,000.

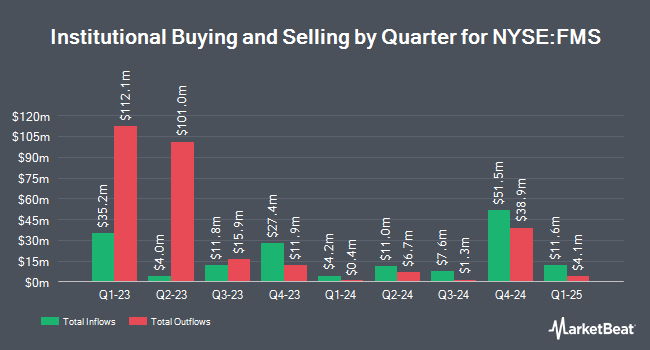

Other institutional investors and hedge funds have also modified their holdings of the company. MML Investors Services LLC raised its holdings in Fresenius Medical Care by 5.3% in the 3rd quarter. MML Investors Services LLC now owns 15,019 shares of the company's stock worth $320,000 after purchasing an additional 753 shares during the period. Wilmington Savings Fund Society FSB bought a new position in shares of Fresenius Medical Care in the third quarter worth about $38,000. Franklin Resources Inc. lifted its position in shares of Fresenius Medical Care by 3.3% during the 3rd quarter. Franklin Resources Inc. now owns 74,640 shares of the company's stock valued at $1,490,000 after buying an additional 2,386 shares in the last quarter. JPMorgan Chase & Co. lifted its position in shares of Fresenius Medical Care by 18.2% during the 3rd quarter. JPMorgan Chase & Co. now owns 9,902 shares of the company's stock valued at $211,000 after buying an additional 1,528 shares in the last quarter. Finally, GAMMA Investing LLC grew its stake in shares of Fresenius Medical Care by 43.3% during the 4th quarter. GAMMA Investing LLC now owns 7,164 shares of the company's stock valued at $162,000 after acquiring an additional 2,166 shares during the period. Hedge funds and other institutional investors own 8.37% of the company's stock.

Fresenius Medical Care Price Performance

FMS stock opened at $23.99 on Wednesday. The company has a debt-to-equity ratio of 0.42, a quick ratio of 1.02 and a current ratio of 1.37. The company's fifty day moving average price is $23.92 and its 200-day moving average price is $22.93. Fresenius Medical Care AG has a one year low of $17.93 and a one year high of $25.96. The company has a market capitalization of $14.08 billion, a PE ratio of 19.83, a price-to-earnings-growth ratio of 0.76 and a beta of 0.93.

Wall Street Analyst Weigh In

FMS has been the topic of several analyst reports. StockNews.com raised shares of Fresenius Medical Care from a "hold" rating to a "strong-buy" rating in a report on Wednesday, February 5th. Truist Financial upped their target price on shares of Fresenius Medical Care from $23.00 to $25.00 and gave the stock a "hold" rating in a report on Monday, January 6th.

Check Out Our Latest Stock Analysis on FMS

About Fresenius Medical Care

(

Free Report)

Fresenius Medical Care AG provides dialysis and related services for individuals with renal diseases in Germany, North America, and internationally. The company offers dialysis treatment and related laboratory and diagnostic services through a network of outpatient dialysis clinics; materials, training, and patient support services comprising clinical monitoring, follow-up assistance, and arranging for delivery of the supplies to the patient's residence; and dialysis services under contract to hospitals in the United States for the hospitalized end-stage renal disease (ESRD) patients and for patients suffering from acute kidney failure.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fresenius Medical Care, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fresenius Medical Care wasn't on the list.

While Fresenius Medical Care currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.